Tamara Milne is Chief Digital Officer at Acrisure, a global fintech company with platforms in insurance, payroll, benefits, cybersecurity, mortgage services, and more. She started her career working in epidemiology and research before transitioning to investment banking at Investors Bank & Trust and State Street. Tamara served as VP, Head of Product Management at Brown Brothers Harriman before joining Santander Bank as SVP, Head of Transformation. She spent nearly a decade with Santander in various leadership positions before assuming her current role at Acrisure.

In our conversation, Tamara shares her experience establishing digital-first strategies for organizations of different growth stages and talks about the importance of defining early on what success looks like. She also emphasizes the importance of getting a team to see “the art of what’s possible” by using clear messaging to build organizational trust and buy-in.

It’s an interesting topic that takes on a lot of different flavors. Each organization’s culture represents a different kind of change that you need to make. It’s not a bunch of confetti and pom poms, and away we go — it requires a lot of time. There’s also an element of excitement that you need to build that can resonate with different cultures — but sometimes it won’t. You have to be thoughtful about what exists in the culture, and then think about a tactful way to evolve it.

Every organization is at a specific state of maturity. When a company grows from small to midsize and, eventually, to a large enterprise, there’s a natural evolution that changes the dynamic of the communication and distribution of information. You also have to think about the organization’s strategic goals — some are very focused on finances, while others want to be more operationally efficient and improve customer quality and interaction.

Often, you’ll need to spend time with the executive team to better understand their objectives and why they’re trying to attain them. Once you understand the organization’s objectives and strategy, the next step is to translate that throughout the company. Each company has a spectrum of groups within it, ranging from those that are highly operational to those that are more precision-driven. And organizations that have a more innovative mindset or are more entrepreneurial will respond to a different style.

As you think about what you’re trying to accomplish, you need to keep the organization, its strategic goals, and its communication style in mind. If you find a way to resonate with that, it will be easier to get buy-in.

The next step is ensuring that it’s directed at the right levels. How you cascade that information is important in establishing trust. If the group’s lead manager gets it, they can relay that information directly to the other levels, and that will be more impactful than if you were to say it. You have to drive that connectivity to proactively guide the narrative in a way that is focused on the strategy and business outcomes.

Communication is often an afterthought for most teams unless there’s a clear objective. Tactical, operational strategy is easy to stay aligned with. But communication strategy, as a soft skill, requires a prolonged period of engagement and consistency. Once you’ve built the momentum and buy-in, that upfront investment becomes worth it. It’s also self-propelling — when you have people buy in, it helps move the initiative along and keeps the momentum going.

Sure. I recommend identifying quick wins first. These are the things that will increase the momentum that will eventually get people to buy in. With small successes to point to, you’ll have a bit more gas in the tank when things inevitably get harder and the team has less energy.

Typically, I recommend focusing on something that can happen in the next six months. Give yourself 30 to 60 days to do the assessment and discover the opportunities for short-term, impactful change you can make in the first three months. Then, six months or a year later, you can focus on what else is attainable.

In the first part of the assessment, when we’re still identifying the strategic goals and understanding how they are likely to evolve, there is some variation in how we define success. As we figure out the timing and cost it will take to accomplish these objectives, we gain a clearer understanding of the vision and expectations for KPIs. Understanding long-term North Star objectives is critical, and establishing clear KPIs is part of that evolution.

It’s important to establish early on what success looks like. This is important because your evolution of the organization’s culture is focused on getting people to have an open mind and see the art of what is possible.

Success can mean that we tested something that failed. There’s always a chance that an experiment will not work. Validating that failure is equally important to us as if our hypothesis had succeeded. That’s why, early on, it’s helpful to have quick wins and quick failures, too. You want to be able to understand the data that you have, as well as how it’s going to be used as an outcome.

As long as those things are aligned, your KPIs become more concrete. You have a better understanding of what you have and what you don’t.

The easy answer is to develop shared goals. That’s a very macro-level thought process. You take the strategic goals, align them to the organization, and then each part of the organization contributes to it.

This is where a roadmap is helpful, because everyone will have accountability and focus. It’s also nice because it mitigates “finger-pointing.” A culture where people aren’t afraid to admit that something has failed and that they contributed to it, or where they take accountability for unintended outcomes, is a healthy one. This environment helps the organization not only quickly learn from those failures, but also apply those lessons in the next exercise.

When you promote a culture that allows people to fail, it gets rid of the sense of alienation and allows for much more collaboration. It’s important to understand that every team represents a critical part of development. Ensuring that teams value each other and their different perspectives is very important. That way, you don’t overvalue anybody’s opinion and instead emphasize that everyone has something valuable to contribute.

We have a Project Management Office (PMO) team that extracts the progress and success, as well as the potential challenges impacting the momentum of changes.

As an organization, we’re focused on how to use data to build better insights and leverage the findings for better experimentation. As we get more insights, that drives the success of the organization, and enables us to refine our strategy in a healthy and impactful way.

For example, we’ve been building a digital servicing center for the past year and a half that will support the entire organization. The idea is that it will consolidate the servicing process altogether. Every time we assume accounts into that service team, there’s an assessment — financially, operationally, and from a talent perspective — to figure out what stage we’re currently in.

We’ve seen improvement in terms of our operating expenses. We’re asking questions like, “Do we see greater efficiency with the number of clients per agent?” and “Do we improve our talent pool so we can see an improved quality of interaction with our customers?” Those are the kinds of key elements driving the way we think about our design.

We think about acquisitions like assets that we’re adding to an existing portfolio. We need to understand how our existing assets integrate into the culture and teams we’re acquiring.

When we acquire a business, there’s existing talent there; the acquired company has its own processes and technologies. Our job is to assess its capabilities and how those can add value to the existing pool of talent at the organization.

From an insuretech perspective, we focus on how the product is differentiated in the market. When we acquire insuretechs, we want to know how they will propel us further from the industry standard. If it’s a diversified product, does that add more value to our overall customers? Does it change the dynamic with our competitors? Does it change the landscape in an impactful way? If so, we’d lean toward an acquisition instead of an in-house build or leveraging a third party.

The decision comes down to assessing the organization’s needs, a competitive analysis of our competitors, and the direction we want to take our strategy.

Sure. We’ve acquired a handful of publicly known insuretechs, and we’re currently focused on leveraging AI to improve and digitize customer interactions.

One of the companies, QuickInsured, offers proprietary technologies related to customer interaction for home insurance. Home insurance comes with embedded tools related to the home purchasing process. This had significant business value, not only related to the way we think about driving digital volume, but also in terms of improving customer interactions.

We also acquired an AI-powered company called B2Z, which takes short-form commercial insurance needs and distributes them to a wide range of carriers to get quotes back to customers. This significantly reduces the overall time and effort customers need to take during the process, so it made sense for us to bring this group onto our team.

When it comes to acquisitions, a lot of the decision comes down to the financial perspective. Can we build the tool or technology ourselves in the timeframe or with less cost than it takes to acquire a company that already has that technology? You have to balance the capital you have with where you want to invest it.

At Acrisure, we’ve had an AI team for several years, so we’ve been heavily invested in it internally. We also have some great partnerships that we use to leverage AI capabilities. We’re focused on what makes sense with the current market, and we don’t necessarily have to build everything in-house.

We’ve seen really good adoption and leveraging of the AI tools. I think that comes from the company’s entrepreneurial spirit, but a lot of it also comes from the fact that our heart and soul are in data. If the underlying data is solid and we can leverage it attainably and transparently, it drives the consumer of that information to trust us. We try to be very thoughtful around the distribution of our tools because building trust is very important to us. It’s a huge driver of value for the business.

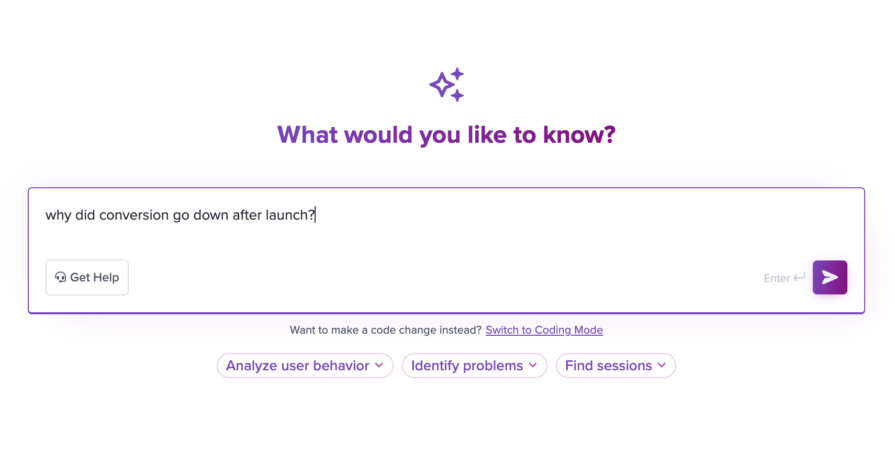

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.