Ryan Lee is a product and ecommerce leader, and was most recently Director, Product Management at Misfits Market, an online grocery delivery service. He studied mining engineering during his undergrad at McGill University before pursuing an engineering management graduate degree at Duke. From there, Ryan started his product career in B2B SaaS and worked at companies such as Citrix, Gartner, and Disney. Ryan worked in ecommerce at Walmart and Zola before his most recent role at Misfits Market.

In our conversation, Ryan talks about how to focus on building your background, personal brand, and track record of success. He shares his experience going through three M&As at different stage companies and offers advice on handling the leadership and cultural changes that come with that. Ryan also discusses the role of a generalist versus a functional product manager.

My time at Misfits Market was a period in which I was able to apply the culmination across my previous product experiences in a la carte ecommerce, customer subscription experiences, and B2B enterprise offerings. Misfits Market is an ecommerce grocery online store. Their initial claim to fame was ugly produce. They’ll buy these fruits and vegetables from a supplier at a discount, pass on those savings to the customer, and deliver the produce to their door.

They use a model that blends a la carte pricing with subscription. The subscription cart is set to a particular cadence, like weekly or biweekly, where you’re billed during that incremental cadence. But what you’re billed depends on what you add to your cart when your shopping window opens before each cadence. For example, say you want to buy a whole box of potatoes one week. Then, the next week, you want a more holistic box and add milk, eggs, meat, protein, and more. What you’re billed is the a la carte portion.

Yes — we launched Misfits Market Rx, as well as Fulfilled by Misfits, which is essentially storage and fulfillment as a service. With Fulfilled by Misfits, say you have a cookie business and you’re too big to continue fulfilling orders out of your house, but you’re not big enough to take the risk of buying or leasing a whole warehouse. You can send your goods to Misfits, they’ll charge a service fee, and you can piggyback on their fulfillment rates. Misfits has partnerships with third-party carriers as well as its own delivery fleet to use as well.

I went through three notable ones at Walmart, Disney, and Misfits Market. Walmart acquired Jet during my time there and, though Disney had a couple of acquisitions during my tenure, the main one that I was involved in was the operational integration of Hulu. Lastly, at Misfits Market, I helped with the M&A of Imperfect Foods.

The nature of those acquisitions varied quite a bit. For example, with Jet and Walmart,a startup was being acquired by a larger multinational conglomerate. With Disney and Hulu, Hulu’s organizational structure and size seemed less matrixed, which may have been attributed to its relatively smaller size, even though it was a very mature company and, for a long time standing, the closest competitor to Netflix. Then, with Misfits Market and Imperfect Foods, we were merging two actual startups.

Also, I was at a different career stage in each experience. I was progressively becoming more senior, so my engagement in each of those was varied — at Walmart, I was more junior and therefore reactive to the M&A, while at Misfits Market, I was in a leadership role making proposals about our organizational structure. It’s been interesting to see that evolution.

My opinion, based on my very small sample size, is to rip the band-aid off. And that advice is agnostic of a company’s size. In my experience, when a more mature enterprise acquires a less structured company, it’s easier to let go of the less structured one because, well, there are fewer structures. For a successful merger, just rip the band-aid off and install whichever team has the best method. Essentially, do not paralyze the organization and spend too much time trying to merge culture and organization operationally. That is time that could have been spent focused on moving the business forward more directly.

A bit, yes. The most challenging aspect was the amount of internal conflicting politics between business units that seemed to have persisted for a while. Also, while Hulu was beginning to operationally merge with Disney, Disney had its own executive change. For example, Bob Chapek was announced to be the successor of Bob Iger in 2021. Within a year, Bob Iger came back and said, “This is not the right fit.” That was while we were trying to organize and operationally integrate with Hulu.

Additionally, leadership on the Hulu side had gone through this before, so navigating the space was more complex in terms of understanding who the influencers were. It helped that I was a mid-level senior manager, so I appreciated some of the level of candor that I received to help prepare for what was to come.

When Misfits Market acquired Imperfect Foods, some people on our team who had never been through an M&A, assumed that Misfit Market would be the one to stay. But, as I had observed with Disney and Hulu, that is not the case all the time. Yes, some specific individuals and leaders will stay, and they will become incumbents who build up their organization. At the same time, there will be redundancies on both ends, so that doesn’t make one side safe and the other unsafe.

The moment I observed areas of redundancy, I did my best to set the right expectations with individuals. You never want to make false promises, but you also don’t want to be an alarmist. I would say, “I’ve observed this in the past. This other leader is saying that because we’re the acquirer, we’re not the redundancy, but I have not observed that to be consistently true in the past. That’s just information I want to share, but we’ll figure this out and share information as we have it.”

For those who want to stay at the company post-M&A, my advice would be that it all depends on the leveling. If you’re a senior executive, you want to stay and not be a duplicate, but it’s all in different step functions. For most employees, identify the main influences in the org. Second, in your domain, do your best to support and gain visibility to that individual — or the leads that report to that individual — to show your value. Optics can be easily discounted, and some people have a distaste for focusing on their personal brand or the optics that surround themselves through an organization.

Yes. When I was at Jet and Walmart, I was not even aware of the shifts in influence. Sometimes it’s out of your control, so my advice to those who have no control is to continue to do what you’re doing in your early career — building a track record and as many accolades as quickly as possible. That is what follows you, regardless if you stay at the company or not.

If anything, that positions you well because you’re focused on your tasks. You don’t have to worry about finding work because work will come to you as a junior associate or an individual contributor. Focus on executing that flawlessly.

Also, regardless if you get to stay or not, maximize your time at the organization and set yourself up for as much success as possible. This saves a lot of emotional distress, honestly. I went through some distress early on in my career because I felt like my future wasn’t certain. When I received this specific advice from a senior leader in the org who said, “One, this is above your pay grade. Two, it’s not helpful to you and it’s not healthy for you. You need to focus your attention on just building your background, personal brand, and track record of success.”

These are not the two exhaustive types of people in product, but they’re interesting to contrast between in terms of trends. In the last 10–12 years, we have observed this proliferation of generalist product management hires. They’d enter a space, be the “CEO” of the product, and drive strategy and business priorities forward. Recently, the labor market has been rewarding more functional product managers instead. These are specialists.

The merits of these archetypes, if you will, vary by the company and macro environment. For example, in the last couple of years, companies have become more risk-averse than when interest rates were much lower. When you hire more generalists, you make a bet with the expectation that they can just learn it. There’s a lead time to learn anything, but the benefit is that they’re flexible and can be deployed on any problem. They can take it and run. However, there’s a risk of the lead time for learning this problem space being too large.

On the other hand, functional product managers hit the ground running. They already know this space, they’ve seen this story before, and you’re hiring them to make yourself and your organization a similar success. With that said, if the company wants to pivot, the PM may not know that space well. Generally, I’m observing a lot of the shifts to functional hires versus generalists. It’s been interesting to see this type of adjustment.

Through all of your experiences, identify the common thread that you’ve had particular success in. For example, if you’ve had experiences in monetization and want to specialize in that, thread the needle through all of your experiences to craft a story that focuses on monetization specifically. Then, orient yourself for those opportunities.

If you are up and coming into the field, now is a great opportunity to select a niche you’re interested in and double down on that at the moment. This will do a couple of things. One, it will secure your position in the market and what it rewards in terms of a more functional, specialized role. Second, you’re getting a head start in building your own personal brand.

For example, I have a peer who came from a management consulting background and became an expert in the realm of pricing of commercial goods. Pricing, as a concept, is relatively complex. It translates across many different sectors of industries. This person could think about their expertise as being extremely narrow. However, I think it’s a great opportunity for them to instead say, “I’m well known for this area that now opens doors to all these other areas of my career.”

Further, think deeply about what your strengths are. Lean into them and then explore. Select a couple of things, and then double down on the ones that you think will give you the highest likelihood of success. It doesn’t hurt to start earlier, either — it will actually reward you.

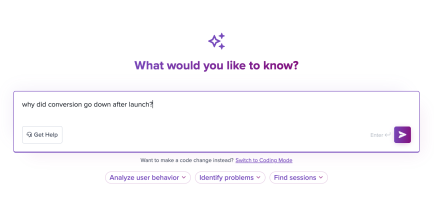

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Melissa Douros talks about how finserv companies can design for the “Cortisol UI“ by building experiences that reduce anxiety and build trust.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.