Matt DiBari is Chief Product Officer at SpotHero. He has spent the majority of his career working in the automotive industry, the first decade of which was at CDK Global. Matt served in senior product management and leadership roles at Cars.com before transitioning to SpotHero in 2019.

In our conversation, Matt discusses how a marketplace like SpotHero only thrives if its B2C side is reinforced in the B2B side and vice versa. He shares how early data signals about people’s working and commuting habits during COVID helped transform SpotHero’s product strategy. Matt also talks about SpotHero’s decision to pursue strategic partnerships with Lyft and Apple Maps.

I joined product over 15 years ago. At that point, when you would go to a meetup or a conference, the first question was always, “Are you part of marketing, sales, or technology?” We were never our own leg of the company. It’s been fun to see how product management has come together where now, we do have a seat and voice at the C-suite table. You see how the expectation of the PM is much more of an innovation, optimization, and discovery role than it was historically.

Now, we spend time in the field, talk to people, and find the right problems and solutions. The hardest part of being around automotive for so long is that the speed of change is much more glacial. Ford will work on an F-150 for seven years before they redo it. I did lots of contracts with manufacturers, and trying to get them to adopt something in six months or a year was very difficult. How we work now and how we worked then with our partners was very different.

Over the five years I’ve been here, I’ve seen a rapid shift of understanding why technology plays a role and why we’re trying to change things so fast — because consumer expectations are so different and elevated.

Both industries are fun in that there’s large fragmentation and you have a handful of big players. You’ve got a handful that are publicly traded, that own land everywhere in every major city, and there’s this big flavor of small/regional where I’m the big fish in either automotive or parking. And then you’ve got the long tail of the other 80 percent that are made up of single or two-store auto dealers or single-point garages.

It’s fun because, as a product person, you get that challenge of going from working at scale with a giant publicly traded company to talking to a shop owner who owns one location that’s their lifeblood. Bouncing between those two extremes on the B2B side is always fun. And then on the marketplace side, you also have to deal with the consumer on the third leg of that. Now I’ve got to impact a million people a day — how do I do that?

It’s easy to fall into the Pareto Principle trap, where 20 percent of customers impact 80 percent of my revenue. You can fall in love with just working on the B2B side for those major players because they have such a large foothold. But if you do that, you bleed off all these other customers. So how do you juggle working on the players that are the biggest, but also the other ones that are just as important? Because there’s a lot more customer fallout if you don’t manage all of your stakeholders.

So the math has to math. You also have to be able to put a thumb on the scale and use your product skill to say, “This works for the big people, but this doesn’t work for everybody. I’ve got to figure out how to take that and modify it, or even start on the other end and focus on that long tail and all the impact that’s going to have.”

One of the things that’s been the most challenging in every company I’ve been at, especially in that product role, is explaining to people that we’re throwing good money after bad. We’ve invested in this product and we’ve gone to market with it, and whether it’s a consumer product or a B2B product, at some point, it’s not worth the effort and the opportunity cost.

I love those challenges of saying, “Yes, we’ve put multiple millions of dollars into this thing. Either it’s paid back and it’s time to let it go, or it’s never going to pay back and it’s time to let it go.” Let’s have that hard sunset conversation. For things that make it into the market, you have to explain your choices very thoroughly to your customers and then give them paths forward as well.

Here at SpotHero, we acquired another parking company, Parking Panda. It was very big in the mid-Atlantic, and over the COVID time, we sunsetted that brand. When you’re doing that, there is going to be the cost of customers who are very brand loyal. How do you explain that Parking Panda got acquired by SpotHero years ago but we were just maintaining two tech stacks? At what point do you merge all of that? And how do you give those customers enough carrots along the way to come to the other path?

At some point, you have to just say that we move who we’re going to move. The other people, despite all of our best efforts, are going to fall off and find some other solution. But that’s where you have to bring data and have a really deep understanding of what’s going to happen. That’s the hardest part with that — what happens when we make that call? What do we gain and what do we lose?

From a leadership perspective, it has to start with a really deep understanding of the company strategy, the company plan, and how much you want to invest in those areas. I look at those as investments with X amount of product and engineering chips to bet on each of those areas, and I have to understand which ones have to return. There’s a lot more volatility on the B2C side, because, again, a million customers are coming every day. How do I meet those needs? If we are wrong in a bet, we can redo it tomorrow, but on the B2B side, those bets are much more firm. If you make a bet there, there’s a longer buildout and time to return.

I start with the company strategy, then I break it down to a portfolio view of my two or three major outcomes. On the B2B side, are there short-term wins, short-term impacts? How do I return revenue faster so I have a bigger impact? On the consumer side, it’s the same idea. Are there things that we could do quickly that meet a bunch of basic problems, or are there longer-term things? Once I bifurcate into two different buckets, B2B and B2C, for example my portfolio is 60/40.

Our company view, especially at SpotHero, is that drivers have the right of way. We take care of our drivers — our B2C side — first. I allocate dollars, resources, people, etc. more toward that side. Then inside of that, I look at short-term versus long-term benefits. I’ve got my B2C set of chips. How many of those are short-term? How many of those are long-term? It’s a layered portfolio view of what we want to accomplish and on what time horizons.

I’m a really big believer in lean UX and test and learn. That’s a different way to gather data. I am a huge advocate for combining qual and quant, talking to users, and understanding what they want and need. But there are fallacies in there. If you ever ask someone, “Would you want to pay less for this?” they’re always going to say yes. That’s why I like to backfill with big data. I like starting with that qual and quant and getting that human behavior, and then using machine learning and predictive analytics so we can run it and see what the reality is.

Both SpotHero and Cars.com were sitting on a decade’s worth of human behavior — whether that’s web analytics or purchasing decisions — in big data lakes. The challenge of that is you have a lot of data to call on, so you’ve got to be very judicious of when to tap into that resource. You can get lost in the details. Instead of looking for perfection, get a high confidence in the directional data and go.

Analysis paralysis is something that people are way too prone to fall into because they’re worried about making the wrong decision. Well, you can’t afford to wait forever either. At some point, you’ve got to decide and go. There is a level of fidelity you have to say is enough. Cycle time is still the biggest killer in any project, so mixing those two and getting to a decision fast is where the magic is.

As a mobility company, going into COVID, people were being told, “Don’t move.” But our company lives by people moving. It gave us a chance to pause and re-understand what the world looks like and will look like. My product design team did a bunch of virtual Zoom conversations and surveys, and they were doing a six-week pulse of average consumers.

We have a bunch of signals powered by data that once things open back up, people’s working habits will change, they’ll be hybrid, their work hours will be different. This rang a bunch of alarm bells for my product team. If that’s the new world, what does that mean for us? Well, we need to change what our customer profile looks like because the commuter is not going to be the most important one for us anymore.

People talked about revenge travel and spending money on connecting with people and experiences over physical goods, so we started pivoting into the events space and other transit, as we call it. We saw that there were going to be a bunch of people driving who have never driven before, or that moved from the city to the suburbs and now aren’t sure how to move around. We needed to find all those new customers. So, we rebuilt all of our pages for SEO and built a bunch of mid-funnel pages to help those new user needs.

We started partnerships with Lyft and Apple Maps to meet the users where they are. We looked at all those different avenues to find new users and use cases that we knew were going to be out there after COVID. We looked at who we could partner with, and we might find those additional eyeballs. We did what we could internally and then externally worked with Lyft, Apple Maps, Madison Square Garden, and all of these big players in these other verticals. We really wanted to help our customers win, so we had to go find where they were going to be.

On top of that, we heard that because the commuter hour was going to shift, the old way that parking was priced had to change. We had to build new tools to help our parking partners price differently. We had predictive analytics laid over the top of parking that said, “This is how people are searching. This is what pricing should look like.”

Specifically around the predictive nature of the partner, we built a product called SpotHero IQ. It basically told them, “Here’s what your traffic’s going to look like and here’s what you should price that at.” We had rapid adoption of that. We also saw a little bit later that people were doing more driving staycations or driving travel, so we built a whole new product set around that multi-day driving trip. It was one of those things where our data was telling us something, we validated it with the operators, and it met a consumer need. And that multi-day segment has grown huge year-over-year since COVID.

Exactly. We have a constant feedback loop across the two sides because the marketplace really only survives and thrives if what you’re telling your B2C side is reinforced in the B2B side, and what you’re telling them is reinforced in the B2C side.

It’s really easy to fall into that build trap of being heads down to build what the B2B side asked for. You lose track of if that is going to help customers ultimately win. Are customers going to benefit from better parking with this B2B tool you built? Sometimes the answer is no, and that’s OK because an operator needs that to do their job or have a better business. In a lot of cases, though, you want to make sure those things are carried through.

AI is going to change our job. Product people will become really good prompt writers and become prompt engineers. We’ve been playing with some of the tools on our product design team, where you can put in a basic set of prompts and get a really good wireframe. I think AI is going to accelerate testing and learning because you can build good enough, high-fidelity mocks in seven minutes by just giving the prompts right.

That’s the part that’s going to change our industry a lot, and I think it’ll allow us to be even faster and try more variations of things, or even be a little bit more creative. At the end of the day, product management is still an art that’s pretending to be a science. AI allows us to think about all the different outcomes, not just what can we build in a short cycle and get in front of a user. It’s never going to replace the good edge case covering engineering work that works in all scenarios, but it’s going to make the discovery and design phase that much faster.

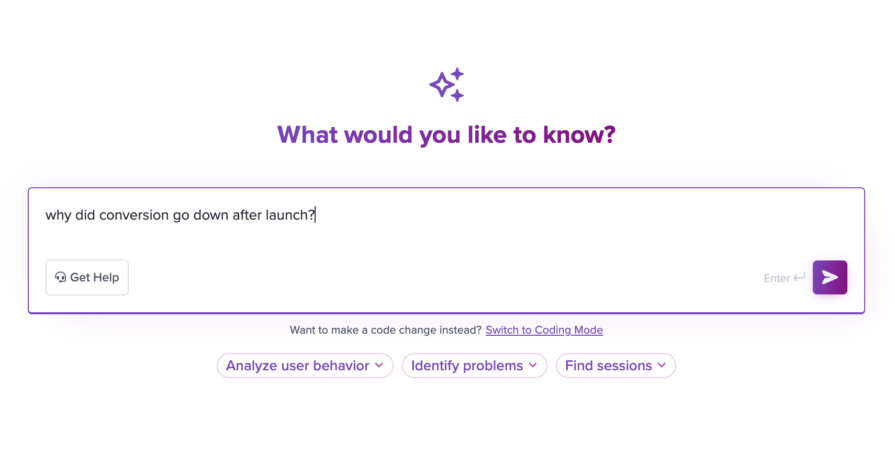

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.