Akash Gupta is Chief Analytics & Strategy Officer, Head of FP&A at Fetch Pet Insurance, a tech-enabled pet wellness company. He began his career as a software engineer and worked for companies like Tata Motors, Lockheed Martin, and Item Software. Akash then became Vice President, Investment Banking at Bank of America Merrill Lynch before working in corporate development at American Express. Most recently, he ran analytics and strategy at Discovery (now Warner Bros. Discovery) before his current role at Fetch.

In our conversation, Akash talks about the importance of empowering your analytics and business intelligence teams to find “golden nuggets” of insights among all the noise. He shares his experience helping launch Discovery’s streaming service, Discovery Plus, as well as the hesitations and risks around cannibalizing cable network traffic. Akash also discusses his work to optimize and track the LTV to CAC ratio across all channels at Fetch Pet Insurance.

When I joined Discovery, we had just started our TV Everywhere service. The whole world was all about streaming services and going digital, so we had a lot of support from our executive team to find ways to grow. We grew that business quite fast. But for Discovery Plus, we had been dabbling with the idea of launching our own paid streaming service for a while. We were hesitant because we didn’t know how it would affect our cable business. We had a sports streaming service in Europe, but cable is not as big there.

The announcement and launch of Disney Plus changed the whole story. Disney was the first to open the gate for others to follow. Immediately after, Peacock announced its own service, and it’s owned by Comcast. A cable company announcing an independent page streaming service gave us a lot of leeway to take the risk of launching our own service.

Regarding go-to-market, we had to make a lot of challenging decisions rolling up all the way to the CEO. How much content should we offer? Should it be all behind the wall or there should be some offered for free? Should we have an ad-tier pricing option? Should we have a partnership? We even considered whether we should strip the TV Everywhere service and add it to the Discovery Plus streaming service.

It was completely different than launching a tech product. Our launch was almost like an iPhone launch or a movie or game release. We couldn’t afford for it to go poorly because of how much PR it was getting. It would be very hard to recover from that.

Even though it was a new product, the content was very well-known. In that way, it was almost like the Disney Plus launch. That plus the PR component put a lot of pressure on us to make sure that our go-to market strategy was very good. In hindsight, I would say that we left no stone unturned.

The execution was almost flawless in the sense that we offered tiers and an option with or without ads, pricing was low enough, and we launched with a lot of new, attractive content. We launched on all nine platforms — web, iPhone, Android, Roku, Fire TV, Google, etc. We also had a partnership with AT&T. It was an immediate success.

Sure. We found that inside operations the data piece was not fully running well. After launch, we knew the data was coming through, but we had to stitch a lot of the data together on the backend to get it right. There was a lot of work involved post-launch for three or four months to make that process seamless. This item wasn’t critical at the time of launch because the frontend was good enough.

The email marketing component could have been better as well. We were still trying to figure out the digital piece — this was our first time marketing a big subscription service, so how do you get that back to people? How do you convert somebody who showed interest a month ago? How do you get back that customer who churned?

Disney was the only player who had a bigger streaming service launch before ours. Other than that, we were very successful. We were so concerned that customers would not like it, so we didn’t leave any stone unturned. For example, a few months before launch, we advertised it a lot on our cable network. We also established a B2B partnership with AT&T in which their customers got Discovery free for 12 months.

We made sure that we were available on all platforms at the time of launch and that our technology was working well. We were concerned in the sense that this was the first big streaming service, and in Europe, our service was only available on the web. We’d never seen authentication working on nine different platforms before this. We did some beta testing over Christmas break, and our service was released the first week of January. On day one, it worked flawlessly.

I joined Discovery in 2016 when we had a very small digital team. Eventually, I ended up leading the strategy, analytics, and research and insights groups. For me, having a joint data analytics, research and insights, and strategy group in one function was a new concept. Traditionally, data acts as a separate function, and the insights team sits within a different business function such as marketing, tech, product, etc.

I believe that the insights group should sit in an area where they can talk about the customer as a whole. Customers don’t think about marketing versus product versus pricing. If you want to provide insights on consumers and how to improve the business, you have to have the analytics function in a place where they can see how everything interacts. Otherwise, things can become very siloed.

That was the first challenge, and I was successful in getting leadership support on making that point — analytics has to sit together so we can make better decisions. The second issue we faced was that traditionally, people think about data analytics as a necessary overhead instead of a value-add. For example, if we fixed a bug that would increase streaming by five percent; that alone could pay for one full year of my insights team.

We saw a long-tail strategy that was almost like YouTube. People may not come for that, but once they start watching, that long tail is what drives viewers. We were able to prove that through our insights. We ran the forecasting function that helped business and finance. My big impact was changing the perception that insights add value to the business overall. You mentioned fixing bugs that cost the business a lot of money. During your tenure at Discovery, you encountered a bug specifically affecting Roku streaming. How did you address that?

We were running the TV Everywhere business, and the key metric was how many hours someone watched. Every 10 minutes, one minute of ads would play. If the number of hours declined, the ads declined and so did revenue. There was a direct correlation. We were monitoring 13 apps, 13 channels, and nine different platforms. There was a lot of noise. For example, if we had a popular piece of content come in, there’d be a spike in viewership and then it would drop. It was hard to draw out trends from all the noise.

We saw a 10 or 15 percent drop in Roku viewership. At first, we thought it was related to content, but our analytics team was persistent that it was due to something else. The tech team insisted, “There’s no bug. It’s all good.”

At the time, we required the CEO of that function to hold a daily meeting on the dropoff. It took almost a month to uncover the cause and by then it accounted for 30 or 40 percent of the business. We were going to miss our budget if we didn’t fix it in time. Ultimately, we uncovered that the bug was not within the first 60 minutes; the drop only occurred in users behind the authentication wall, so that narrowed it down. When we investigated further, we found that if the previous authentication was more than an hour ago, the user would get de-authenticated.

Uncovering this bug was a great lesson on not giving up and also for empowering your analytics and business intelligence teams to find those golden nuggets. There might be something that just looks like noise, but if you see signals around it, dig deep!

When I joined Fetch, we were going through some significant operational headwinds. We had just changed our billing system and unfortunately, that did not go well. The new business was still fine at that time, but as the tech team fixed billing issues, we lost a lot of visibility into the new business data. One of the immediate big challenges was that there was less new business coming in and our cost of acquisition was increasing.

I worked closely with leadership, external consultants, and internal analytics teams to resolve this. Two major things came out of this effort: improving our overall data capabilities and tackling a problem in a very untraditional way. Fetch Pet Insurance is a much smaller company than Discovery, but we have stronger data capabilities. Even at the corporate level, we can see things very clearly. That was one piece. When it came to tackling the problem, we decided to try something completely different.

Our pricing and configuration used to be constant — if you asked for a quote, it would give you a $15,000 limit, $300 deductible, and 80 percent copay. We said, “What if we made it dynamic based on the pet’s age, breed, and location? This strategy might reduce the quote users saw for the first time.” But, we were worried that this approach might increase new business but reduce premiums, thereby decreasing revenue.

We decided to put all the data aside and think about it from a consumer perspective. If the price is lower, the odds of someone engaging with the quote is going to be higher. So, we implemented a very rudimentary technology using Excel. If it fits X criteria, show this configuration, and if it fits Y criteria, show a different one. These were the 200 configurations in total. Ultimately, we saw a 10 or 15 percent increase in conversion with this approach.

Yes, I work on helping increase new business, increase retention, and lately, I’ve also worked with the financial planning and analysis (FP&A) function. I’ve taken over the forecasting function as part of my strategic role to improve profitability per customer and lifetime value (LTV) calculations.

For example, we can tell the LTV to CAC ratio for any channel in any state. This tells us how much we spend per lead in each channel, and we have eight of them. If we have an in-person agent at a shelter or a breeder partnership, for example, we can tell exactly how much we can afford to pay this person and their expected longevity with us. It’s almost automated. A revenue team can look at it and know exactly what they can spend. That’s a key initiative I’m working on at Fetch.

As an insurance company, we focus a lot on our profitability. We care about new business and our policies in place, which equate to things like subscribers and churn. We talk about the cost of acquisition and return premium, and that pretty much gives us our revenue. That feeds into expenses, EBITDA, and cash flow numbers, which we want to maintain.

However, within each of these, we go very deep, very fast. We can tell the exact terms of the churn — is it a 90-day churn? Is it for a cat or a dog? Is it for a customer acquired from an in-person agent or through a digital channel? And within that is what we call pet debt, which is when we cannot retain a customer for whatever reason. Maybe they moved out of the US or they just decided to not continue using us anymore. We go deep very fast to figure out where issues are and where we can make improvements.

It depends upon the type of decision. For example, we had the idea to make our pricing dynamic instead of constant. We noticed that the biggest reason people churn is because they found the insurance policy too expensive. Within that, the cohort that churns the most is the one that doesn’t use the policy because they think it’s not giving them enough value. This showed me that churn is not a price issue, but a perceived value issue.

I presented data that by adding some additional non-insurance features or educating customers on health issues their pet may develop based on their breed, the perceived value would increase. Pet owners don’t want to be without insurance if their pet becomes ill. Educating pet owners should help increase perceived value and reduce churn, as well.

We also do a robust cost-benefit analysis for each initiative. My team is responsible for helping with estimating the benefit of each project and tracking it through. I regularly work with the leadership team to help them make better decisions and help the operational team be more effective.

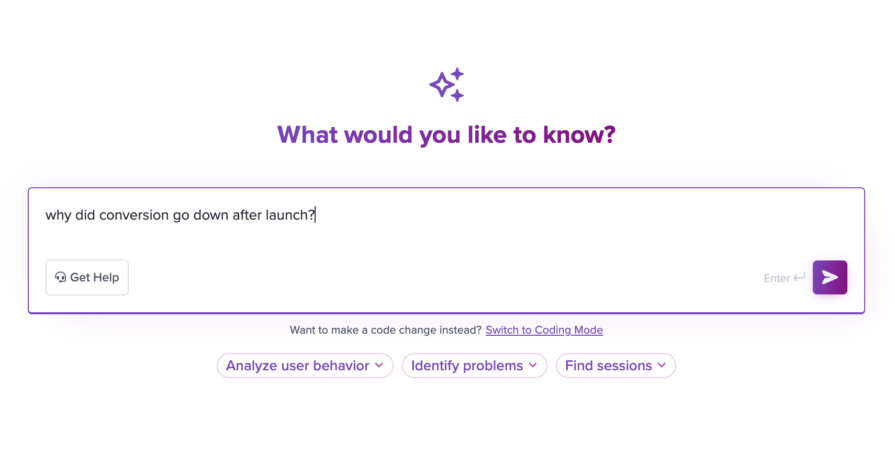

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.