Suhas Reddy is Senior Vice President of Product Management at Pathward, a unique banking entity that also serves as a platform for its fintech partners. His career has been deeply rooted in the nexus of pioneering product strategies within highly regulated sectors. Suhas previously made noteworthy strides at Fannie Mae in areas like underwriting, capital markets, and loan quality, which propelled him through the ranks to become a senior director. This experience laid a robust foundation for his current role at Pathward where he is dedicated to broadening financial inclusion, applying his rich expertise to drive significant advancements in the industry.

In our conversation, Suhas talks about the principles of human-centric design and its emphasis on delivering products at the right time in the context of the customer’s life journey. He shares how, by looking at the mortgage process holistically, his team was able to solve problems differently and entirely transform the mortgage process. Suhas also discusses the necessary listening and self-reflection that companies have to undertake to design truly human-centric products.

Human-centric design is interesting. Design, as a concept, has become quite popular since Apple’s innovations changed the digital space. People think of design as being very software-centric, but design as a science has been around for a long time. Now, it has also trickled down to mainstream financial institutions.

There are a few key principles to successful human-centric design. Number one is empathy — being able to put yourself in the shoes of the person using your product or service, and being able to think from that perspective. There are many techniques under the design thinking umbrella that tell you how to create useful, actionable insights for a specific persona.

Second, don’t design for a problem — design for an experience. This means that you have to look across individual siloed value streams and connect the dots for everything you’re delivering to a customer. Third, be value-driven. Traditionally, software is very output-driven and centered around how many features we deliver. One level up from that is the OKR revolution around being outcome-driven. What’s the business outcome you’re driving toward? Human-centric design takes it up one more notch — what’s the value to that customer at the end of that value chain? Can you articulate the work you do with the value parameters that are important to them?

Making fintech human-centric means taking things to places that traditional banks or financial institutions have not been able to go. Further, it means delivering these products or services in the context of a customer’s everyday life, which is another key principle to human-centric design.

This goes against the model that gets the customer to come to you when they need financial service. Here, we’re delivering services to them within their context, when they need it. A nice example of that Spruce mobile banking app that we enable with our checking accounts, savings accounts, and debit card. A Spruce customer is using that in the context of their shopping experience — they’re saving, getting early tax refunds, and managing their expenses every month using the product that we built in partnership with H&R Block.

Most companies tend to be very bottom-line-driven. That’s not a bad thing, but it’s hard to take something qualitative like customer experience and trace it to bottom-line profit. Think of Microsoft and the transformation that it went through to become customer- and human-centric. Satya Nadella said that everything starts with empathy. First, they recognized who they are: a B2B company that’s an enabler. Once they made that pivot, it changed how they looked at things.

Fintech companies have been doing it from the ground up recently too. Wells Fargo, JPMorgan Chase, etc. are big banks that are not traditionally considered customer-centric but have turned that around. That’s a big challenge for sure, and there are ways to solve it. There are ways to convert quantitative measures, customer experiences, and customer satisfaction into quantitative metrics like NPS, CSAT, CES (customer effort score), etc.

Human-centric design comes after you’ve done the necessary listening. You’ve been on the road, you’ve lived a day in the life of your customer, and if you serve 10 different channels, that’s 10 different customer personas. You have to understand and empathize with each one. What is that problem that they’re trying to solve? What is the context of that problem of the ecosystem in which they’re facing that problem?

Once you do that, you ask, “If I want to be the company that solves that customer need, how do I need to change?” That is self-reflection. You have to pay attention to unstated needs too. There are so many things a customer will tell you, yet so many things they don’t state clearly. You can deliver those things by living a day in their lives and doing that research.

I spent almost a decade in the mortgage lending space. The last five years changed everything about the way we do mortgage lending in the US. In my tenure with Fannie Mae, we decided to figure out what our customers’ needs and wants were before we designed solutions. As part of that exercise, we went to 14 different lending shops that were Fannie Mae customers and we lived a day in their lives.

We mapped out the personas within those lending shops that were using our tools, products, and services. We’re talking about a loan origination person, loan officer, loan processor, underwriter, closer, etc. We wanted to build a best-in-class underwriting solution — a digital version of the loan application. We’d collect all the data we needed so that we could underwrite it, assess the risk of the loan application, make an assessment, and offer the right mortgage at the right price. It was all self-centric.

We did a lot of discovery and found that if we stripped our products and solutions away from these loan phases and roles and looked at them holistically, we would solve it differently. First, we changed our goals. We came up with a North Star goal of going from application to close in under 10 days because the turnaround is really what everybody cares about. We also realized that the certainty of the loan decision is what people are looking for. They said, “If you’re not going to approve the loan, signal that to me early.” We applied this to multiple solutions and came up with some key things that transformed the lending experience.

For example, we wanted to eliminate the collection of bank statements in the mortgage process. That was where most underwriting conditions were surfacing from. We built a checklist that gives certainty to the lending institution on what’s done and what’s left to do. It reduced the mortgage application process to a 16-day cycle and eliminated bank statements. We unlocked opportunities to pull in additional data elements into the underwriting process, like rental payment history, and unlocked the ability to give loans to people who were great renters.

Looking at things from the outside-in opens your perspective on what the real problem is. Then, you can command it differently.

We were at 70 days before that transformation. In some states, we reduced it to 16, but in others, appraisals were the long pole in the tent. Even then, we attacked that problem in many ways. During COVID, when interest rates were low, we had millions of borrowers refinancing loans. We didn’t even have to require an appraisal for many of them because we were so comfortable with the data we had on some properties about risk tolerance, loan-to-value ratio, etc. Technology powered by empathy can change lives.

As digitally savvy people who are creating a lot of product innovations and development, we haven’t really solved this. We’ve gotten good at improving our solutions, but by changing things so rapidly and disrupting the way we do things so frequently, we should be careful not to disenfranchise an entire generation of users who are no longer able to use that tool.

Diversity has to be ingrained in the way we ideate and design solutions. We need to bring that to the plate all the time. Increasing financial access is our overarching mission, but going to the pockets of people who don’t have access or are out of the financial ecosystem is really hard. This is why human-centric design is powerful. With this approach, we’re trying to solve for that human based on where they stand and what they know, from the lowest common denominator to the most digitally tech-savvy person.

There are many different ways to do it. As part of product development, you co-design and co-create with your customers. Sometimes it’s a tabletop exercise, but sometimes it’s actual user testing along the way. You have to get really qualitative about this. Who are the personas you’re serving?

You have to road-test your products by co-designing and co-creating. Once you launch, that’s where you embed value metrics to see if you’ve delivered the value you were hoping to. Make the value component front and center in how you measure success.

At Fannie Mae, we worked on an initiative called digital customer service. It was centered around how to deliver a multichannel, multimedia customer service experience that seamlessly mixes human and digital help. First, we partnered with several third-party firms to figure out our value metrics. Applying human-centric design, we looked at what the customer wants to solve and how they want to solve for it.

We got customer personas in all shapes and sizes — some wanted something digital and self-service, and others wanted to cut to the chase and talk to a human. In between, there’s this whole gamut of chatbots and AI-driven tools that can accumulate knowledge, contextualize it, and deliver it.

We had the overall business metrics around customer retention, customer satisfaction, and NPS. In the context of digital customer service, we worked with Gartner to land on customer effort scores. This would measure the level of effort it takes a customer to get their query answered. After tracking this metric, we were amazed at how much it changed how many new features we developed.

In fact, we saw a correlation between CES and customer satisfaction, and both of them together started to influence the overall NPS. It’s important to understand customer tiers when you solve things like this. We wanted to be high-touch with our largest customers that have the largest volumes, and digital-first for our smallest set of customers. But digital-first doesn’t mean digital only. We wanted to make personal assistance available if needed, so we designed it as a tiered approach. For a B2B company, this was revolutionary.

I landed on human-centric design because of the way I was trying to style my leadership approach. Agile, at its advent, brought to prominence principles like servant leadership and lean management techniques. These became really popular, and I was trying to make sense of what they meant at a deeper level.

The Chinese philosopher, Lao Tzu, is frequently quoted a lot in The Tao of Leadership. He says, “A leader is best when people barely know he exists, when his work is done, his aim fulfilled, they will say: we did it ourselves.” For me, that’s what being a servant leader means — it’s about empowering teams to do what they do best.

As a leader, my role is not directing work. My role is removing blockers for the team. It’s about giving them a problem to solve and not an action plan for a solution. As I went through that journey of transforming my own leadership style, I realized that what I was doing was being human-centric.

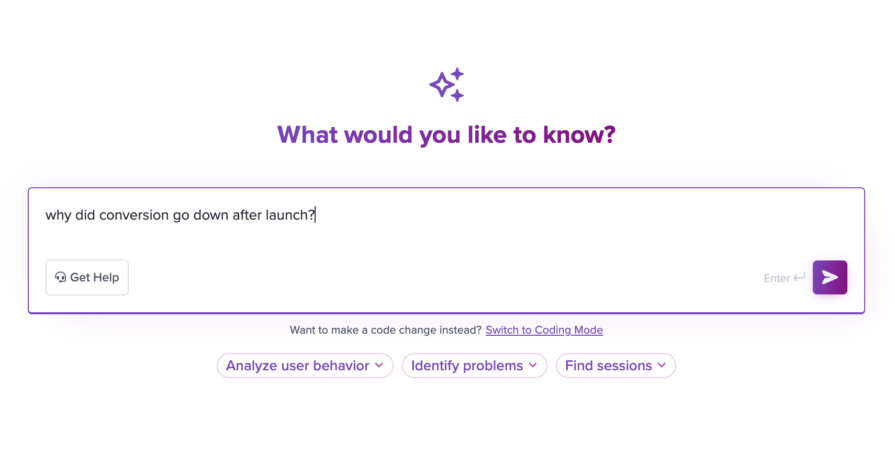

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.