Sarah Owen is Chief Product Officer at One Inc. She has an extensive background in the payments industry, having “pretty much worked at all the large processors,” including First Data, Heartland Payment Systems, and TSYS.

In our conversation, Sarah explains how she drives adoption by letting her customers influence the product roadmap and outlines her team’s “magic mountain” model for prioritizing big-picture initiatives.

I have a very customer-driven product methodology, so we get a lot of feedback on the roadmap from our customers. However, it is important to not just take that request verbatim or you run the risk of just becoming a feature delivery machine. We listen to the request and then work with our clients to figure out what problem they are trying to solve.

Then the team gets feedback from many clients and end users to find the best and broadest solution for that problem or opportunity. This usually includes working prototypes, user sessions, interviews, and surveys. We have an iterative process to ensure that we get the best feedback.

We’re very deep in our relationships with our 200 carriers. We have user groups and a product advisory board who we talk to about what problems they’re trying to solve. This helps us make sure we’re tackling initiatives that the most customers will get the most benefit from.

We also look at the user journey. We identify moments that matter by finding the steps in the journey that are the most important. For example, in the insurance payments space, some of those moments are going to be things like sending a reminder that an insured’s premium is due or when the insured has had an accident and needs to receive a claim payment. Finding the moments that matter and making those work seamlessly is very important.

Prioritization is an art, not a science.

We set up a One Inc product advisory board, which has been instrumental in helping us prioritize. We will go to them with our roadmap and get feedback from them on what’s important, what would drive the biggest benefit, and what would drive the most adoption.

We implemented a corporate-wide North Star this year: everything we do is to try to increase digital payments. In the insurance space, that means supporting the ability to take premium payments and to distribute claims payments either to their insured or a vendor. Insurance carriers have a vendor component where they pay auto body shops or medical providers, for example. Carriers are very interested in moving from paper to digital payments. Paying by check costs anywhere from $7 to $25 to produce, handle, and manage. Moving everything digitally helps decrease their costs and just makes everything more efficient.

We have used various measurement tools, like RICE and the McKinsey measurement scale, but there’s nothing scientific. There are always different things that would come in and take precedence.

Absolutely. This is something the company implemented this year and it has driven cross-team alignment. So we have the North Star and we also have something that we call the “magic mountain.”

We looked at our objectives and then identified the initiatives that had to happen to meet those objectives. Our chief marketing officer created a graphic of a mountain for those initiatives with our North Star shining at the top. Someone started calling it the magic mountain, and it stuck. Now, the magic mountain slide is pretty much in everyone’s presentation.

We have quarterly program increment (PI) planning where we work with the engineering team to plan what we will be able to deliver that quarter. We start each planning session with a review of the magic mountain and are able to show how each initiative is aligned.

What I am seeing, more so than I’ve ever experienced, is that my team wants to know how they are contributing to the company’s success. If they can see that what they’re working on aligns with the magic mountain, it gives clarity and helps us make decisions. If it’s not on the magic mountain, don’t prioritize it; prioritize what’s on the magic mountain.

We do. We validate that the solutions meet the needs of our customers and industry experts. We consult clients, end users and industry analysts. We also have experts on our team both in property and casualty insurance and payments that help validate use cases. We work with them on how to improve the existing software in place, but we also come up with some big, revolutionary ideas that we’ll probably be first in the market for.

When we launch something new, we put it in customers’ hands, do the prototypes, and get feedback on what works and what doesn’t.

For an insurance company, the thing that matters most is their insureds. There are very few times when they interact with the consumer; the moment that matters is being there when the insured gets into an accident. That is when their insured needs them to pay the claim. So they want to make sure that’s seamless and as close to real time as possible.

We have 24/7 monitoring with alerting in place and a support organization that has 24×7 support.

In addition, we want to make sure that our clients are maximizing the benefit and adoption of digital payments, so we have a strategic account team that helps them put the best adoption programs in place. On our client success team, we actually have a leader of customer experience. She manages the voice of the customer and NPS score surveys. I think it’s pretty cool for a 600-person company that we have a dedicated focus on customer feedback.

We segment it by persona and by what they are responding to. Are they responding to questions on the products? Are they responding to the service? We slice it by type of user at the carrier, such as a treasury team member or a claims adjuster.

The number one thing product managers need to do is know their customers. We have a goal of making sure that our product managers are talking to at least one client a week, at minimum.

Heck yes. We have a product intake process, and our product team meets with all of our internal stakeholders every Friday. Anyone can submit an idea, and we ask for a certain amount of information. Sometimes, the ideas are how to improve our internal processes. We take ideas there, vet them, and prioritize them.

Some of them go straight into our backlog and some of them are injected in to start working now. Some go into discovery, and then some of them go into what we call the icebox — we know it’s not something that we’re going to get to for the next 18 months, but we think it’s really cool and don’t want to lose it.

Our clients are property and casualty insurance carriers. For the disbursements of the claims payments, the claimant can decide how they want to receive them — ACH, check, a push to their debit card, Venmo, etc. Today, only 13 percent of customers are choosing check. Five years ago, everyone would’ve thought that check’s not going away. Yes, there are always going to be checks, but at some point, there will be very little usage of them.

Nowadays, we’re getting carriers with more and more concentration in the workers’ comp space. With workers comp, there are additional legal requirements and it is critical to get that payment out as soon as possible.

We wanted to be able to capture a person’s payment preference as soon as the notice comes in, as soon as the claim is initiated. So, as the adjuster gets that claimant’s name and information, that claimant can select how they want to receive payment upfront. As soon as that worker’s comp payment is ready, it can get paid immediately.

It has created just a really great experience. We have it out in the market with a customer, and we’re getting really great feedback from users.

It is. We would get feedback from as many as possible. For a full beta, in payments, the solution still needs to get integrated into our clients systems. So, ideally, you have a partner client who will work with you to roll out the solution to a segment of their consumers to get real user feedback.

Of course. And because we’re B2B2C, we’re always working with a consumer solution, such as P&C carriers to roll something out. If you’re trying to launch something with a new consumer behavior, you really have to have that consumer channel or the marketing and brand power behind it to make it work.

Sometimes, it might be internal users that need to adopt the solution. For example, adjusters in the P&C space have gotten very used to sending checks to pay claims. Getting them to adopt a new behavior, like sending a digital payment instead of a check, is a change of behavior. Every time you have to change behavior, you have to make it easy to adopt and even prompt the new behavior.

For adjusters, their back-office software had a payment choice flow, but defaulted to check. We had to work with those back office providers to change the flow so that, instead of a check, adjusters had to think through that decision on what to offer the claimant. Turns out, 70 percent of consumers prefer to have a digital distribution.

Communication and transparency. Maybe this is why I’m successful at product: I err on over-communication and over-inclusion.

We have monthly product meetings, a product newsletter, and we host stakeholder events where they can view demos and provide feedback. We also have quarterly planning where we enlist our stakeholders to participate in prioritization and share monthly reporting to show progression.

Stakeholders get readouts of what’s prioritized, what we’ve accomplished, and what’s left to develop. The market and business are growing so fast that we need to do monthly updates with our leadership team and adjust if necessary.

In the monthly product newsletter, we talk about changes in methodology, launches, and success stories that have been a part of engineering, delivery, and product together, or operations, engineering, and product together. We include all of our release notes and all of our links to our sources of information.

In addition, we have internal and external product documentation. We have playbooks that show how carriers can optimize our solutions. I have to say that this is the best product team that I’ve ever worked with. They make all of this possible and they push me to be better. As a CPO, one of the most important things you can do is to find the right talent and nurture that talent.

They feel a sense of responsibility. They are team players. They want to do the right thing and make sure they are contributing to the company’s success.

They are all bought into product excellence and want to just do better and make better solutions. We have a complicated product that’s growing fast. They have to have an innate sense of curiosity about getting to the root of how things work. And they absolutely do that.

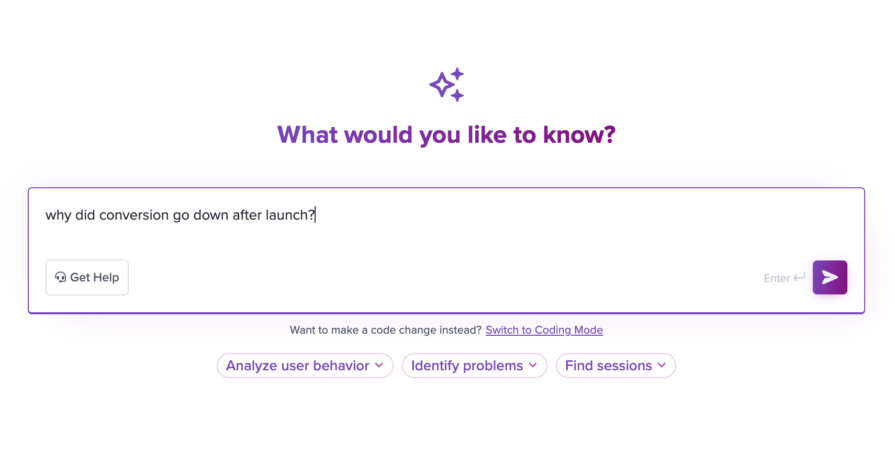

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.