Editor’s note: This article was reviewed on 26 August 2024 by Sara Nguyen and updated to elaborate on the consequences of not achieving product-market fit, discuss quantitative and qualitative metrics by which to measure product-market fit, provide more clarity around how to achieve product-market fit, and provide another real-world case study.

In this guide, we’ll go over the definition of product-market fit, explain why this balance is critical to the long-term viability of your product, and review who is responsible for achieving and managing it.

We’ll also walk you through steps to identify and strive for product-market fit, list some metrics to track in that pursuit, and drive the point home with some real-world examples of both excellent and poor product-market fit.

Product-market fit describes a product or service that effectively fulfills the underserved needs of the target market in a way that can sustain growth and profitability.

That is, assuming enough people are using your product and it is providing enough value for them to continue to choose it over your competitors. It doesn’t hurt if your users or customers are advocating for your product at a high enough volume to drive continued growth.

The aim is to find the sweet spot where you’re offering just enough value that your customers find the product usable and your business sees it as feasible and viable.

Product-market fit is critical if you want to grow your business and effectively scale your product or service. If you’re a startup, you’ll likely need to demonstrate product-market fit to unlock further funding, as investors want to know they’re going to see a return on their money.

Without ensuring product-market fit, you’ll face consequences like:

A product that doesn’t meet the needs of the market is likely to lead to business failure. The success of a product hinges on product-market fit.

Responsibility is very much shared when it comes to product-market fit. Depending on the size of your company, either the business leaders or the product manager may be responsible for identifying the target market and customer.

A product designer, user researcher, or product manager (or a combination of all three) might contribute to identifying underserved market needs.

The cross-functional product team is responsible for identifying the value and creating the product or service, and sales and marketing is responsible for getting the word out and acquiring your first customers.

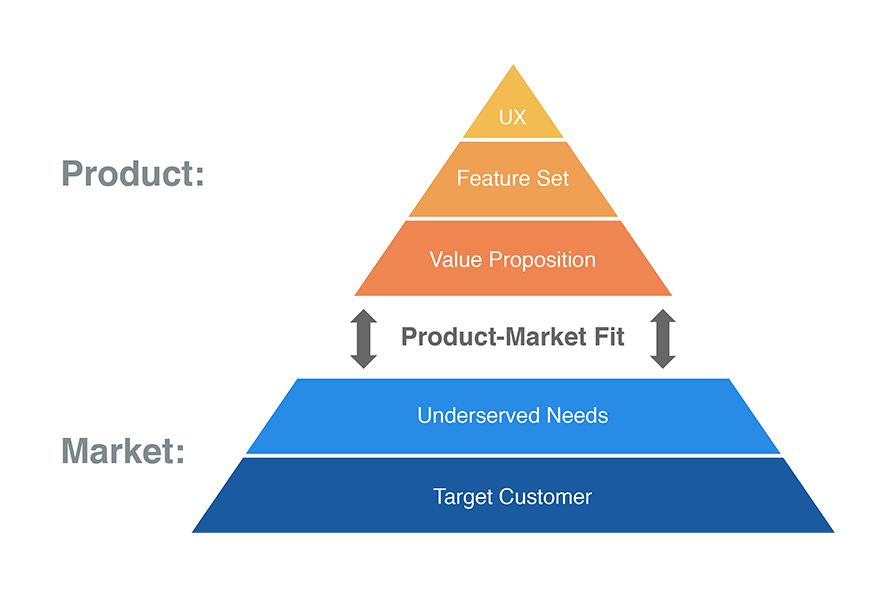

If we break down the components of product-market fit using the model outlined by Dan Olsen, we can see a path to achieving it.

Dan Olsen: “The Playbook for Achieving Product Market Fit”

Dan Olsen created the Lean Product Process to help teams achieve product-market fit. The 6-step process provides a framework for teams to validate and reiterate their product idea.

To truly understand the Lean Product Process, you’ll also need to familiarize yourself with the Product-Market Fit Pyramid:

Each layer needs validation to achieve a strong product-market fit. Let’s take a deeper look into how this pyramid works.

Looking at the market section first, you need to have a good grasp of who the target customer is for your product. Many companies make the mistake of trying to create something for everybody. But if you don’t know who your product is for, you won’t be able to succeed at creating something people want to buy and use, or create effective marketing.

When thinking about your target customer, it’s important to consider things like demographics (age, location, gender, ethnicity, etc.) and psychographics (behaviors, attitudes, values, etc.). In addition, you need to understand their core needs and problems and how other products on the market are serving those needs today, as well as the potential size of your market.

The goal is to find a gap where the needs of your particular target customer are currently underserved or unmet by existing products. The blue ocean strategy is a great framework for identifying gaps in the market. Of course, you will need to do your research and speak to potential customers to understand their needs.

Once you’ve identified your target customer and an underserved need, you’ll need to identify a value proposition that effectively meets that need — the product part of the product-market fit diagram.

In short, what are you going to offer to your target customer that will add significant enough value for them to choose to use those products or services? A value proposition canvas is a great tool for mapping out how you’re going to serve target user or customer needs and the products and services you plan to offer.

Finally, you need to deliver a product that provides just enough value to your target user or customer that is usable, technically feasible, and business-viable — the minimum viable product (MVP). Identifying this will come from prototyping your ideas, testing them with your target users or customers, and iterating to find the value.

Once you’ve achieved all of the above, the work doesn’t stop there! You’ll need to look at how you can continue to provide value to your customers as the market shifts and changes and other players come emerge with new services.

When it comes to measuring product-market fit, there is no one North Star metric. Rather, several metrics come into play at different parts of the journey.

You might consider measuring quantitative metrics like:

You’ll also need to consider qualitative metrics such as:

There is no magic number associated with any of these metrics. When you see consistent progress and success in all of the above, you can have confidence that you’re well on your way to achieving product-market fit.

To really bring the idea of product-market fit to life, let’s take a look at some big-name examples: one where the company truly understood its market, value proposition, and how to execute its products and service, and another where the company failed to hit the mark.

Uber was founded in 2009 by Travis Kalanick and Garrett Camp as a next-generation ride sharing service. Today, it operates in 72 countries and in more than 10,000 cities worldwide.

Uber has since expanded its operation to include food delivery, couriers, package delivery, motorized scooters and bicycles, and more. The company is currently worth over $42 billion.

If we break down Uber’s approach to product-market fit by market and product, we can see how it started out.

Uber was very specific about its target customer and identified a real need that no other company had solved in a meaningful way.

The target customer, initially, was professionals in American cities; obviously, it has scaled way beyond this.

The need was there because, in the late 2000s, it was often time-consuming and inconvenient to find a taxi — as unimaginable as that might seem today.

Taking advantage of recent advances in technology and the advent of the first iPhones, Kalanick and Camp came up with an initial value proposition and feature set that had clear differentiators:

Value proposition/feature set:

The company launched its first ride in 2010 and received initial major funding of $1.25 million shortly after.

Spotify was founded in 2006 by Daniel Ek and Martin Lorentzon as a response to music piracy. Since then it has grown to include podcasts and audiobooks. Today, the company has 626 million users and is worth over $67 billion.

Let’s take a look at how Spotify managed to achieve product-market fit.

It was the post-Napster era, and millions of consumers had proven that they were willing to download music illegally to avoid purchasing physical albums. The music industry was losing money, but it was difficult to get customers to buy music when they had the option to download it for free over the internet.

The target customers were people who wanted to listen to music without buying the album.

Spotify took a bet that many of these people were willing to pay a small fee to listen to their music legally. Music lovers wanted an affordable and convenient way to get their tunes.

Spotify provided a legal and user-friendly platform to listen to music. Its value proposition and feature set included:

Spotify reached product-market fit by creating a product that let users listen to music on an affordable budget.

Canva is a graphic design platform launched in 2013 and was co-founded by Melanie Perkins, Cliff Obrecht, and Cameron Adams. Today, it has more than 170 million users worldwide.

Let’s take a look into how Canva’s graphic design platform stood out from its competition and found product-market fit.

There are many work situations where a graphic designer is needed but there isn’t anyone who knows how to use Photoshop. A design tool like Photoshop takes time and effort to learn how to use it. It’s not a user-friendly option for people without a design background.

Organizations with a tight budget like non-profits, small businesses, or the solopreneur may run into this problem. They need a solution that could help them create graphics, presentations, flyers, and more. Even if they had no design skills.

For Canva, the target market was a broad audience of business professionals. They most likely didn’t have design experience and lacked a program that could help them create high-quality images and graphics.

Canva democratized graphic design by creating a drag-and-drop platform. It was simple enough for anyone to use but still created professional images.

Its value proposition and feature set included:

Canva reached product-market fit by creating a graphic design platform that was accessible and easy-to-use.

Coca-Cola is one of the world’s best-selling soft drinks, but in the late 1970s and early 1980s, rival Pepsi-Cola was gaining market share and consumer feedback was showing that people preferred the sweeter taste of their main competitor’s product.

In 1985, with over 190,000 blind taste tests performed and consumer research data in hand, Coca-Cola launched New Coke to compete with Pepsi and took its existing formula off the market entirely.

Researchers had failed to realize the emotional attachment that consumers had to the original Coca-Cola beverage and hadn’t asked how they would feel were the existing product to be taken away (recall the 40 percent rule). Loyal consumers were outraged; at the height of the furor, Coca-Cola was receiving 8,000 angry complaints a day.

Just 79 days after the initial launch of New Coke, the company announced the return of the original Coca-Cola formula and a rebranding of New Coke to Coke II, which was eventually abandoned in 2002.

Today, product managers around the world view New Coke as a very costly case study in launching the wrong product.

Below are some tips and best practices to keep in mind when striving to achieve product-market fit:

Finding product-market fit can be elusive, but clarifying your target customer/market, understanding their core needs, and identifying the right feature set and value proposition are a recipe for success.

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Suvrat Joshi shares the importance of viewing trade-off decisions in product management more like a balance than a compromise.

Great product managers spot change early. Discover how to pivot your product strategy before it’s too late.

Thach Nguyen, Senior Director of Product Management — STEPS at Stewart Title, emphasizes candid moments and human error in the age of AI.

Guard your focus, not just your time. Learn tactics to protect attention, cut noise, and do deep work that actually moves the roadmap.