A profit and loss (P&L) statement, also known as an income statement or statement of earnings, is a vital financial document that provides insights into a company’s financial performance during a specific period. It offers a comprehensive overview of a company’s revenues, costs, and expenses, enabling stakeholders to evaluate its profitability.

Analyzing P&L statements enables investors, managers, and business owners to make informed decisions about product development and management and continuously identify areas for improvement.

A profit and loss (P&L) statement is a type of financial statement covering a specific period and revealing a company’s revenues, costs, and expenses. Ultimately, it helps show whether a company is making a profit or losing money.

Profit and loss statements are crucial to prove to potential investors that your company is fiscally responsible and profitable.

Many components make up a P&L statement, but they all fall into one of three categories:

Revenue will summarize how much money was made by the company within the specified period. It simply keeps track of revenue or sales. Some ways to calculate revenue include:

Revenue can also include net revenue which is the gross revenue minus adjustments. This can involve refunds, returns, discounts, or commissions.

Expenses summarize how much your company spent within the specified period. It involves any costs involved with running your business. Some examples include:

Net income is essentially your company’s bottom line. You take the revenue you earned and then subtract your expenses. The result is your company’s profitability.

While this isn’t the only financial data to indicate the success of your business, it can help you determine what is and isn’t working financially.

Keep in mind, a profit and loss statement is different from a balance sheet, although they are both crucial financial documents for companies. P&L statements focus on income and expenses. Meanwhile, a balance sheet shows a bigger and more detailed picture of a company’s financial position since it also includes assets, liabilities, and stockholder equity.

Now that you have the general overview of a profit and loss statement, let’s dive into more detail about what it includes.

The five components of a P&L statement are:

There are two types of accounting principles to create the profit and loss statement: the cash accounting method and the accrual method. Depending on which meth you choose, your P&L statement may look very different.

Here is a breakdown of each profit and loss accounting principle:

The best approach to profit and loss calculate will vary depending on whether your company uses the single-step or multistep approach.

The single-step profit and loss statement is fairly straightforward: you take the total revenue and subtract the total expenses. The result is your company’s net income.

P&L = Total expenses – Total revenue

If revenue is higher than your expenses, your company has a net profit. But if your expenses are more than your revenue, then your company has a net loss.

The single-step method makes record keeping easy, but it could also cause you to miss valuable information on your business performance. Single-step P&L statements are more commonly used by service providers and small businesses.

The multistep profit and loss statement is more detailed than the single-step approach. While it also tracks income, expenses, and net income, it breaks down expenses as direct costs or indirect costs.

This means you can use those numbers to calculate your company’s gross profit and net operating income, which tends to pain a more accurate picture of what is happening with your business.

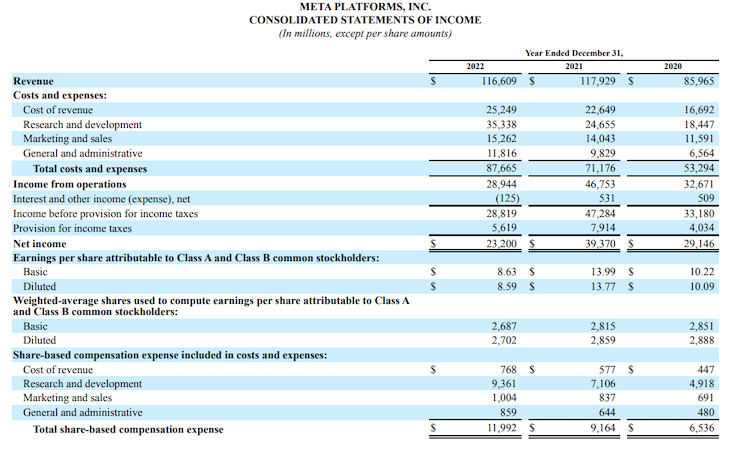

Multistep P&L statements are frequently used by large businesses to better understand what’s driving their profitability.

The multistep method involves three components:

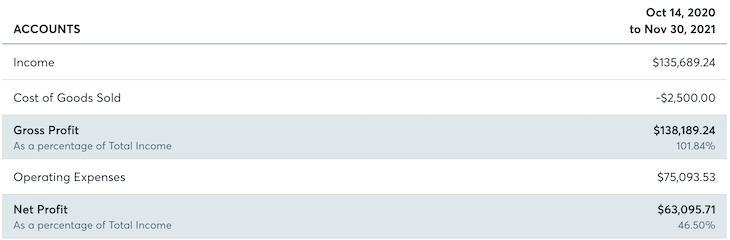

P&L statements will look different depending on the company size, accounting method, and whether they choose the single-step or multistep approach.

For example, here’s a profit and loss statement from Meta Platforms, Inc.:

Smaller organizations may have simpler P&L statements. Here’s an example of a P&L statement from a small business:

A profit and loss statement is valuable for financial analysis because it proves the profitability of a company, which can make it more attractive to prospective investors. Put simply, a P&L statement can prove the financial strength of a company.

Investors can use a P&L statement to:

A P&L statement is also important to internal operations. It can show fluctuations and flaws in income and expenses and what needs to be done to improve the financial position of the company. This may involve finding additional sources of revenue or reducing expenses.

Here are a few findings a company might discover by analyzing its P&L statement:

A profit and loss statement (P&L), also known as an income statement or statement of earnings, is a crucial financial document that provides insights into a company’s financial performance. It summarizes revenues, costs, and expenses, allowing stakeholders to evaluate profitability.

To help you track and analyze your company’s financial health, we have prepared a profit and loss statement template:

| Amount | |

|---|---|

| Revenue | [Enter revenue amount] |

| Cost of goods sold (COGS) | [Enter COGS amount] |

| Operating expenses | [Enter operating expenses amount] |

| Gross profit | = Revenue – COGS |

| Other income | [Enter other income amount] |

| Other expenses | [Enter other expenses amount] |

| Net operating income | = Gross profit + (Other income – Other expenses) |

| Interest expense | [Enter interest expense amount] |

| Taxes | [Enter taxes amount] |

| Net profit | = Net operating income – Interest expense – Taxes |

We’ve also created a customizable, plug-and-play version of this profit and loss statement template in Google Sheets. Simply enter your financial data, and the table will automatically calculate key figures such as gross profit, net operating income, and net profit.

Note: To use the template, first make a copy by selecting File > Make a copy from the menu above the spreadsheet.

A profit and loss (P&L) statement is one of the most important financial documents for a company. It can clearly show whether a company is making a profit or not. It can also break down income and expenses for further analysis and reveal areas needing improvements.

The P&L statement is a snapshot of the company’s financial state. Regularly creating and analyzing the changes in the profit and loss statement over time can help you better understand how your company’s products and services are performing.

It’s crucial to create accurate P&L statements so you can know whether your expenses are worth their cost. Otherwise, you risk not knowing what is causing the failure or success of your business.

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Maryam Ashoori, VP of Product and Engineering at IBM’s Watsonx platform, talks about the messy reality of enterprise AI deployment.

A product manager’s guide to deciding when automation is enough, when AI adds value, and how to make the tradeoffs intentionally.

How AI reshaped product management in 2025 and what PMs must rethink in 2026 to stay effective in a rapidly changing product landscape.

Deepika Manglani, VP of Product at the LA Times, talks about how she’s bringing the 140-year-old institution into the future.