Monthly recurring revenue (MRR) is one of the most important subscription metrics to track. Let’s unpack what monthly recurring revenue is, why it’s important, how to measure it, and what you can do to improve your MRR.

Monthly recurring revenue (MRR) is a metric that shows how much revenue your active subscriptions generate during a particular month.

Although it appears in other industries, MRR is most commonly used for SaaS products. So, whenever you hear monthly recurring revenue, it’s usually safe to assume you’re talking about a subscription product.

Monthly recurring revenue is one of the most important subscription metrics for product managers and businesses to track. That’s because MRR:

Great products deliver great value to users. But how do you actually measure value?

While there’s no perfect proxy, when it comes to subscription product, revenue is one of the most reliable measures of value. The more people are willing to pay for your service, the more value they must get back to break even. The longer they pay you, the stickier the value. And the more paying users you have, the more validation you have for your value proposition.

At the end of the day, businesses that grow in revenue year by year are usually ones that manage to deliver more and more value consistently — whether by increasing the value they deliver per user (i.e., charging more) or providing value to more users (i.e., charging more people).

There are many ways to measure the overall performance of a product. Monthly recurring revenue is a great performance metric for subscription products in particular.

To maximize MRR, you must:

MRR and its components provide a holistic picture of your product performance. If you could only track one metric as a measure of success for a subscription product, it should be monthly recurring revenue.

In the fancy world of product development, customer journeys, UX research, and so on, it’s easy to forget the fundamentals, such as accounting and budgeting.

But without proper budgeting, you’ll either:

Knowing your monthly recurring revenue and other key metrics that influence it will help you predict how much income you can generate in upcoming months and how changes in underlying product metrics can impact this budget.

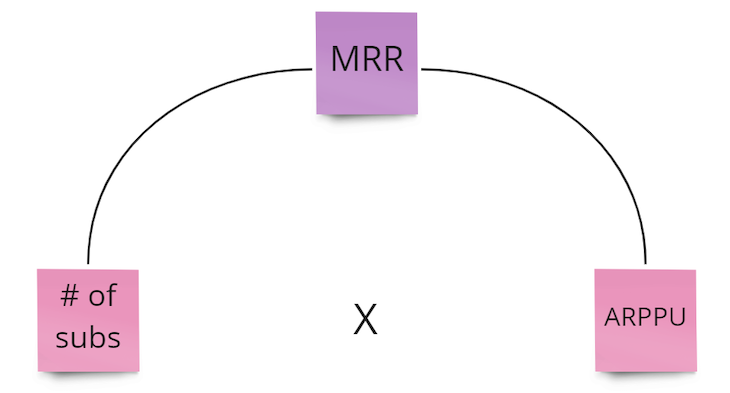

The basic formula to calculate monthly recurring revenue is straightforward: multiply the number of paying users by the average revenue per paying user (ARPPU).

MRR = # of subscriptions * ARPPU

Let’s look at an example:

If you have 4,000 active monthly subscriptions in March and your ARPPU is $30, your MRR is $120,000 (4,000 * 30 = 120,000).

We call it recurring revenue because you can expect that amount, on average, every month (assuming your conversion and churn rates are in equilibrium).

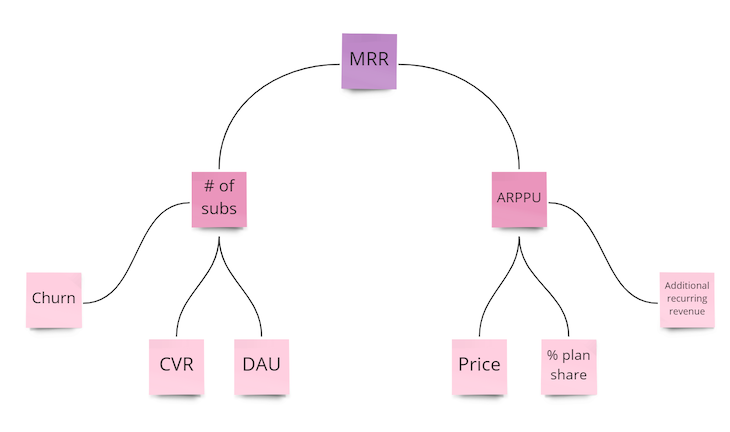

Let’s take a deeper look at what influences the number of subscriptions and average revenue per paying user:

The total number of active subscriptions is the result of your:

The average revenue per user comes from:

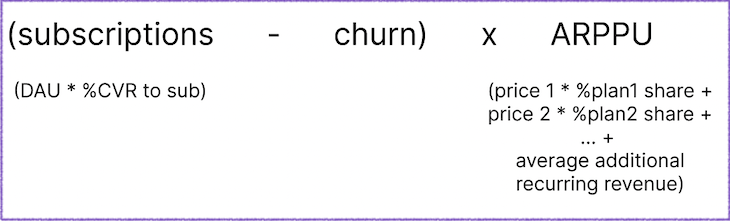

So, a more advanced formula to calculate monthly recurring revenue would be:

MRR = (DAU * %CVR to sub – Churn) * (price1 * %plan1 share + price2 * %plan2 share + [..] + avg. additional recurring revenue)

Here’s the same complex MRR formula presented in a way that is more visually pleasing:

We could go even a layer deeper and investigate particular sub-metrics, such as what contributes to the number of daily active users, but that’s another article for another day.

Now that we understand what monthly recurring revenue is and how to calculate it, tactics for improving MRR should be quite evident. The name of the game is simple: improve underlying metrics. Namely:

The primary way of increasing MRR is by increasing the number of active subscriptions. Increasing your reach should be the primary way of growing your subscription business since most subscriptions have a relatively low cost of serving an additional user.

Also, it helps limit revenue risks — is it safer to have two users paying $1,000 a month or 1,000 users paying $2 a month?

To increase the number of subscriptions, you should take steps to:

The very first thing you should consider is churn. If you can’t retain your customer, no matter what you do, you’ll lose big money.

Although there are various reasons why people churn, and over-optimizing for churn is unhealthy (there’s a degree of churn you can’t avoid; deal with it), make sure you keep it within healthy ranges.

For subscription products, a “good” churn rate is usually around 6–8 percent. Personally, I wouldn’t dream of going below 5 percent, but a good rule of thumb is to keep it within single digits.

To reduce churn, consider:

Conversion is one of the main drivers of subscriptions. There’s no point to putting more people through the funnel if they don’t convert anyway.

It’s worth looking at market benchmarks. For example, for mobile apps, conversion from download to subscription is roughly 1.4 percent. If your mobile subscription app falls below that benchmark, it means you have a lot of ground to cover here.

To increase conversion, consider:

The most straightforward way to increase monthly recurring revenue is to put more people through the funnel (provided you can do so without lowering your CVR in the meantime). To some extent, MRR is a volume game.

Consider:

Although it’s more challenging to optimize for ARPPU than per number of subscriptions, it shouldn’t be neglected. Changes here are often more sensitive than in the number of subscriptions.

For example, you could increase the price by 100 percent and thus boost your MRR by 60 percent almost overnight. Getting 60 percent more subs is more challenging.

However, increasing ARPPU often results in a lower number of active subscriptions. Make sure you strike the proper balance and endeavor to:

The higher the price, the higher the ARPPU. It’s almost linear. However, it’s also the easiest way to reduce your conversion rates and increase churn.

The sweet spot is hard to find and usually requires extensive experimentation.

Consider:

If you have more than one plan, there are ways you can direct users to plans with the highest MRR potential.

For example, I recently managed to dramatically change the plan share by just changing the default plan pre-select on the payment form. Small changes matter.

Consider:

However, don’t be short-sighted. The plan with the highest MRR isn’t necessarily the plan with the highest LTV. Choosing the best plan split requires a lot of balancing between short-term and long-term revenue.

There is one category of sales that is often included in MRR calculation: recurring add-ons.

For example, if your basic subscription costs $10, but there are multiple add-ons to that subscription, it also contributes to the MRR.

There are different “accounting” methods. One approach is just to treat it as a normal subscription. For example:

This works if you have relatively few subscriptions and add-ons, but if you have plenty of combinations, then maintaining multiple separate “plans” might be too taxing. In that case, consider a new metric: average additional recurring revenue.

Average additional recurring revenue = Total recurring revenue from add-ons / Number of subscriptions

Just to be clear, we’re talking about recurring add-ons, such as an additional premium feature for $5/month, not one-time additional purchases, which are by no means recurring.

To maximize additional recurring revenue, you can apply tactics similar to those designed to maximize your overall MRR, which means you should consider:

Monthly recurring revenue (MRR) is a must-have metric for any subscription product. It measures the value you deliver to users and your overall performance and helps you forecast revenue and budget.

The simple formula for calculating MRR is to multiply the number of subscribers in a given month by the average revenue per paying user (ARPPU) you get. You can go as deep with these metrics as your context requires.

You can maximize revenue by either increasing the number of paying subscribers. You can do this by:

You could also endeavor to increase the ARPPU you get from every subscriber by:

While maximizing ARPPU is usually more impactful than maximizing the number of users, it also tends to have the biggest negative impact on other metrics (a more expensive product equals less CVR and higher churn).

At the end of the day, it’s all about finding the right balance between short- and long-term revenue and maximizing your overall reach.

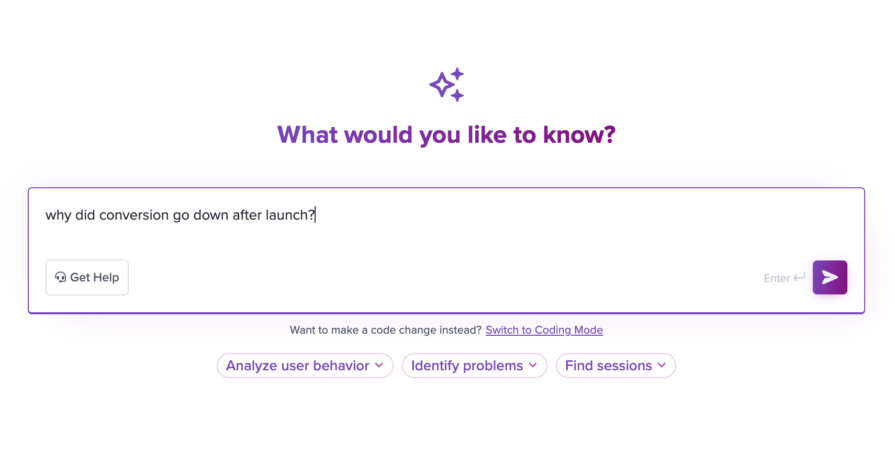

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.