Acquiring new customers is critical, and it’s not free.

Whichever method you use to attract new users to your product, there’s always some cost associated with it. It might be as straightforward as purchasing a Facebook ad or a more indirect cost such as paying a content writer to write an SEO-friendly blog post.

If you understand the cost structure of user acquisition, you can act on it and optimize it. In the long run, lower customer acquisition costs lead to more users or funds for product development.

Because the product itself plays a crucial role in user acquisition, every product manager should have a solid understanding of their growth engine.

In simple terms, customer acquisition cost (CAC) is the amount of money spent to acquire new customers.

There are various components of customer acquisition costs. The exact price structure depends on your growth model and might include:

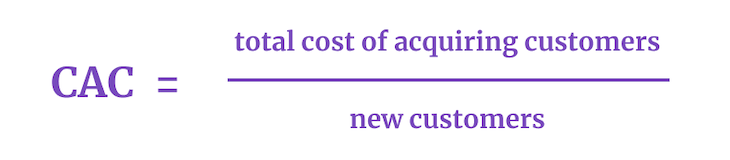

To calculate the average customer acquisition cost (CAC), combine all acquisition costs and divide this figure by the number of new customers acquired in a given period.

The formula to calculate CAC is as follows:

For a practical example, let’s say that, in June, you spent:

For a practical example, let’s say that, in June, you spent:

Meanwhile, you acquired 40 new customers.

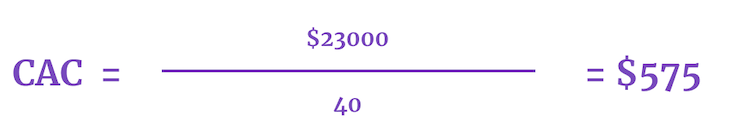

The CAC calculation for the example above would be as follows:

In this scenario, the cost of acquiring a single new customer in June was $575.

In the example above, we calculated our customer acquisition cost of $575. However, the number itself doesn’t tell us much about whether it’s a bad or good result.

Although you want your CAC to be as low as possible, high customer acquisition costs are not necessarily bad.

Optimal CAC depends heavily on customers’ lifetime value (LTV). Lifetime value tells us, on average, how much revenue one customer provides us during their whole lifespan.

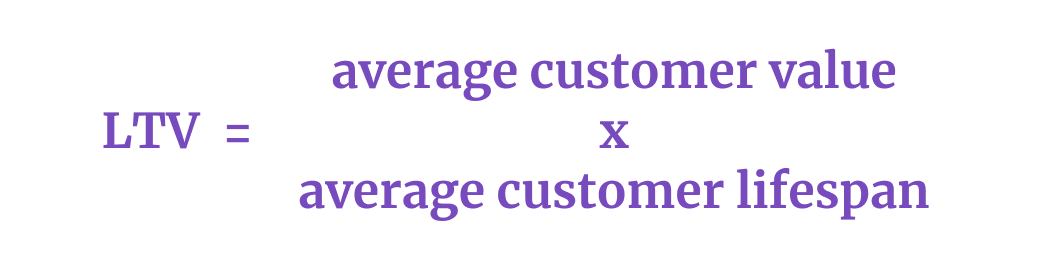

To calculate customer lifetime value (LTV), multiply an average customer’s value with their average lifespan.

The formula to calculate average customer lifetime value is as follows:

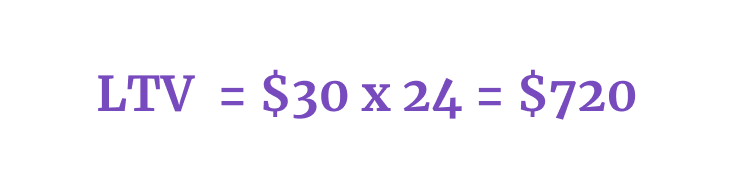

For example, in the case of an SaaS product, we could use:

So, if the average subscription cost is $40 and users use the service for an average of two years, then:

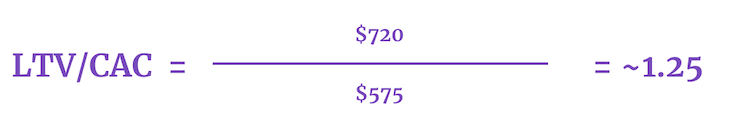

Having calculated both lifetime value and customer acquisition cost, we can develop an LTV/CAC ratio:

As a general rule of thumb, 3 or higher is a healthy ratio — meaning you earn at least three times the amount you spent acquiring each customer.

This means that even a CAC as high as $5,000 per customer is perfectly fine if the LTV of every customer is, say, $30,000. On the other hand, $3 CAC is exceptionally high if you only earn $4 from every new user.

In some cases, lowering the LTV/CAC ratio might be beneficial if it allows you to get more customers in the long run. Imagine two scenarios where, in both cases, LTV is $100.

Technically speaking, scenario 1 has a more beneficial LTV/CAC ratio of 10 compared to 7.5 in scenario 2, but when we do the math, the second scenario has a higher total profit:

Of course, this example is a simplification and doesn’t include things such as the cost of maintaining every single active user. The point is that there isn’t a perfect answer to how high CAC or LTV/CAC ratio should be. In every case, it all comes down to math.

As a general rule of thumb, the lower the CAC and the higher the LTV/CAC ratio, the better.

The customer acquisition cost is steadily rising. It has increased by roughly 60 percent in the last five years and is poised to continue to rise.

Reasons for the rise in CAC include:

This increasing customer acquisition cost is a severe threat to most businesses. To mitigate these risks, you should do whatever you can to lower their acquisition costs.

Tactics to reduce customer acquisition cost include:

Conversion is one of the key factors impacting average customer acquisition cost.

If you pay $0.20 for every visitor and your visitor-customer conversion is 1 percent, then you need 100 visitors ($20) to get a customer. If you improve the conversion to 2 percent, you need half the number of visitors for half the cost ($10).

Maximizing the conversion rate is one of the highest-leverage activities you can do when it comes to minimizing the overall CAC.

When you show an ad to the wrong persona or your salesman approaches the wrong type of business, you’re just throwing money away.

The less focused your targeting is, the higher the chance of losing money by approaching the wrong people.

Specificity is the key. Define the type of user persona your product targets and ensure your acquisition efforts focus on that persona. Don’t just throw money against the wall.

Experiment with your acquisition tactics as you experiment with your product-market fit.

Try different messaging, graphics, or ad/email titles. See what converts the best, double down on winners, cut losers, and keep experimenting. It takes time and plenty of failed campaigns to discover what truly resonates with end-users.

Your first campaign, e-mail, or promo video will never be your best one. The more you experiment, the better you will acquire new users and the cheaper it will be.

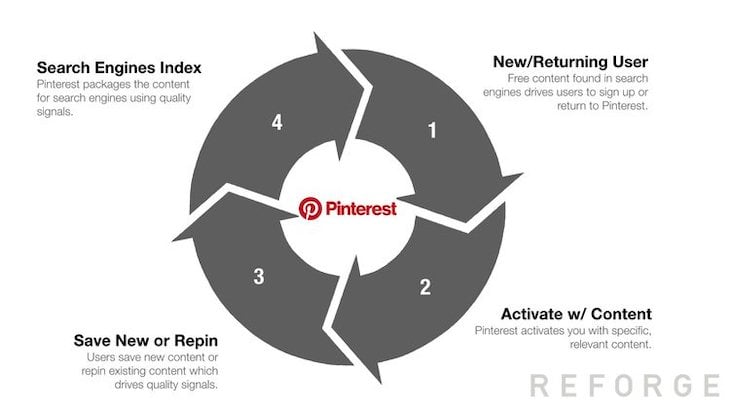

Growth loops are mechanics where new users indirectly bring more users with them. Pinterest is a great example:

A healthy growth loop is the ultimate solution to lowering customer acquisition costs. An ideal loop will even allow you to acquire new users for free.

One of the easiest ways to lose money is to invest in multiple growth channels simultaneously.

There are multiple ways to grow a product, including:

Usually, there’s one growth channel that fits the product the best. The goal is to find it and adjust the product and strategy to maximize its potential.

Don’t try to master all distribution channels. It will only drive your customer acquisition costs crazy.

Customer acquisition cost (CAC) tells us how expensive it is to get new users. Whether a given CAC is high or low depends on the overall LTV/CAC ratio and the ultimate return on investment.

The cost of acquiring new users is growing yearly due to increasing competition and new data privacy laws. For this reason, entrepreneurs and product managers should seek ways to minimize their overall customer acquisition costs.

Although there are many micro-tactics and growth hacks to lower the CAC, the most important ones are:

Don’t neglect your acquisition strategy. It doesn’t matter how great your product is if no one uses it.

Featured image source: IconScout

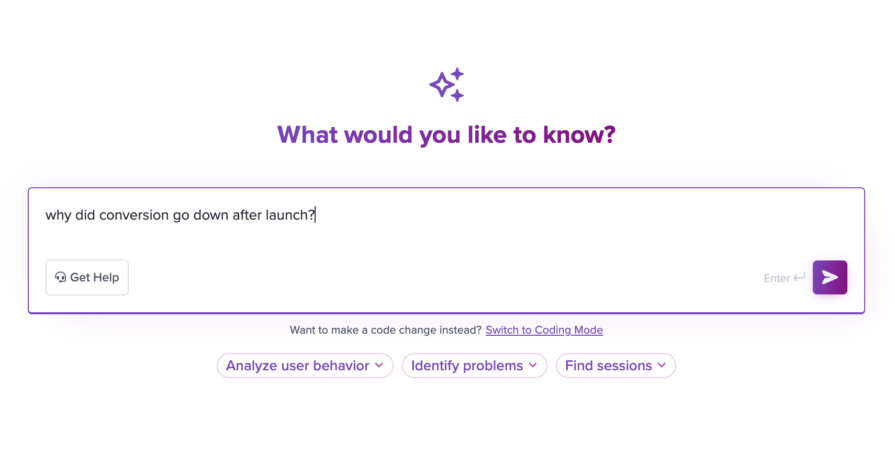

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.