Product design is a bit of a “chicken and egg” situation — should we get the product idea first and then attempt to find product-market fit (PMF), or research a market to see if there’s a product that’s missing from it? Well actually, both are great approaches and market research surveys can help with either of them.

In this article, you’ll learn about the different types of market research surveys, what each type is useful for, and what questions to put in them to ensure that you make great data-driven decisions about your products and overall brand.

Market research is the process of gathering information about a market. More specifically, the customers and opportunities to thrive within it (if any), and how it feels about your products and brand if such exists. In a nutshell, this information is used to determine product-market fit.

Market research surveys are used to map out markets and the customers within them, determine target markets, reposition brands within the markets that they’re already in, or simply just reaffirm that the products are in the best positions and that the brand is perceived in the right way.

Now let’s take a look at the different types of market research surveys.

There are different types of market research surveys. We’ll cover the following:

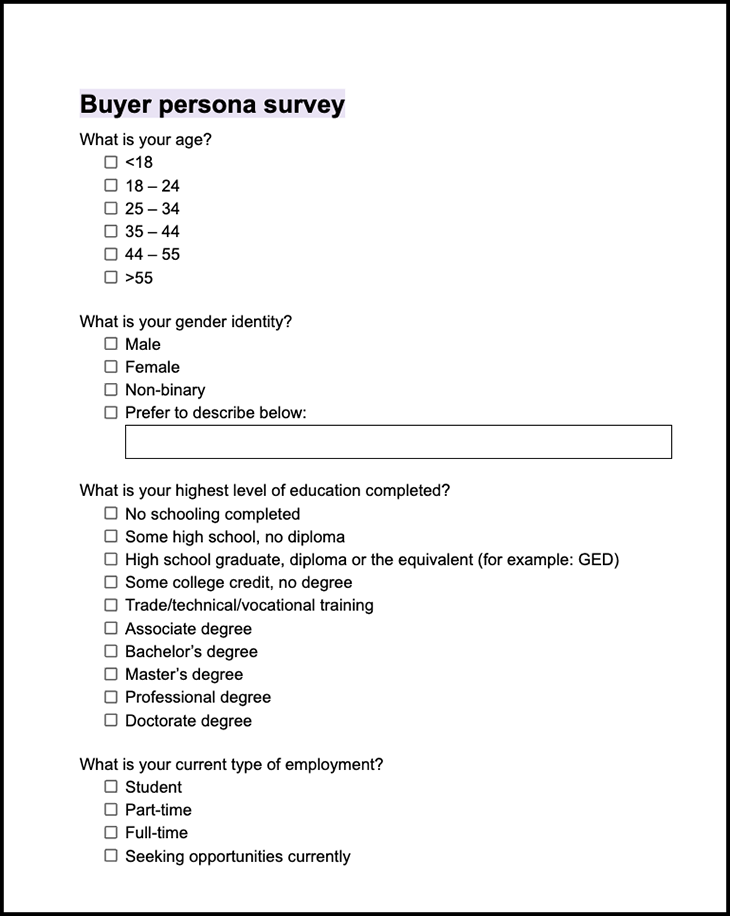

Buyer persona surveys are used to understand who buys the type of product you’re selling or thinking about selling. This is the market research survey you’d start with but also carry out periodically, investigating further should the market appear to change.

These are the questions that I’d ask (but feel free to adapt as necessary):

You can access this buyer persona market research survey template on Google Docs:

Find out where customers of the product “hang out” and send them this survey.

You won’t acquire any insights from observing the results at face value — you’ll need to identify trends within them. For example, different age demographics might have different motivations for buying. For this reason, you’ll usually learn about the size and motivations of multiple submarkets as well as the market overall.

You’ll also learn where customers hang out most by the number of responses per source. In addition, the “How do you typically learn more about [product]?” question provides additional sources of respondents to the survey.

Ultimately, you’ll learn who and where.

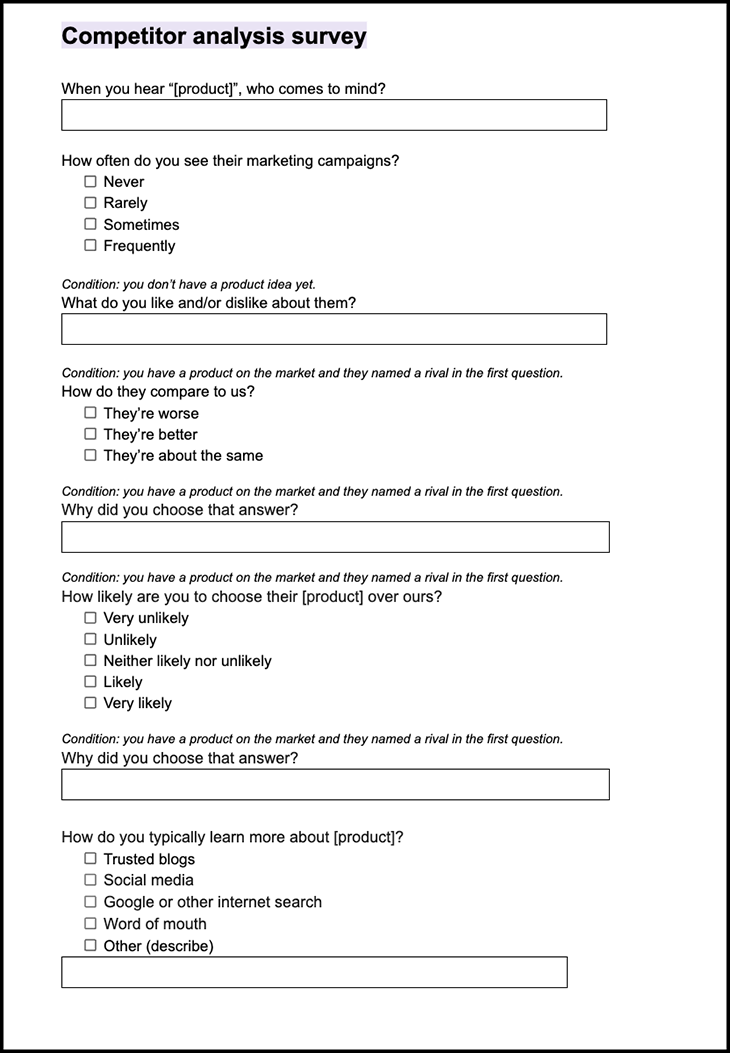

Competitor analysis surveys are used to see how dominated, underserved, or untapped a market is. They’re also used to discover opportunities for improvement, the shortcomings of rivals to exploit, and even fresh product ideas. When combined with buyer personas, you’ll be able to position or reposition your product in the market, or if necessary, call it a day and exit the market entirely.

Again, these are the questions I’d ask (adapt as necessary):

You can access this competitor analysis market research survey template on Google Docs:

The audience for this survey is the same as that of buyer persona surveys — customers who use the type of product in question. Run it periodically, especially if you’re seeing low sales. However, if you’re fishing for a product idea, start with this survey (feel free to be a bit more vague; for example, ask about coffee rather than coffee shops) and then lead into your buyer persona survey after that.

Competitor analysis surveys are a bit more qualitative than buyer personas, so you’ll want to synthesize the data by using affinity mapping to quantify the insights.

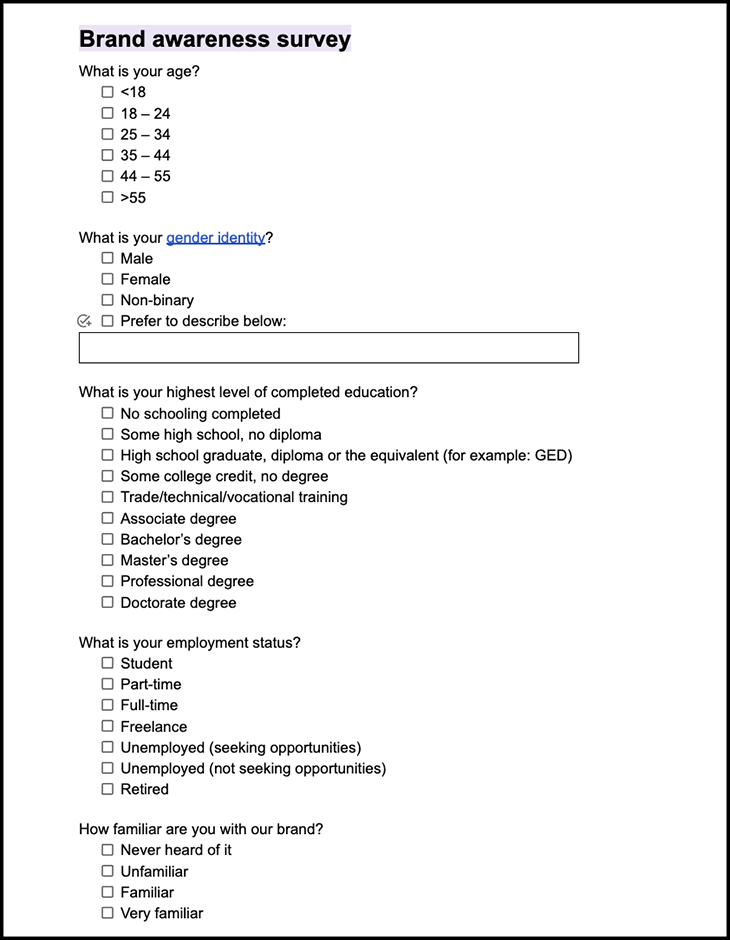

You can use brand awareness surveys to see how your brand is perceived by a target market. This is less about product needs/wants and more about how people see your brand overall, which in turn affects whether or not people are willing to consider or recommend your products.

Sometimes it can seem like you’re doing everything right, yet the market looks to your competitors. In this case, it could be that people are just unhappy or unaware of your brand, and this is where brand awareness surveys come in. Previously mentioned market research surveys cover brand awareness a bit, but this focuses on it.

These are the survey questions I’d recommend:

And here’s the brand awareness survey template for you to adapt and use:

Send this one to your target market specifically.

It’s a quantitative survey, so once again, synthesize the results using affinity mapping and then use the insights to make data-driven decisions about your brand.

Market research surveys should be utilized alongside other types of market research. Let’s take a quick look at what those types are.

With market-field research, you’d carry out your survey in-person and more contextually. For example, if you were researching an existing or potential market for coffee shops in a neighborhood, you’d benefit from surveying people at those establishments or whatever you think is the next best thing. You can approach this as a 1:1 interview or as what’s referred to as participant observation (which in this scenario is coffee and casual conversation!).

There’s also direct observation, where you’d just observe from a distance (in this scenario, you’d perhaps observe how long customers spend in coffee shops). If you’d really like to lean into this type of market research, I’d suggest doing both as part of a general market-field research case study.

Also, ethnography is a type of field research where entire social settings are observed, but this has very few use-cases.

The point of field research is to catch people in context, where their thoughts and feelings are at their most intense. Diary studies are similar, except that participants will record their experiences with a product (or lack thereof) over a specific course of time. Do whichever feels most applicable.

Market research interviews are 1:1 conversations to be used in place of market research surveys or as follow-ups to them.

Market research focus groups are essentially interviews but with all of the interviewees at once. The main benefit of focus groups is that a participant’s remark can help other participants to discover their unconscious thoughts. They’re also faster than conducting 1:1 interviews individually, but slower than surveys.

Different people open up in different situations depending on their personality type, so if resources allow I’d recommend doing all of them.

Conjoint analysis helps you to determine how much customers are willing to pay and for which features. If you’ve ever come across a useful feature but the overall product seemed expensive and/or had too many unwanted features, you either weren’t the target market for it or they didn’t do any conjoint analysis.

There are also many types of product pricing surveys — generic price testing, willingness-to-pay, price laddering, Van Westendorp’s price sensitivity meter — that are typically used during the product design process. While these are more for product research than market research, they can still be useful and you’ve probably done them already, so the best way to avoid reinventing the wheel is to see what kind of insights product designers are already sitting on.

Market research surveys are extremely useful for defining target markets, actually targeting them, repositioning ourselves within the markets that we’re already in, or reaffirming that we’re already in the right positions for product success.

However, market research surveys alone aren’t enough — we must also utilize other types of market research (as mentioned above) and utilize them in a strategic way. Kimberly Hale put together a great high-level guide to the overall market analysis process that demonstrates how to approach market research strategically.

As always, thanks for reading. Drop your thoughts and questions into the comment section below!

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.

Maryam Ashoori, VP of Product and Engineering at IBM’s Watsonx platform, talks about the messy reality of enterprise AI deployment.

A product manager’s guide to deciding when automation is enough, when AI adds value, and how to make the tradeoffs intentionally.