Karthik Viswanathan has served in multiple transformation-centric roles — most recently as Chief Digital Product Officer at Optum, a health services and innovation company part of UnitedHealth Group. He has led digital transformations in a wide range of industries, including telecom, financial services, healthcare, and retail. In his 20-year product management tenure, Karthik has brought his leadership and strategic playbook to companies like Oracle, ShopNBC, Macy’s, and AT&T. He currently advises companies on growth strategy.

We sat down with Karthik to discuss his experience leading digital transformation across a number of verticals. He shares how aspects of digital transformation can look different by industry, such as in revenue fluctuations, where and when companies invest in costs, and scale. Karthik also discusses the triad of consumer needs, business strategy, and technology and data strategy, and how that intersection and balance determines the success of the digital transformation.

Part of it was planned, but a lot of it was me being curious about learning adjacencies. Two very important life cycles positively impact an enterprise regardless of industry or size: the product lifecycle and the customer lifecycle. The product lifecycle is typically enabled by technology. The customer life cycle is governed by marketing, how we grow our reach, how we engage and retain customers, and how we increase lifetime value. The product lifecycle drives the customer lifecycle, and the customer lifecycle helps monetize the product. I wanted to spend time on both sides of that facet to nurture my curiosity and build empathy.

As a digital product leader, you always operate at the intersection of understanding and addressing consumer needs, supporting the ambitions of the business and the strategy that keeps an organization solvent, and, lastly, figuring out how you can tap into either the existing technology and data infrastructure, and how you can modernize that to support each other. It is really a triad. It needs to be looked at as that virtuous cycle.

You also need to be good at catering to each one of those segments. From a consumer perspective, empathy and curiosity are key to understanding needs and anticipating what’s next. From a business standpoint, influencing skills and having exceptional stakeholder management are traits I encourage people to have. You can have the best idea, but if you’re not able to showcase how it’ll make money or why its value is important to the organization’s evolution, you’ve lost the battle. And from a technology standpoint, having data and technology fluency is also essential.

A lot of these skills differ by industry or company size. If you’re in a big tech native company, for example, you’re going to likely have deeper data or tech fluency. At a consumer-first org, consumer empathy skills may be a much bigger focus than technology skills. So, it really depends. But this triad of skills is the commonalities that have led to successful careers in this space.

In terms of core principles, I think they’re largely similar when going through digital transformation. You want to come in and be a change agent. You want to be somebody who is truly looking at it from a transformative perspective. However, you need to align the digital strategy back to the business or monetization strategy. Without that at an enterprise level, you’re never going to find that adoption.

And, there’s a difference between a vision and a strategic plan. Strategic tasks are milestones and tasks, and a vision is something that you aspire to be. Having both of those things will either increase cost efficiencies or grow your revenue. Last is the unification of how you are investing in technology — where you’re storing your data and how and why you’re building certain capabilities. How those decisions align with that vision and broader enterprise strategy are key commonalities.

Also, everyone in the organization — from the call center all the way up to the C-suite, is interested in what the digital team is doing. You’re operating under a very hot spotlight. Every decision you make or don’t make has a ramification to the broader organization.

Each sector has a unique rhythm to make money or expend costs. For example, retail spends somewhere between 40 and 50 percent of its marketing costs and investment in the cost of goods sold within six weeks between Thanksgiving and Christmas. That’s make or break from a revenue standpoint. It’s an extremely competitive space as well. How you marshal all of your assets aligned to that strategy is important.

Telecom’s spending, on the other hand, is a little more spread out. There’s a big focus on aspects like when the next iPhone or Samsung phone is going to launch. The cost element is also extremely varied because it’s not just in investment in marketing, but into fiber installations on the ground or investing in cell phone towers. Healthcare is unique in its own way, but it relies on the real-time nature of it. It should cater to what the consumer needs and their perceived sense of urgency. You’re not left to your own indulgences in terms of where you can spend time and money — it’s more of a push/pull.

Each of those verticals and industries is not one-size-fits-all, even within their sub-verticals. Understanding how a company makes money and where we invest the cost is a big part of that learning cycle. Without that, you’re going to build fabulous roadmaps and strategies that fundamentally don’t resonate because they’re not scalable or don’t add value.

It’s a nuanced discussion because it varies by industry. I’ve seen anywhere from two to six years. And there are three very distinct phases. You’ve got to fix the foundation first. A lot of the time, it starts with data. Do you even have the right data in the right place? Do you have an inventory of your digital assets? Sometimes, getting that takes several months.

Getting to a level of what I would call strategic parity with your competition is the second phase. The third phase is building differentiation. Now, these are not sequential tracks of work. Oftentimes, if you have sub-businesses, some may already be in a differentiation stage because they’re a lot more mature. Typically, they go through these three set stages. I would encourage companies to not operate in a waterfall manner because often, there are seismic changes in technology or macroeconomic changes that require you to re-evaluate your priorities.

When you’re going through mergers and acquisitions, you assume that just because a strategy worked at one point in time means that everything is going to stay the same. You may find yourself looking inside out versus outside in. Although it might mean two entities coming together for you, the customer sees one brand, one product set, and one service. Thinking experience first, rather than operations and technology first, has been a big and valuable lesson.

You have to figure out, from an organizational strategy, how to standardize processes. How do you share service models across? Especially as you bring companies together who are doing their things, how do you have one business model that brings the revenue streams and the cost streams together? There are also people strategy implications. Roles change and titles need to be standardized. We have to make sure that people are speaking the same language. Sometimes there are planned attritions, and you have to have a change plan associated with that. Although from a business perspective, the marriage makes a lot of sense, at a working team level, it may or may not. It may cause more angst and dilute your culture.

From a tech standpoint, how do you have a unified portfolio? How do you bring data and systems into one unified enterprise product set? Most companies that go through a merger and acquisition will have their own carve-outs and bolt-ons that are unique from compliance or a governance perspective that they just have to keep on. So what are the exception criteria? How do you govern that moving forward?

All three things — people strategy, operational strategy, and tech strategy — have a direct impact on the end experience of the consumer. If any of these moving parts don’t come together the right way, the experience suffers.

I’d say the main one is related to my earlier point about mergers and acquisitions. The core guiding principles don’t fundamentally change. Rather, the uniqueness comes in how the company prioritizes hitting their numbers for that year and beyond. There has to be a balance in investment for the short term with winning in the long term.

Oftentimes, a mistake that companies make is obsessing over that particular fiscal year. They come to the start of the next year, and they’re like, “Now what are we going to do?” Typically, you want to start seeding that the prior year so you have enough investments to carry you and build that momentum. That balance changes by industry, but is extremely important.

The other thing I’ll say is failure and learning is part of the journey. Anything companies can do to lean in on data, quickly prototype or experiment, and avoid groupthink, the better. Those are the things that allow you to fail fast in a very controlled manner, without you investing millions of dollars over a set of quarters, and then realizing that there’s no need for it.

I’ll reference the consumer needs, business strategy, and technology and data strategy triad again. First is consumer needs, which can be industry-specific. A lot of it is around the NPS or satisfaction scores from consumers. Looking at NPS not just at a channel level, but at a relational level as well, is crucial. With the focus on mobile first these days, I also gauge if the app has tasks that can be completed in 30 seconds or less. Anything more is better off on a desktop. Regarding digital adoption and containment, how many people are we driving to use digital? Digital is a very efficient channel to transact in, so you can use real-time feedback to not only improve digital experiences but also your broader organizational touchpoints.

From a business standpoint, revenue and cost are the big numbers that show up on a balance sheet or cash flow statement. Are you driving up more revenue? What can you do from a back-office automation standpoint to reduce cost? In the past, digital transformations were largely around channel share and attribution mix. But in isolation, that may or may not give you the long-term win.

The true value of a digital transformation is if you’re unlocking new business capabilities. Digital transformation should lead to new revenue streams or new product ideas based on the data that they are collecting. To me, that’s a key metric to look at in terms of digital success. Lastly, from a data and technology perspective, how much cost do we need to dispense yearly to support and maintain the technology stack? How much tech debt have we built up that hasn’t been reduced?

I don’t believe any of these metrics are more important than the other, especially in this day and age. We have to look at KPIs working together in synergy, impacting each other as you make decisions.

Qualitative is obviously harder to collect than quantitative, because you can’t lean on tag instrumentation or web analytics. Qualitative is oftentimes noisy because other biases and friction points come into play. But if you go back to the KPIs I mentioned, how easy is it for somebody to transact something? Are they getting that task done? Looking at session replay tools, like what LogRocket provides, can help you see that.

I also recommend doing blind brand testing, which means putting your experience alongside other competitors or AI-generated models, to see what resonates better. It could be the size of the font or the UI, but those things are just as important in terms of getting real-time feedback. Get people who are both well versed in that industry and not so that you are looking at it from a true consumer mindset. You may be in telecom or healthcare, but the same consumer is interacting with five different industries on the same day.

Friction means different things to different consumers based on what they’re trying to do. I just ordered something online for my daughter. If I wanted to get it quickly because it’s in limited stock, Amazon’s “Buy Now” feature allows me to do that quickly. For me, friction in that case is adding an extra page or extra button. It could be something as simple as that.

If I am in a stage where I’m just still understanding what I want to buy and trying to compare items, the extra page is not friction. It’s actually very useful information for me. It’s important to remove friction, but for that, you need to be able to understand the intent of the consumer. This is why apps are awesome — in many cases, they are either logged in, you know enough about them to anticipate their needs, or you know where they left off in their buying journey.

It gets a lot trickier when this is a prospect or a brand-new customer who isn’t signed in. This is why looking at sessions or experience patterns can help you say, “This person is going all over the place. We need a chat popup to say ‘It looks like you’re lost. Can we help you?’” It all comes down to understanding intent and really trying to solve that problem as effectively as possible.

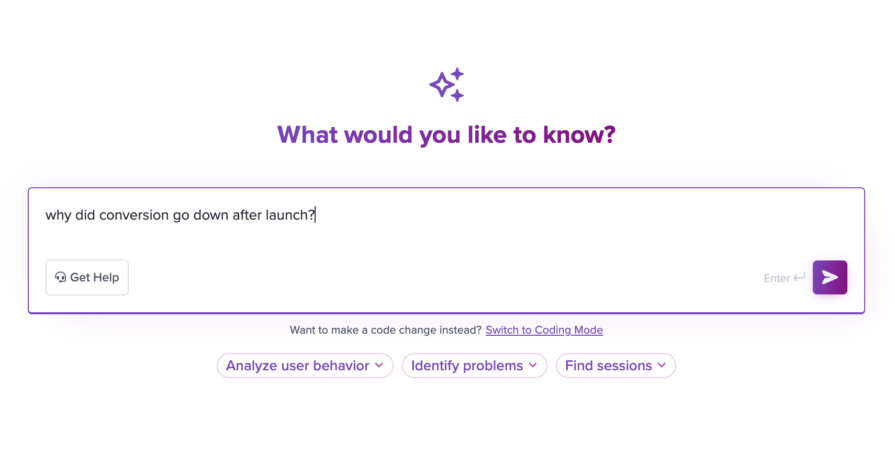

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.