When it comes to pricing digital products, there are two important questions to answer:

This article focuses on the second question. If you’re still trying to figure out what to actually bill your customers for, consider taking a look at our guide to value metrics.

There are three main ways to define a price point:

In the product world, more and more companies are moving towards a value-based pricing strategy. Keep reading to learn how value-based pricing works, including its benefits, how you can implement it, and examples.

Value-based pricing is all about using the perceived value, often also referred to as willingness-to-pay, to set the right price points for the product.

The more value your customers see in a particular feature or outcome, the more you can charge them — regardless of how much it costs to deliver this value or how much your competitors charge for alternative solutions.

Value-based pricing is often confused with outcome-based pricing.

Value-based pricing is about how much you can charge your customers — the higher the perceived value, the higher the willingness to pay.

Outcome-based pricing is about what you charge for — the final price scales with the outcomes you deliver.

Consider Uber, which embraces value-based pricing to set the price and outcome-based pricing to scale it.

The value-based aspect would be the price per mile. During New Year’s Eve, the perceived value of getting home safely and in comfort is higher, so the price per mile increases compared to a normal Wednesday afternoon.

Then, the more miles you travel, the higher your total bill is going to be (price scales with the outcome).

So, the pricing formula is perceived value (price per mile) x received outcome (np. of miles).

Although value-based and outcome-based pricing answers different questions, they can often work together — which is one more reason why these two are often confused with each other.

To help understand value-based pricing, pay attention to how these companies implement it with software products:

Notion is all about perceived value.

By being ahead of the market with AI features, database approaches, templates, and much more, it can charge a premium since it delivers premium value.

It’d be leaving a lot of money on the table if it embraced competitor-based pricing since even Confluence — the market leader in internal wikis space — is cheaper per user than Notion.

Cost-wise, serving additional customers is a negligible cost for this type of product, so Notion can secure truly great margins per paid user.

If you look closely, you’ll notice that Slack doesn’t differ much feature-wise from alternative products such as Teams.

To some extent, Slack is even underperforming.

But people still love Slack.

A lot comes from the power of habit. Slack was one of the first digital communicators widely embraced in professional environments. Because of this, many people know how to use it and would rather stick with it instead of learning a new tool.

This fact increases the perceived value of Slack tremendously — thus the price point it can charge — regardless of how other solutions perform.

That might be an unpopular opinion, but Figma is all about fame.

Competitors aren’t that far behind.

Yet, Figma managed to establish itself as THE design tool in the minds of the design community.

With a vibrant community, big events such as Figma Config, and almost every large company using it, the perceived value of using Figma is high.

People don’t even compare Figma with Adobe XD or Sketch anymore. They just go straight to it.

With such a high perceived value, Figma doesn’t need to worry about recovering costs or waging price wars with competitors.

Airtable’s story is very similar to Figma’s.

Is it the best, most innovative, and most unique spreadsheet tool on the market? Not really.

But it’s definitely perceived as such.

Even though most alternatives are cheaper (free Google Spreadsheet, anyone?) and Airtable’s costs don’t grow dramatically with each record in a spreadsheet, the additional value it delivers with automation and extensions is valued so high by customers that Airtable can charge a premium for access.

Zapier’s formula is similar to Uber: The perceived value of outcome (automated tasks) x scale of outcome (number of tasks).

Imagine Zapier charging on competitor-based pricing. The biggest competitors aren’t other task automation products. The main alternative is doing these tasks manually — for free.

However, the perceived value people get from saving time and not having to remember about doing things is so high that they prefer to pay extra for automation.

Zapier managed such a good cost optimization that it doesn’t have to worry about the marginal cost of each new automation.

After looking at those examples, the benefits of this approach should be rather clear. Regardless, the three most important include:

Products that deliver exceptional value can charge the highest rates — regardless of how other players on the market price their product or what the underlying cost structure is.

In many cases, focusing on perceived value allows us to simply charge more.

Aligning the price to the scale of value delivered is a significantly more efficient way to find a price point that attracts most of the customers than using artificial metrics that customers simply don’t care about.

Basing the price (thus the revenue) on customers’ perceived value pushes you to constantly focus on improving the value rather than wasting resources on fights with competitors and price wars.

To implement value-based pricing there are many various frameworks and approaches, but they all usually center around three key steps:

Out of all the features or outcomes you offer (or plan to offer), which ones resonate with your customers the most?

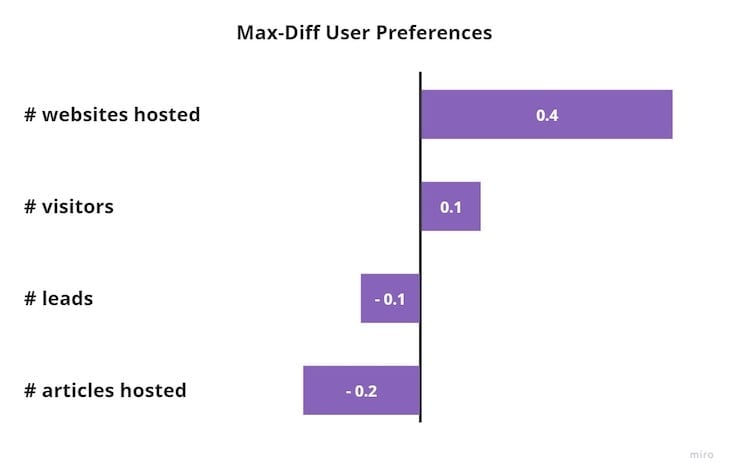

My go-to approach for this question is to develop a max-diff survey. By listing out the most important capabilities and asking people to choose one most and one least important for them, we can get an unbiased view of what matters to our audience the most:

Example of max-diff survey results: The number of websites hosted is the most preferred outcome for the users, so it’s the most important metric to understand the willingness to.

The best way to test perceived value for a given feature/outcome quantitatively is to test the willingness to pay for it.

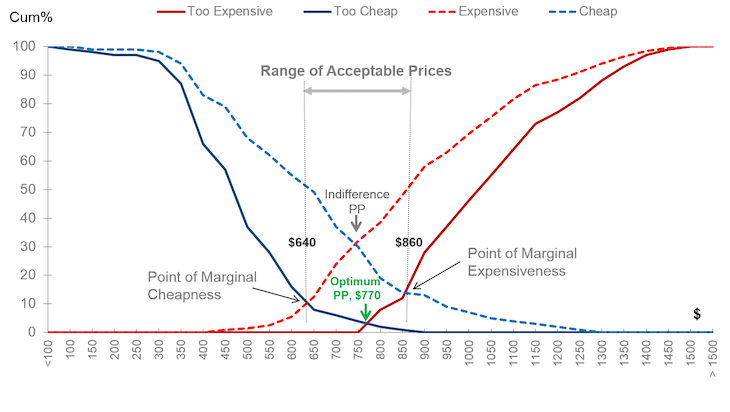

There are many ways to do so, although running the Van Westendorp Price Sensitivity Meter is the most effective.

Run a survey asking customers what price they find:

Then, plot a cumulative frequencies chart (or, as most people do, use a tool that does that for you):

As a result, you’ll develop a range of acceptable prices — which is a good indicator of how much they actually value the feature.

For simple products, you can stop here. Just understand the most essential feature for your customers and their willingness to pay for it, and you can set any price point within the range of acceptable prices.

For more complex products, however, you should conduct the price sensitivity analysis for each feature and move to step three.

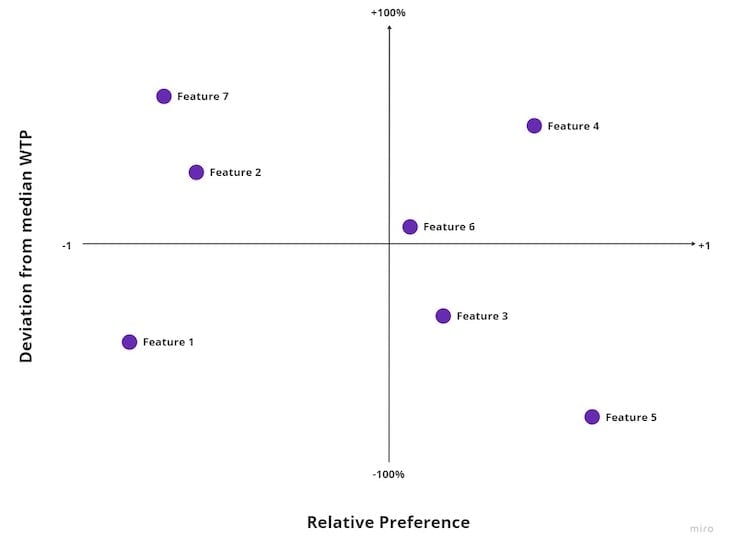

After figuring out which features are most important for your customers (max-diff survey) and what the perceived value (willingness-to-pay) for them, you can plot all of them on a 2×2 matrix:

Features that land on the top-right corner are your best candidate for revenue drivers.

You could now perform the price-sensitivity analysis once again — but this time for the whole set of features that landed on the top-right corner.

As a result of this exercise, you’ll identify a package with the most valuable features for your customers and how much they are willing to pay for it. That’s the best starting point for value-based pricing you can get.

In modern software development, there should be no discussion about value-based versus cost-based versus competitor-based pricing.

Value-based pricing is the only way. Period.

Customers don’t care about your cost — it’s your problem, not theirs. If your costs are higher than the value you deliver, you have a value proposition or business model problem, not a pricing problem.

Although looking at competitors and pricing is a valuable exercise to understand the market landscape, and in some cases, penetration pricing might be a good strategy to enter a crowded market, it can quickly become a limiting factor. Focus on your customers and their needs first. Competitors come in second.

Regardless of how your price scales — whether it’s per seat, outcome, or feature available — value-based pricing is the most efficient way to set a price point that’s right for both you and your customers.

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.

Maryam Ashoori, VP of Product and Engineering at IBM’s Watsonx platform, talks about the messy reality of enterprise AI deployment.

A product manager’s guide to deciding when automation is enough, when AI adds value, and how to make the tradeoffs intentionally.

How AI reshaped product management in 2025 and what PMs must rethink in 2026 to stay effective in a rapidly changing product landscape.