Qualitative analysis is one of the main tools in product managers’ toolset to understand users, generate actionable data, and validate assumptions.

In this guide, we’ll take a look at a qualitative analysis, the steps to conduct it, and how you can combine it with quantitative analysis to gain deep insights about your users.

Qualitative analysis is a UX research technique that aims to deeply understand particular participants’ contexts, pain points, and opportunities.

The goal here is to gain valuable insights and validate initial assumptions. Qualitative research is also a great way to establish much-needed user empathy.

Open-ended questions, conversations, and observations are the most common tools used in qualitative analysis.

A few common qualitative analysis exercises used by product managers and designers alike include:

User interviews are at the heart of qualitative analysis. After all, it’s challenging to build user understanding and empathy and to find truly game-changing insights without talking to users regularly.

At a high level, there are two types of interviews:

The goal is to understand new things about the user, generate new insights, and build empathy. The research question here is often quite wide, such as, “How users do X?” You can even conduct an exploratory interview without a clear research question.

Contrary to exploratory interviews, during validation interviews, an interviewer has a set of assumptions they want to validate.

For example, you might want to test your core hypotheses before building an MVP, so you structure your questions and the interview flow to understand whether your hypothesis is true. Gathering new insights is secondary.

Focus groups help you tap into collective thinking by inviting a few people into one room.

One of the benefits is that you can interview them collectively and get multiple perspectives on the same question. It also leads to conversations between participants that can help you uncover more things than just interviewing people on 1-1.

You can also give the group various tasks, such as feedback on the user flow, commenting on competitors, or even co-designing the product with you.

There’s one disadvantage, though: a collective discussion might make it harder for more introverted people to speak up and share their opinions. The participants might also be influenced by the group dynamics and not be as open about their true feelings or experiences.

Sometimes the best way to learn about users is simply to observe them. There are two ways to conduct these studies:

You invite recruited candidates and ask them to perform specific tasks. Thanks to that, you can be sure to observe behaviors you are most interested in.

However, these are also skewed, as people tend to behave differently when they know they are observed.

Observing people in an incognito mode without them being aware of the fact. It gives you the most reliable information and can help you uncover insights you didn’t even consider.

However, you achieve that at the cost of longer and more unpredictable studies.

Let’s take a look at how to plan, conduct, and wrap up a qualitative analysis. Follow this four-step process:

The fundamental part of qualitative analysis is the research question. What answers to what questions are you seeking? Do you want to understand users’ evening habits, their views on AI, biggest pain points in the workplace?

Without a clearly defined research question, you might waste dozens of hours asking random questions and not getting any meaningful insights. On the other hand, formulating research questions upfront will help you:

Limit yourself to a few core questions (ideally, one) per study. It’s better to gain a high-quality understanding of one issue than a vague understanding of 20 issues.

The next step is to choose the research method. This usually depends on the type of research question you have and the timebox.

For example, if you want to understand the motivations behind users’ behavior, then interviews are the way to go. However, ethnographic studies might be more effective if you want to understand what they actually do in some specific situations.

By the same token, you wouldn’t run a diary study if you needed to generate insights within one week.

There’s rarely a right or wrong answer here. Follow your gut feeling, and if in doubt, start with an interview and then decide on the next steps.

The quality of your research heavily depends on the quality of your candidates. You can’t just conduct qualitative studies on random people.

The first step is to clearly define who you want to talk to, including:

Then you create a screener — something that’ll help you distinguish these target users from all the rest. In most cases, a well-designed survey will do just fine:

You can recruit candidates yourself or engage a UX research agency to help you with that.

The next part is the actual study. Depending on your chosen research method, it can take as little as an hour or as long as a couple of weeks.

While the details depend mainly on the type of technique you chose, keep in mind these tips:

The final step is to document lessons learned and insights you gathered during the study. Some interesting exercises for that include:

Qualitative coding is all about categorizing insights you got from the research.

For example, if you did ethnographic studies, you probably noticed some pain points, opportunities, and interesting quotes. Start by categorizing them — for example, by adding colored sticky notes on a whiteboard or an additional column in a spreadsheet.

Then, go a bit deeper. If there are recurring themes in the pain points, also categorize them per type of pain point.

This will not only give you a clearer view of the insights, but you’ll also be able to quantify them, for example, by counting how many times you noticed a particular type of pain point. It’s going to be helpful in further prioritization.

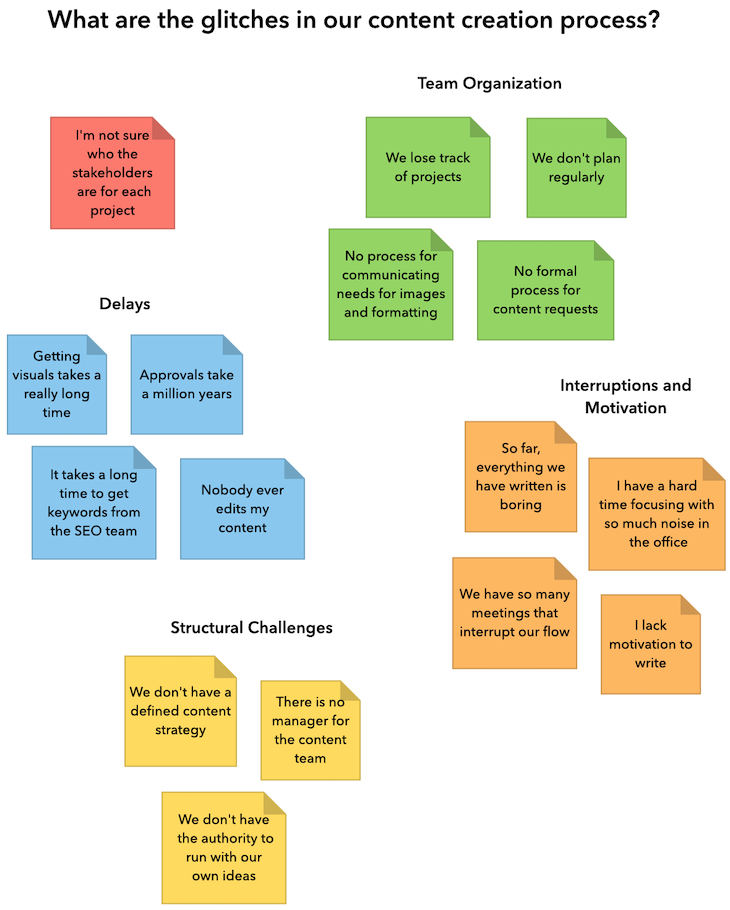

After qualitative coding, group similar insights together in a process called affinity grouping.

Here’s an example of what affinity grouping might look like:

Trying to process and develop actionable next steps based on 100 insights is nearly impossible. Doing it with 10 groups of similar insights is way easier.

If you decide to do interviews, create snapshot summaries of these interviews. Include:

It’ll help you refresh your memory from the interview when you need it and make further sharing your insights easier.

Qualitative research alone isn’t perfect, though. It’s time-consuming, subject to bias, and most importantly, it doesn’t give you statistically significant results.

The best way to get the most out of qualitative analysis is to combine it with quantitative research — that is, research focused on collecting large data samples to conclude statistically significant results.

I see it as a four-step loop:

Based on the results of your solutions, define the main points of improvement or question marks you have and go back to qualitative analysis to identify how to improve the solution even further.

Or, if you achieved your desired outcome, look for new opportunity areas to investigate deeper with qualitative analysis.

Qualitative analysis allows you to understand user context, build empathy and discover valuable insights from users.

The most common types of qualitative analysis include:

A proper qualitative analysis consists of five steps, which are:

However, qualitative analysis has its limitations. For the best results, you should combine it with quantitative analysis, creating a loop:

Qualitative analysis is a valuable tool for understanding users and their context. By combining it with quantitative analysis, you can gain a deeper understanding of your users, develop more effective solutions, and continuously iterate and improve your product or service.

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.

Maryam Ashoori, VP of Product and Engineering at IBM’s Watsonx platform, talks about the messy reality of enterprise AI deployment.

A product manager’s guide to deciding when automation is enough, when AI adds value, and how to make the tradeoffs intentionally.