Firmographic data is the backbone of any data-driven B2B go-to-market strategy. It’s critical because you need it in order to identify, target, and nurture your best leads. Without it, your pipeline of leads will be a black box, and you won’t be able to effectively sell to the right customers.

Here’s a simple example of how firmographic data drives B2B go-to-market. Imagine you have a lead capture form on your website. When users want to download a whitepaper, they provide their company email in the form.

Now, your sales and marketing team will want to figure out how they want to reach out to this lead. If it’s a big customer, perhaps sales will reach out personally. If it’s a small customer, marketing might route that lead to a nurture campaign. But you have to know who this customer is in order to do that!

An email isn’t going to tell you what industry the customer is in, how big the company is, and whether or not they are a fit. That’s where firmographic data comes in. In this article, you will learn what firmographic data is, how to pursue it, and common challenges to avoid.

Firmographic data refers to traits about a company that can be used to segment it into different categories. This includes, but is not limited to, traits like company size, industry, sector, location, or revenue. Firmographic data is primarily used by marketing and sales to segment companies so that they can target the right customers, but it can also be used by product teams to build more personalized experiences.

There are two key go-to-market concepts that are powered by firmographic data: ideal customer profile (ICP) and qualification. ICP describes what type of customer is an ideal fit for your company. Qualification is the process by which companies “qualify” whether or not a customer is an ideal fit customer. Firmographic data powers the definition of ICP, as well as the process of qualification.

If you aren’t entirely sure where to start when it comes to collecting firmographic data, here are some common examples:

Unlike demographic data which describes a person, firmographic data describes a company. However, both can be used to define ICPs and qualify leads. In fact, demographic data is often used in combination with firmographic data to do this.

For example, let’s say [email protected] signs up for your website. Well, you’ll use demographic data like Alex’s location and job title to decide if they are a good fit for your company. And then you can add firmographic data like Coca Cola’s company size to further figure out if someone should reach out.

Although it might sound like firmographic data mostly drives your go-to-market strategy, it’s also critical to access this information in B2B product management.

First, the idea of an ICP matters not just for your go-to-market teams, but also for your product teams. How can you build a product without knowing who you are building it for? So having alignment on who the ICP is and why is important for driving alignment between product and go-to-market.

Second, collecting firmographic data can help you update and shape your ICP. Perhaps you always thought your best customers had a certain profile based on sales and customer success conversations, but in digging through the data, you discover that another type of customer is actually getting to success faster and better than your initial hypothesis. Analyzing this data can help you ensure that you’re working on the best solution for your customers.

The other area in which firmographic data is important is in prioritization. Let’s say that 80 percent of your customers are asking for a specific feature, and only 5 percent of customers are asking for another feature, but the 5 percent of customers asking for the other feature account for 80 percent of your revenue potential because they’re large customers. Which feature should you build?

You probably want to build both for different reasons, but you can see how understanding who a customer is can help guide your thought process on whether or not to build a given feature.

When thinking through any kind of product-led growth or self-serve flow, firmographic data can be extremely powerful. Imagine signing up for a product and having that product recommend templates that apply most to the company that you’re working at?

This kind of personalization can only be powered via firmographic data. Note that you can also ask the user to provide this data to you, thus powering better flows.

Now that we’ve established that firmographic data is really useful for B2B as well as for product management, how should you go about collecting firmographic data about your customers? There are typically two common ways to do this: you can buy the data from a third-party vendor, or you can collect the data yourself.

There are many third-party vendors who provide firmographic data about companies. If you’re searching for these vendors, you can search for “data enrichment” providers, which is typically how they classify themselves. Vendors include Zoominfo, Clearbit (recently acquired by Hubspot), and Apollo. These third-party vendors can be used to augment data you already have about your customers.

Let’s go through a quick example. Let’s say customers can sign up for a free version of your product with their company email. They will type in their company email and the name of their company in a sign up form. So now, you have collected some information about this user, but you aren’t able to determine whether or not this user is your ICP.

You can access data available via third-party data enrichment providers to figure out, for a given company, how many employees it has, where its located, and what its revenue looks like. Now, you can use this information to determine whether or not this new customer is a fit.

You might be wondering why you can’t just Google a customer when they sign up. The thing is, companies often have hundreds of net new customers signing up every week, and it’s simply impossible to expect someone to manually look up every single customer. On top of that, many data enrichment providers actually offer custom, proprietary fields that may not be accessible on the public web.

Although firmographic data via third-party vendors is a common path that companies take, third-party vendors do suffer from coverage and accuracy issues. Coverage is essentially how many companies out of the entire universe of companies a vendor has data for. The other option is to simply ask customers for this information.

One common way to do this is to ask for more information up front in a signup flow. For example, you could ask someone for their company name and size. However, be careful of asking for too much information up front, as you might scare potential customers away.

Another great way to collect information from customers is in a progressive manner. For example, your signup flow could only require an email, but once you start onboarding customers, you can start asking that customer to tell you more about themselves so that you can personalize the experience.

Finally, some customers rely on their sales teams to fill in certain pieces of firmographic data that can only be answered by calling up a customer. For example, let’s say a new customer signed up for a whitepaper, but one of the criteria for qualifying that customer is whether or not they have a new cloud initiative. That can really only be answered by calling the new customer who signed up for a white paper and asking them whether or not they have a new cloud initiative ongoing.

When it comes to analyzing firmographic data, a great way is to think in terms of segmentation. You’ll want to break up your customers into segments based on a couple criteria:

A simple way to go about analyzing firmographic data is to think in terms of averages, percentages, and counts. Let’s take the first bullet as an example: which customers are more likely to pay? You’ll want to create a spreadsheet of your customers with columns for the firmographic data points that you have. You’ll also want a column for whether or not a customer is paying.

Next, for each firmographic data point, calculate the following:

With these simple math formulas, you’ll be able to get some insight into firmographic data points that lead to customers being more likely to pay. Now obviously, there are more complex ways to analyze firmographic data (including machine learning), but using these simple math formulas will get you much further than you expect.

While firmographic segmentation can be useful for your product team, there are some challenges that you should consider before implementing it.

First and foremost, be very careful with data quality. As mentioned early, if you purchase firmographic data from a third-party vendor, they might not have correct or complete information about a company. When you run analyses, make sure to account for unknown values, otherwise you’ll end up with very skewed results.

Firmographic segmentation is only as useful as what you do with it. If you overcomplicate how you define ICP with 100s of data points, no one will know how to actionably use that definition to run their sales motion or design a self-serve product. Keep your ICP simple, handpicking the most important data points to incorporate and ignoring the rest.

Firmographic data is an important input that you simply can’t ignore if you’re running a B2B business. Only by understanding who your customer is are you able to design a product that speaks to them and scale a go-to-market process that can reach them efficiently.

When thinking through how to collect firmographic data, make sure to combine third-party vendor data with data that you collect on your own, keeping in mind that bad data can be very misleading. Ultimately, don’t overcomplicate things, as having a high-level understanding of who your ICP is trumps defining an ICP that is simply too complicated to understand.

Featured image source: IconScout

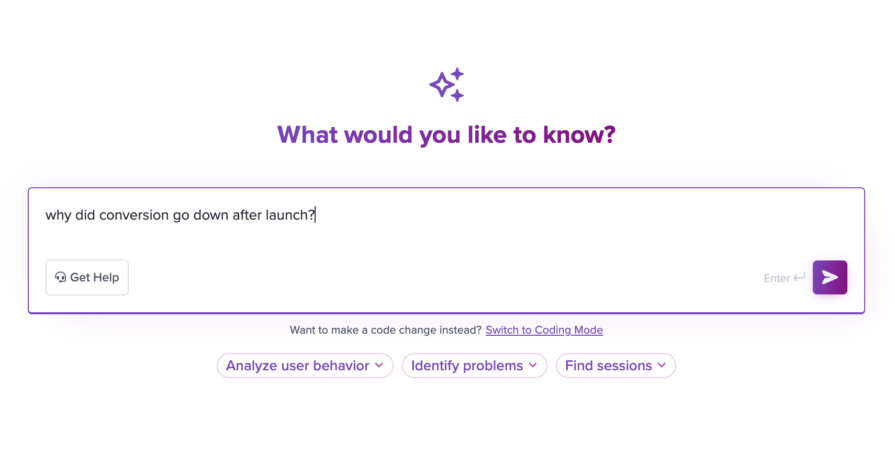

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.