In most companies, defining product strategy and positioning the product in its market is not the product manager’s responsibility. Some find it great because the most stressful part will be done. As you can imagine, I’d rather create a strategy for my product myself. Why not, I love challenges!

You may be starting to wonder what the connection is between strategy and distinctive competency. Well, strategy is here to compete differently — it helps us find distinctive points in our product/company. If you have problems with strategy, you should first dive deep into the strategy world and understand the complexity of creating a distinctive point!

In this article, we’ll talk about how to become a market leader by creating a distinctive competency. We’ll also go over the differences between core and distinctive competencies.

By the end, you will understand how to list your product strengths and turn them into a strategy. We’ll go over real-life examples as well — let’s learn from the mistakes I already have.

A distinctive competency is a hard-to-imitate or obtain feature that sets you apart from your competitors. “Hard to imitate” is the key part of this definition and includes marketing, quality, technology, and any niche area you have.

Brand recognition, an applied marketing strategy, or being a first-mover in a niche industry can all be distinctive competencies. Tinder gained over a million monthly active users in less than a year with their “swipe right” feature. Swiping right or left can be imitated, but now it’s associated with Tinder.

You can also protect your product’s specific features with copyright and certifications. You can take advantage of being a first-mover. This can create a competitive advantage for your product. If it is an easy-to-imitate feature, it can not become a distinctive competency.

We can think of the Google search engine as an example. There are lots of search engines, but none of them can beat the Google name because they have the power, brand name, and hard-to-imitate features like their R&D, overall technology, and a world-class engineering team.

Core competencies are different from distinctive competencies because they are created by employees, not by a tangible source. The skills and capabilities create a culture inside the company and it reflects across the company’s departments, processes, and activities. In the end, the company will gain a tangible advantage over its competitors.

Distinctive competencies can be core competencies but core competencies don’t always have to be distinctive competencies.

Companies’ intellectual capital helps them improve core competencies, such as feedback culture, being sincere and honest, sharing knowledge, providing education systems, and company meetups.

Let’s take when companies send their employees to training or educate them internally for example. In return, they wait for employees to apply their new knowledge to their projects. A well-educated employee will create more usable and stable customer-friendly features. Their added knowledge will directly affect work quality, productivity, and profitability.

Good managers and fully-equipped employees will create a roadmap with smarter priorities, — this includes reducing company weaknesses so that they are no longer a liability and increasing strengths in the market. Only focusing on your weaknesses will make your company lose focus on the evolution of competitors.

Core competencies can be anything that your company does well. One company can have multiple core competencies and these don’t have to be distinctive competencies. Your competitors may have the same capability. On the contrary, distinctive competency should be a unique capability that only your company can achieve.

To gain a competitive advantage, companies should invest in their core competencies. I think improving weaknesses is like patching a ship. It can save the day, but eventually, a big storm will make it keel over.

Companies should spend their effort building and strengthening their core competencies to be more powerful in the long term. Having competencies shared in the whole company will create greater focus in management strategy and provide common goals for all employees. This increases the capacity for adapting to new challenges and also adds a certain amount of elasticity to existing problems. In turn, your company will not be affected by an instant demand change.

Core competencies can be listed inside your SWOT analysis as a strength. According to your strengths, you can decide where your company is in the market and see the difference between companies. Powerful core competencies alone will not be sufficient to compete in the market. Adding strengths may increase your sales, but will not provide a long-term market position.

Core competencies feed the distinctive competency and they are powerful with a good strategy.

We can understand the difference between those competencies with examples. Apple is the best example of how a successful marketing strategy evolves a company and moves it to the top of the industry. Innovation is an important capability for all technology companies but is also the main core competency for Apple. Mac computers, iPods, iPhones, and iPad products are unique and marvelous in engineering.

Remember how iPod was in its first years. As an engineer and an end user, I cannot find a better word than marvelous for the design and user experience😊. Marketing, brand name, and user experience can also be added to Apple’s core competencies. The distinctive competency of Apple is obviously marketing. I am doing marketing for them willingly and that’s a big accomplishment. We call Apple’s strategic approach a broad differentiation strategy.

Walmart has a different competitor strategy called a focused low-cost strategy. The company has big power that comes from its core competencies, which are buying power and supply chain management. They achieve the low price strategy and none of their competitors can compete with Walmart’s prices. As a result, we can say that having lower prices is Walmart’s distinctive competency.

Under Armour has a niche marketing vision — they focus on high-profile professional athletes and professional sports teams. Their company strategy is a focused differentiation strategy. Under Armour’s core competencies are innovation and marketing, which directly focus on professional athletes. Their customers know that whatever they buy from the company is the best in its profession. They implement their creative design core competence in every part of their brand.

To create a core competence, a company’s proficiency should rise consistently and at an acceptable cost. Under Armour licensed its products to maintain brand standards and consistency. They created a quality assurance team to ensure that licensed products meet the same quality and compliance standards. This focused, superior product vision is their distinctive competency. With retail and marketing arrangements, Under Armour products were placed in prime floor space and gained a distinctive competence over its rivals.

As I said earlier, strategy is about competing differently, and a distinctive competency is how we compete differently from our competitors. In light of this point of view, our distinctive competencies should have the following characteristics:

We discussed that a distinctive competency is not necessarily one of your company’s core competencies. If you want to be sure, you can score and examine them. As for me, defining your distinctive competency is like the competitive analysis.

First, we want to see where the product is in the market (if the product has already been launched). Finding out where we want to move my product is our second action. You can guess that I am going to say we should start with a SWOT analysis. It is the easiest and most effective method, there is no better way to point out your competitive advantage. We should know our products/company’s strengths and weaknesses to be able to see what makes us different.

An example list for our analysis can be as follows:

| Strength | Weakness |

|

|

I described the responsibility for product managers in the beginning, but when it comes to creating a good strategy from the analysis, we can consult with business teams, upper management, sales, customer success team, and more. Maybe customers can help with basic interviews. We should collect as many neutral points of view as we can.

Weekly-collected metrics, market analysis, and even the company’s other product results can be data for us. I think the most powerful data is the company’s own strategy, like broad differentiation strategy, focused low-cost strategy, focused differentiation strategy, best-cost provider strategy, etc. The overall strategy enlightens us about our strengths.

What else can we do but put our best wishes in a balloon and send them into space? Continuous tracking, obviously! 😅

I am a big fan of tracking weekly product metrics. Metrics can help us understand how we can put our product on the market. Unfortunately, if you use only the metrics to decide whether to continue your strategy or not, you should be careful because they are biased.

Market share is the most significant data to show if your distinctive competency is working or not. I suggest you follow communities that are sharing market position reports like Gartner, ReportLinker, Independent Agent, Statista, etc. These reports may not apply to every business, though.

Then, you can use customer feedback, you can check product feedback pages, Reddit, or forum pages. If your company has a customer success team, you can use their knowledge, they are the best for collecting feedback.

For example, in my previous product, our customer interviews were pointing out that customers were choosing us because of our stability. Our product strategy was adding new integration with our other products to produce more sales for that year. We aimed to create a distinctive competency by providing more add-on and integration capabilities than our competitors. As you can imagine, this meant more deployment and more bugs. We realized that our active user numbers were decreasing and the customer success team was coming to us with more complaints.

After collecting more insights, we decided to decrease our deployment frequency and increase the testing coverage. We announced that we will provide fewer new versions and promise sustained stability. The announcement and the later process showed us that our data was biased earlier and with customer feedback, we finally found our real distinctive point. Changes in strategies do not always create a good result.

Lastly, turnover rates are also helpful if you have a chance to collect them in both ways. Do you lose your customers to competitors or do you get customers from your competitors? Weekly is not sustainable for this kind of data, so quarterly results can be sufficient. Just be careful about not being late for a change, so stay alert for changes.

Identifying a distinctive competency is a long and hard thing, but we are living in an ever-changing world. Do not be persistent and stubborn about your decided strategies. Continue to look for different opportunities and ideas.

Our decisions can be biased and real demand can be different than we imagined. It will never be late, just keep up with the changes and listen to your customers.

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

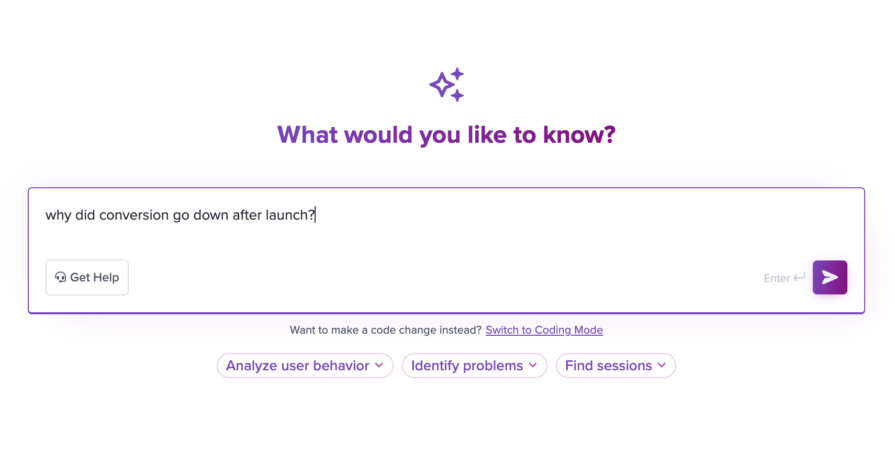

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.