René Insam is a Director of Product Management, Retail at Western Union, a financial services company. He has almost 20 years of experience working in various roles in the financial services industry, including stints at Wells Fargo, American Express, Charles Schwab, and AIG. Before René’s current role at Western Union, he served as the vice president of corporate and institutional solutions and wealth management at Morgan Stanley.

In our conversation, René talks about how he empowers and retains top talent by keeping an active interest in people’s development. He discusses how he gauges a candidate or employee’s abilities by asking open-ended questions to promote critical thinking. René also shares his take on where AI is going to take the financial services industry.

When hiring, I think not only about asking the right questions but also what to listen for. Is the candidate understanding the crux of the question? I ask candidates to take a few minutes to tell me about their professional lives. Are they simply reading out their resume to me, or are they describing actual activities, tasks, challenges, and accomplishments that have shaped their careers?

Are they describing their professional background to help me understand how they tackle problems? Do they come from a strong technology background or from a business background? Do they lead with relationships, execution, or strategy? A candidate’s professional self-pitch tells me a lot about how they think and how I can expect them to fill the role. I do this not only in interviews but also in 1:1s and development conversations.

To understand someone’s capability, I like to ask them situational scenario questions: tell me about a time when a certain scenario happened. How did you address the problem? Open-ended questions like these showcase critical thinking and existing capabilities. Another question I ask candidates is to tell me about their favorite product. I listen to their description of the problem that this product solves. Are they able to speak the language of product? Can they think from the user’s perspective? Are they describing UI/UX with depth?

Depending on the role, I may ask a few additional questions. For example, I might ask how the candidate would inform a critical decision in the absence of precise data. Are they pushing for the creation of primary data? Sometimes, that can take too long and is not always possible. I look for how open they are to ideas like using secondary data or acquiring existing data sources that inform the decision. I like to see “out-of-the-box” thinking. Questions like these explore potential and a learning mindset, because they focus on thought process more so than on experience.

Taking an active interest in people’s development is key to retaining top talent. This means skill-building, mentorship, and connecting them with my network.

I’ve found that asking people what their dream job is especially gets people going. I ask them to find a job description they’d consider their dream role and paste it into a slide, and then we talk about how I can help them gain the skills and exposure they need to be ready for that role. I commit to giving them the opportunity to apply the skills from that “dream job” in their daily work which, in time, enables them to ace an interview for that kind of job.

By going through that effort, I establish myself as a sponsor of my direct report’s career. I’ve found that this approach resonates with people because it’s a great North Star activity that facilitates meatier check-ins and performance cycle conversations. It’s also a great door opener for honest mentoring and coaching conversations. We can assess the maximum exposure someone can get to the skills they need to interview well while identifying ways to get closer to their dream job in their current role.

Everybody talks about work-life balance and flexibility. I want to give that to my team, but not just in the sense of giving them the flexibility to take their kid to the dentist. That’s all good, but that’s table stakes. I want to give people flexibility to find time to develop. In my role, I intend to create that space not as an expectation to spend evenings and weekends developing, but as an integral part of your 40-hour work week. I want to back that up with the ability to give individuals real work-life and development balance.

Empowerment is key. I manage a platform with over 170 distinct capabilities, and I want each person on my team to own one of these capabilities end-to-end as if it were their own business. If someone asks me, “What’s the status quo and the future vision for capability X, Y, or Z?” I want to say, “That’s a great question. You should talk to this person on my team because they know it inside out.” I also love advocating for people in front of stakeholders because that shows my people that they are informing the direction of their capability.

Post-COVID, having a robust remote culture has become table stakes. For me, this means promoting a culture that values flexibility, trust, accountability, and ensuring remote employees feel included and engaged. This can be as simple as turning on your camera for meetings. However, financial services and the tech industry are generally recommitting to an in-office policy and culture.

In the financial services industry, the in-office mandate is an opportunity to stand out. Many companies focus on working hard and playing hard — with in-office mandates, you can prove that you fit that bill. If you stayed late for a happy hour on Thursday night, be the first person in the office on Friday morning. It has nothing to do with how good you are at your job or how skilled you are at product management; this is about showing and sending a message about how dedicated you are to the cause. Presence is not a performance; but it is an opportunity.

I look for interest in this kind of participation when interviewing for local positions. Bringing in candidates for a round of interviews into the office almost feels old-fashioned, but it allows people to feel the vibe on the product floor. The team has reacted positively to meeting people in the flesh as well.

I’m all for the flexibility of remote work — it’s opening up the talent pool quite a bit. But every time there’s a strong movement in one direction, there’s an opposing force. The opposing force to remote work is the in-office culture and the many advantages that come with it for the organization and the individual.

The most important aspect of effective coaching and mentorship is helping people become a better version of themself, not a copy of you. That’s challenging because of the idiosyncratic rater effect — we tend to evaluate others based on our biases, expectations, and perceptions. What I see as a “10 out of 10” might look like a “2 out of 10” to someone else.

To be a good mentor and coach, you must evolve your mindset to suppress biases. It requires mastery of listening and asking questions. My best mentors didn’t show me how to do something or give me feedback. Instead, they showed me how many things I can do and how many options are available to me. They made me think about the angles to the problem I could pursue and then let me pick.

Good mentorship is more about contextualizing, encouraging, and lending experience than prescribing solutions. Also, a mentee has to provide input and direction — only then can I meaningfully lend that assistance. I always remind myself that the most important thing is to help my employees become more of who they want to be, not become who I am.

Innovation can come from different places, and financial services are riddled with legacy systems and old, monolithic platforms. Innovation can take so many forms. It could mean reducing the total cost of ownership of an ecosystem or modernizing and getting to a cleaner, faster, more agile, and more efficient platform. It can also mean shedding weight by getting off a monolithic application and moving to a service-oriented or cloud architecture. Innovation unlocks value.

Innovation doesn’t have to be a new product that we launch with a bang and a big go-to-market strategy. It’s hidden in all of these other places. UI and UX offer a ton of opportunities for innovation because there are ever-changing paradigms in that space. We find ways to present experiences more seamlessly or conveniently.

Financial services seem to have many opportunities to innovate around a holistic client experience. The product mindset has been taken over for so long that we’ve always built a solution around a product instead of a solution around the client. That may mean reorganizing existing products and solutions rather than launching new ones.

AI’s potential makes my mind boggle. I think about AI in two categories: my and my product team’s practice and AI’s impact on my industry.

David Cooperrider, a business professor and writer, published a change model called Appreciative Inquiry. It postulates that any organization will evolve in the direction of the questions it asks itself the most. Can AI help a team of 15 product managers work like a team of 25? Can it take on repetitive tasks and free us up for higher-level thinking? I see AI as a thought partner that can help us brainstorm better, solve problems faster, and communicate more effectively.

I firmly believe that if we ask ourselves important questions and make those questions part of our DNA, there will be some inevitable breakthroughs. I’ve even thought about adding a slide at the beginning of our presentations that asks, “How would AI solve this problem?” This simple practice will nudge every product person on the team to not do it alone. Even if it’s just a gut check or a sanity check, involving this super-smart friend who never gets tired of our questions will be beneficial.

It’s difficult to comprehend how big and outsized the impact could be. I see higher degrees of personalization in terms of communication and investment options offered to clients. Some investment products already use some sort of intelligent approach, and they will be turbocharged when AI is creating proposals that can audit for cost-effectiveness, risk profiles, asset allocations, and customized inclusions or exclusions of certain assets.

In the servicing space, whether it’s for the client or the agent chatbots, I see a lot of inquiries that can be taken care of right then and there versus calling a phone number.

It’s also important to remember that while there is an early mover advantage to embracing AI and building products, there are also known pitfalls to getting it wrong — at the top of which are data and privacy concerns. But like every groundbreaking technology, AI will bring capabilities that were previously reserved for top clientele down the market. Things are now becoming available for a broader range of clients, including those with smaller portfolios who were locked out of certain capabilities.

I see a few accelerating trends that could push traditional financial services to react and open the door for disruptors. Non-traditional financial services providers, like ecommerce platforms and social media companies, could enter the space. They’ve already captured consumers’ attention and figured out how to enable payments.

There’s always the possibility that a company like Amazon could enter the financial asset management business. They already have a loyal customer base, and with over 70 percent of Americans having a Prime Membership, they could make financial transactions more seamless and accessible. That kind of market penetration would give them a real advantage.

Another potentially disruptive trend is the idea of a “super app,” which is especially popular in Asia. These apps are multifunctional digital platforms that give closed-off ecosystems a run for their money. They offer convenience of use, and speed for the consumer. They also offer the convenience of fewer passwords, logins, and navigation paradigms.

These trends force companies to respond. But can they? Are they caught up in a never-ending modernization cycle?

The challenge for many financial services companies is balancing the need to stay on par with the competition and create capabilities considered table stakes versus focusing investments on their secret sauce. What you want is to truly create a capability that creates market differentiation. If you don’t do that, Clayton Christensen’s “innovator’s dilemma” comes to mind — you’re stuck in the past that keeps sucking you in and prevents you from making investments that create noticeable market differentiation.

How companies navigate this will determine whether they win or lose in the face of these challenges and trends. If you can go beyond the basics and create something that differentiates your brand, you’ll unlock value for your customers. If not, you’re just treading water.

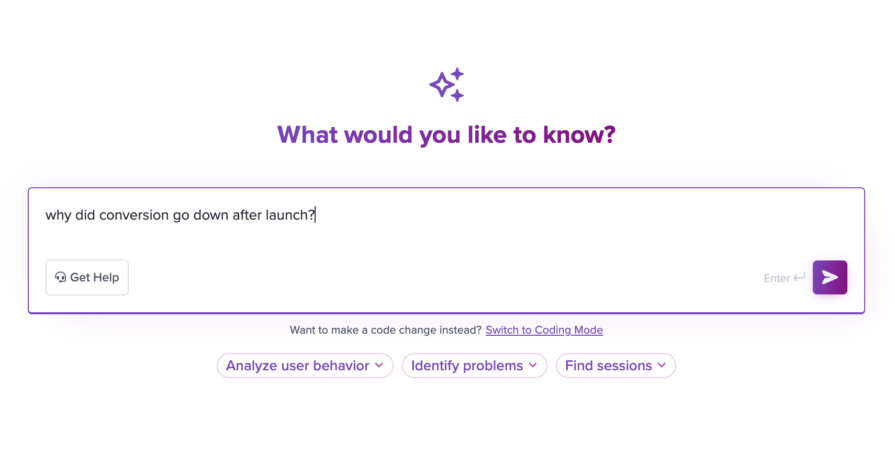

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.