Customer surveys are a great way to collect qualitative and quantitative insights about your product and audience.

Although NPS surveys are undoubtedly among the most common types of customer surveys, they can be very limited. They give you late insights, measure only the loyalty dimension of customer feelings, and, more often than not, aren’t super actionable.

In this article, you’ll learn beyond the classical net promoter score and explore other valuable ways to gather insights from your customers.

A customer survey is a structured research tool that product people use to gather insights about their customers.

Depending on the survey, you can focus on gathering qualitative insights, such as opinions and perceptions, or quantitative measurements, such as 1-10 scores for various categories of customer experience.

There are three main ways to conduct a customer survey. You can conduct a:

Specific survey questions differ depending on your research objectives, so let’s focus more on the form itself.

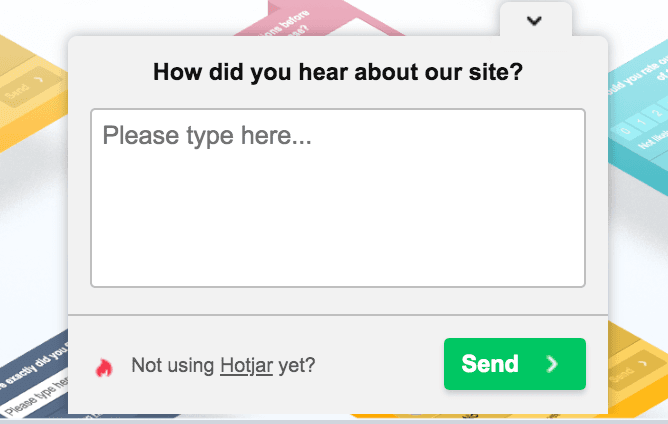

On-site surveys are quick surveys appearing while a user uses the product.

They can appear as a non-invasive widget somewhere in the corner of the screen, as well as full-screen attention-grabbing modals:

The biggest advantage of these surveys is the ability to capture users in a particular context of their user journey. On the other hand, they tend to add clutter and friction to the user experience as a whole.

Use on-site surveys when you:

With a research survey, you define a set of questions and send them out to a targeted group of users.

Compared to on-site surveys, research surveys tend to be more robust (consisting of around 5-10 questions) and require more time to complete. For this reason, they’re usually incentivized.

These are best suited as a part of exploratory research when you want to learn more about your customers and their beliefs and attitudes.

Use research surveys when you:

Another way to conduct a customer survey is to combine it with usability studies.

You first conduct a usability study, whether moderated or unmoderated, and right after completing all the tasks, you ask testers to answer a few questions regarding the product.

My favorite approach is to simply ask a few exploratory questions about:

Use post-usability surveys when you:

To run an effective customer survey, you need to set yourself up for success. You can follow these steps to help you get started.

The number one mistake people make when crafting customer surveys is a lack of specific goals in mind.

A lack of a clear objective leads to random questions, which in turn leads to unperceptive results.

The first step is to clearly name what you want to learn from the survey. Ask yourself:

Don’t run a survey if you don’t have a clear goal behind it.

Depending on the objective you set up in a previous step, decide what type of survey makes the most sense. As a reminder from earlier in the article:

Use on-site surveys when you:

Use research surveys when you:

Use post-usability surveys when you:

There are hundreds of survey tools out there, but the most noteworthy include:

Survey design is a discipline of its own. Some companies even have dedicated survey designers.

Not only does the exact setup of questions depend strongly on your research objective, but there are also many principles one needs to keep in mind when choosing and phrasing the questions.

Last but not least, I recommend sending out the survey to a limited sample first to test response rates and whether your audience understood the questions. It would be a significant waste to send a survey to thousands of customers just to realize one of your questions was unclear.

Before wrapping up, here are the most common mistakes when it comes to conducting customer surveys:

Customer surveys are a great way to gather both qualitative and quantitative data about your customers.

Depending on your research objective, you can choose from

Always make sure to start with a clear objective in mind and only then choose the survey format and the questions themselves to satisfy that research objective. Don’t fall into the trap of running research just for the sake of research, as it wastes both your and your customers’ time.

Also, keep in mind to avoid the most common pitfalls, such as overwhelming customers with questions, or not randomizing answers and segmenting results.

Customer surveys can be a powerful research tool, but only if used correctly.

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.

Maryam Ashoori, VP of Product and Engineering at IBM’s Watsonx platform, talks about the messy reality of enterprise AI deployment.

A product manager’s guide to deciding when automation is enough, when AI adds value, and how to make the tradeoffs intentionally.