Being aware of your competition is not only vital to building and maintaining the right product, but also to position and sell your product successfully in the market. Understanding your competition can help validate your product in the market as well as provide you with valuable insights into differentiation, competitive edges, strengths and weaknesses, and positioning.

Investigating your competition helps you stay up-to-date with technology trends, however there is a fine line between staying competitive and simply keeping up with the Joneses.

Competitive analysis is not meant to provide you with a step-by-step guide for developing what your competitor has. Developing “me too” features that copy your competition will only result in you playing a never-ending game of catch-up.

Instead, good competitive analysis acknowledges similarities and differences between solutions, identifies how those solutions are positioned in the market, and analyzes how to differentiate your product from the competition to provide a valuable and unique product to the market.

To start, ask yourself whether you know who your competition is. Cross-functional collaboration is important for product managers and during competitive analysis, this is no different. Lean on your sales team, partnerships, marketing, and customer success to gather a list of company names they’ve heard of or ran up against in the market.

If starting fresh, I recommend using our old, reliable friend Google. Start by searching classic SEO terms associated with your product and what problems it solves. Combinations of keywords and phrases can help you find related software companies providing solutions in the same space.

Once you have at least one company, you can plug them into Owler or another competitor search tool to find more related competitive companies. Owler also provides you helpful insights such as fundraising data, company size, estimated annual revenue, and more. LinkedIn is also a helpful source as they show you a list of “pages people also viewed” when you access your own company’s page.

Whether you use the internet or help from your internal team, collecting your list of competitors is the first important step of this process. Once you have your list of possible competitors, that’s where the real digging begins and you can refine your list.

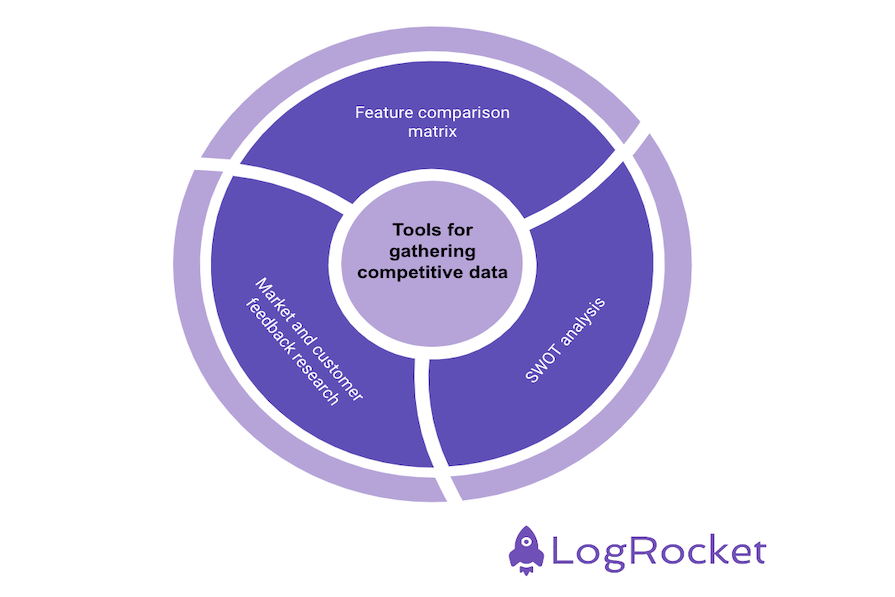

There are a few tools for competitive analysis that you can use to paint a complete picture of your competitor and provide all the data you need to make better product and marketing decisions:

This allows you to actually compare competitive products to your own based on product offerings such as core functionality and features. Not only is this good for getting a basic understanding of what your competitors offer in the market, but you can easily spot gaps between solutions, possible weak spots, and strengths.

Again, this shouldn’t be used to help develop your roadmap by simply copying everything your competitor has that your product currently lacks. Instead, it should be used to analyze the ways in which your competitors are solving the market’s problems and how your solution can differentiate itself. It should also be used to identify any gaps or weaknesses your competition has so you can better position yourselves in the market against them.

Some general market and customer research about your competition is necessary when creating a full competitive analysis. Understanding how your competitor positions their solutions in the market and how their customers actually feel about said solution is vital to getting a good understanding of their strengths and weaknesses as well as identifying more customer pain points.

Searching your competitor company name online for press releases, social media posts, blogs, and more can help you understand how they are positioning their product and features in the market in order to solve certain problems.

Ask yourself: Are they similar to how you’re positioning your products? Is there a trend across all competitors where they are positioning their solutions in a similar way to fight against one common market problem?

Identifying these things can help you better understand what problems your customers are facing and how these companies are solving for them. Then you will be armed with better market data that will help you develop and position your solution in a unique way that better solves customer pain points.

You also want to consider where your customers live, hang out, and openly communicate with each other. Sure, review sites like G2 or plain Google Reviews can be helpful in getting direct feedback from customers regarding your competitor’s products, but that’s not all. Sites like Reddit, Twitter, LinkedIn, special industry forums, etc., are often great breeding grounds for open and honest customer feedback.

It takes some skill with Google search to find these customer feedback gems, but it’s worth learning about your competition’s strengths and weaknesses directly from the customer’s mouth. Oftentimes, you will also get direct information regarding industry changes and market trends.

All of this information can be used for your own positioning whether in marketing collateral or in sales demos and can also be helpful in building out your roadmap, as there are often identifiable gaps in your competitor’s solutions that are yours for the taking.

Just remember, when it comes to public market and customer feedback research, the data you find is public to anyone so it’s possible (and likely) that your competitors are keeping an eye on this data as well. Because of this, I will repeat it’s important to steer clear of building exact features you learn about in your research and instead focus more on identifying common pain points first.

Once you are aware of those pain points, that’s when the solutioning and positioning can begin. It’s never a good idea to read about a feature (or lack thereof) and begin developing it just because a competitor has it or doesn’t.

A SWOT analysis, which stands for Strengths, Weaknesses, Opportunities, and Threats, can help you achieve a more general understanding of where your product sits in comparison to your competition. Now that you’ve done a feature comparison matrix and general market and customer feedback research, a SWOT analysis can help you tie everything together in order to identify opportunities for growth and differentiation in the market.

You can conduct a SWOT analysis on your own company or your competitors. I find it helpful to conduct a SWOT analysis on your own company after collecting the majority of your competitive intel in order to get a thorough understanding of where your product stands in the market and where potential differentiation and growth opportunities are.

Since you are often in competition with more than one company, it’s easier to collect all your competitive intel in one area instead of separate, individual analyses on each company. Since there are multiple facets to collecting this competitive intel, I’ve combined a few templates together in one sheet to help facilitate your analysis.

However, there is a secondary tab on the spreadsheet that provides an area to better expand upon individual companies. These should typically be filled out after you’ve collected the majority of your information and can be shared within your org to give your colleagues (particularly sales and marketing) the vital intel they need to position, sell, and win in the market.

Once you’ve done the hard work of collecting your competitive intel, documenting it, and drawing conclusions from it, it’s easy to want to pat yourself on the back and set it aside. Do pat yourself on the back, but keep the competitive analysis close to the forefront of your mind. You want to be obsessive with your customers and the market, but that doesn’t mean you shouldn’t allot time to competitive research and analysis consistently on your product journey.

It doesn’t have to be hard to keep up on your competitive analysis. You can set up Google Alerts to do a lot of the heavy lifting for you and send you a list of any and all press releases, blog posts, or other articles that are published by your competitors every day. This helps you constantly stay on top of the comings and goings of your competitors without having to dig in yourself.

Competitive analysis is not about searching for product ideas to copy. Competitive intel is vital to product development because not only does it help validate your own products, but it also provides you with the information necessary to build the right things that will help separate and differentiate yourself in the market.

While it’s important to understand the shared functionality necessary for your customers to use your product across all competitors, competitive analysis elevates your understanding of where your product fits in the market and what you can build to further differentiate yourselves from your competitors.

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.

Maryam Ashoori, VP of Product and Engineering at IBM’s Watsonx platform, talks about the messy reality of enterprise AI deployment.

A product manager’s guide to deciding when automation is enough, when AI adds value, and how to make the tradeoffs intentionally.

How AI reshaped product management in 2025 and what PMs must rethink in 2026 to stay effective in a rapidly changing product landscape.