Alright, folks, let’s get ready to rumble! Today’s topic is all about net present value (NPV), the heavyweight champion of financial analysis.

You may have heard of the legendary “Rumble in the Jungle,” one of the most significant boxing matches of all time, that took place on October 30, 1974. Muhammad Ali was facing a much younger and stronger opponent in George Foreman.

Ali knew he couldn’t beat Foreman with his usual boxing style, so he developed a new strategy, which he later dubbed “rope-a-dope.” It involved letting Foreman tire himself out by delivering punches to Ali’s arms and body while Ali remained in a defensive position.

Once Foreman was exhausted, Ali took advantage and delivered a series of devastating punches, ultimately knocking out Foreman in the eighth round and thus winning the fight.

In boxing, you always want to know the value of your punches before you throw them. The same is true for investments; you can’t simply rely on traditional methods and expect to achieve success. Instead, you need to evaluate potential investments with a critical eye and look for innovative approaches to maximize your returns.

This is where net present value (NPV) comes in to help you assess the potential profitability of an investment and make informed decisions that are more likely to result in success.

In this guide, we’ll review the definition of net present value, the formula to calculate NPV, limitations associated with using this metric, and how it can help you improve your decision making around investments.

Ding ding, let’s get ready to rumble!

Net present value (NPV) is a financial metric that is used to measure the value of an investment.It shows the variance between the current value of the money you receive and the current value of the money you spend for an investment over a specific duration.

In other words, NPV calculates the present value of all expected future cash flows, discounted at an appropriate rate, and compares this to the initial investment.

The formula to calculate NPV is:

NPV = Σ (CFt / (1 + r)^t) - C

Where:

If the NPV is positive, it means you are expected to generate value and the investment is likely to be profitable. A positive NPV indicates that the estimated future cash inflows are greater than its estimated future cash outflows, which is a desirable outcome.

If the NPV is negative, it means the opposite. A negative NPV indicates that the estimated future cash outflows are greater than its estimated future cash inflows, which — you guessed it — is not what puts food on the table.

Here’s an example:

Suppose you’re considering investing in a project that requires an initial investment of $20,000 and is expected to generate cash flows of $5,000 at the end of year 1, $7,000 at the end of year 2, and $8,000 at the end of year 3. The discount rate for the project is 11 percent.

The NPV is as follows:

NPV = (5000 / (1 + 0.11)¹) + (7000 / (1 + 0.11)²) + (8000 / (1 + 0.11)³) - 20000

NPV = -$3964.61

Because the NPV is negative, this project is not expected to generate a return greater than the required rate of return (11 percent). Therefore, this could be considered a bad investment.

It’s important to note that the NPV should not be analyzed in isolation. It is advisable to compare NPV to other financial metrics and evaluate it in the context of your goals, risk tolerance, and other factors.

Additionally, it is good to carefully consider and continuously review the assumptions you use to generate the cash flow projections and the discount rate to ensure they are reasonable and accurate.

There are several factors that can significantly impact the outcome and the ultimate decision on whether to pursue the project. It is important to carefully consider them when evaluating the NPV.

These factors include:

The discount rate is the minimum rate of return expected from the investment. A higher discount rate means that future cash flows are worth less today, and therefore reduces the NPV. Needlessly to say, a lower discount rate increases the NPV.

The accuracy and reliability of cash flow projections significantly impact NPV. Being unrealistic or overly optimistic here with your projections leads to incorrect assumptions about future cash flows, which results in an inaccurate NPV.

The timing of cash flows is important in calculating NPV. Money received sooner holds greater value than money received later due to the concept of the time value of money.

The amount of capital required has a significant impact on the NPV. Higher capital costs results in lower NPV, and vice versa.

Last but not least the level of risk associated impacts the required rate of return and the discount rate, which in turn affects NPV. Investments with higher risk typically require a higher rate of return, resulting in a lower NPV.

In addition to NPV, there are other financial metrics by which to evaluate an investment opportunity, such as the return on investment (RoI), profitability index (PI), and operating profit margin, to name a few.

And then there is the internal rate of return (IRR).

IRR is the discount rate that makes the NPV of an investment equal to zero. Where NPV is a dollar amount that represents the absolute value of the investment’s profitability, IRR is the percentage rate of return that the investment is expected to generate over its life.

A more attractive investment opportunity is indicated by a higher IRR.

Here is an example:

Let’s say you are considering investing in a project that requires an initial investment of $100,000. Over the course of five years, the project is expected to generate cash flows as follows:

To calculate the IRR, you need to find the discount rate at which the NPV of these cash flows becomes zero. Using trial and error, you find that the IRR for this investment is approximately 12 percent.

Expert tip: To find the IRR, without the hassle of trial and error, use a spreadsheet program like Microsoft Excel or Google Sheets with the following formula:

=IRR(value,[guess])

IRR is useful when you are comparing investments with different expected cash flow patterns as it directly incorporates the time value of money.

However, IRR can have limitations. For example, it can give misleading results when comparing investments with different cash flow patterns or when there are multiple IRRs for an investment. In these cases, NPV is your most trusted sparring partner.

In general, to get a more comprehensive understanding of the financial viability of an investment, don’t feel ashamed to use both metrics together.

So how can we use NPV to evaluate potential product decisions?

The most obvious use case for calculating NPV is to estimate the present value of all expected cash flows from your product, including revenue and costs. As described above, this helps you determine whether your product is expected to generate a positive or negative return on investment and make decisions accordingly.

When you have multiple product development options, you can use NPV to compare the expected profitability of each option. It allows you to choose the option that is expected to generate the highest return on investment.

NPV can also help you to determine the optimal price point for your product. By estimating the present value of cash inflows at different price points, you can choose the price point that is expected to maximize NPV and thus your profitability.

At a certain point, you’re going to have to make changes to your product. Use NPV to estimate the impact of the various changes you are considering on the product’s profitability. By estimating the change in expected cash flows resulting from the changes and recalculating NPV, you can determine whether the changes are likely to be profitable.

Now NPV is not always one-punch knock-out. While it is a useful tool for evaluating financial decisions, it does have limitations:

Net present value (NPV) is a financial metric that measures the value of an investment by calculating the present value of all expected future cash flows and comparing this to the initial investment.

A positive one means that the investment is profitable and generates a return, while a negative one means the investment is not profitable and results in a loss.

Several factors affect NPV, including discount rate, cash flow projections, the timing of cash flows, capital expenditures, and project risk.

So, whether you’re a boxer looking to win a fight or a product manager looking to win over the world, the key is to approach your goals with a strategic mindset and a willingness to evaluate your options and make informed decisions.

With tools like net present value in your corner, you’ll be well-equipped to make smart investments and achieve success!

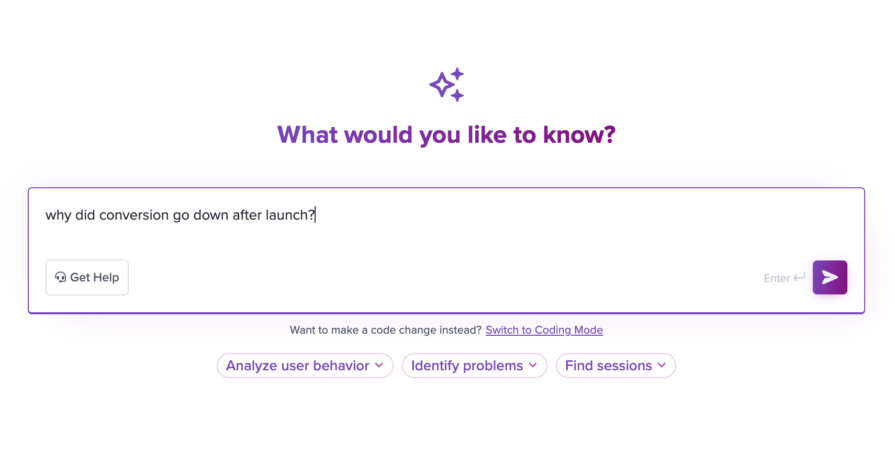

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.