There are numerous crucial metrics that product teams and business owners must track and comprehend. These crucial measures can assist you in staying on course as you expand and scale your business, from net profit margin to sales revenue and customer retention.

It’s risky to not measure these metrics because it could create some surprises down the line as you grow.

Customer lifetime value, or CLV, is one of these crucial indicators and you should pay close attention to it. CLV outlines the typical customer experience you may anticipate throughout the life of your business relationship.

Customer lifetime value is the total amount of money a customer is anticipated to spend on your products, and with your company in general, throughout an average business relationship. Knowing this number is crucial because it informs your choices on how much money to spend attracting new customers and keeping existing ones.

You can analyze and evaluate current customer loyalty using customer lifetime value. It’s usually a sign that you’re operating your company properly if customers keep coming back for more products or services. Furthermore, the higher the lifetime value, the less you need to spend on acquisition costs.

Consider the following examples to better understand what CLV is.

If a vehicle owner is satisfied with their choice of car and decides to buy more over time, their CLV might reach as high as $100,000. Alternatively, a daily coffee drinker’s CLV may be significantly greater than that, depending on how many cups they consume each day and where they get it from.

In contrast, someone who purchases a home twice in their lifetime might only be worth, say, $15,000 to a real estate agent. This is because, despite the high purchase price, the agent’s commission is only a small portion of the whole sum.

Customer lifetime value, in the larger picture, is a measure of the revenue connected to a certain customer connection. This should direct how much you are willing to spend to keep that relationship. In other words, if you think a customer’s CLV is $500, you wouldn’t spend more than that to maintain the relationship. Simply said, you couldn’t make money off of it.

Knowing your CLV well might help you develop a business or product plan that focuses on retaining existing customers, rather than spending money on attracting new ones. Of course, attracting both new and existing customers is crucial for business development in general.

Making business decisions is one of the key benefits of calculating the CLV for various customers. Knowing your CLV allows you to, among other things, determine:

Together, these choices can greatly increase your product’s profitability. Knowing the figure alone is insufficient, just like with any other business metric. Your complete business or product plan must be shaped using your CLV.

If your customer lifetime value is increasing, you might want to keep funding your customer success teams or product development. Your most recent marketing campaign may need a refresh if your CLV is dropping. Knowing CLV can help you drastically lower your customer acquisition expenses over time, which is one of its key advantages.

CAC is an acronym for customer acquisition cost. As the name suggests, it’s the expense of converting a prospect or potential consumer to a real customer. Customer lifetime value (CLV) and customer acquisition cost (CAC) are two different but equally important metrics.

Naturally, you want your CAC and CLV to have an inverse relationship, with your CLV being higher than your CAC. The more profit you stand to gain, the less it takes you to acquire a single consumer and the more overall value that customer represents.

However, a more fruitful approach is to establish the two figures, utilize them as a baseline, and then work to push them apart over time. This is preferable to looking for a clear discrepancy right away. If you let that margin go too thin, you can have serious stability problems.

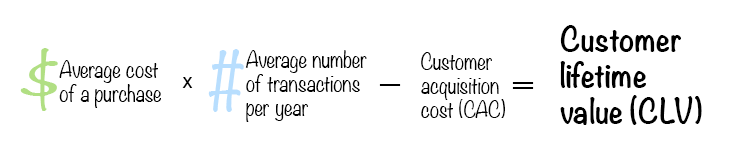

Calculating one person’s customer lifetime value is not that difficult. The easiest way to determine a unique customer’s CLV is:

The average cost of a purchase multiplied by the average number of times a consumer makes a transaction per year (in years), minus CAC.

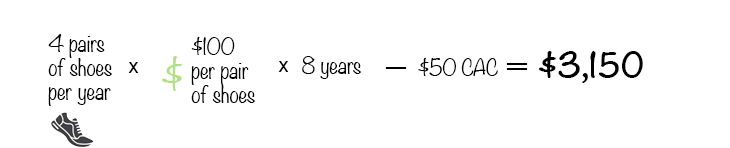

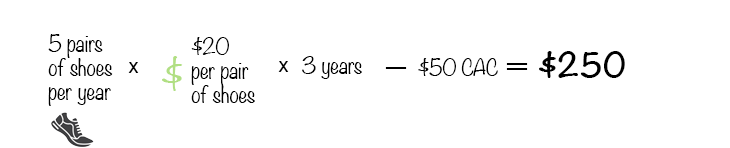

Let’s go through some examples assuming that you own a shoe store.

Let’s calculate the CLV of a marathon runner who frequently purchases footwear from your store. They buy four pairs of shoes per year at $100 each for eight years. Multiplied together, the total is $3,200. Subtracting a $50 CAC comes to a CLV of $3,150:

Now say you have a customer that’s the mother to a toddler. They buy five pairs of shoes per year for their toddler at $20 a pair. They do this for three years and the CAC is $50. Their CLV is therefore $250:

So, whom should you pay closer attention to? Based on the CLV calculations, you should concentrate on the marathon runner!

Product managers and every leader in a position of authority need to understand how to calculate customer lifetime value. CEOs in particular need to know it more than anyone. You may get a clear and current view of the state of your business by knowing how much revenue you can anticipate from an existing customer.

For instance, you might increase your customer service and retention spending if you observe a decline in your CLV over two consecutive quarters. Customer happiness plays a significant impact, even if it’s not the only factor that influences customer lifetime value.

CLV will probably decrease if there’s a variation in service quality between a customer’s first and third purchases.

The chances of selling to a new customer are quite low; the secret is to focus your resources on increasing sales to your current customers. Most of the time, selling to current customers is far simpler than investing in gaining new ones.

Here are some strategies that will make it more likely for a consumer to make additional purchases from you.

First, make returning things that customers have purchased from you simple. Making it difficult or expensive will drastically lower the likelihood that they will make another purchase.

Next, make thoughtful exceptions for your most devoted customers. Give someone the choice to continue using your subscription service while receiving a little discount, for instance, if they are considering quitting it.

Additionally, to learn why they keep buying from you, speak with and interview your top customers.

It’s also a good idea to set expectations for delivery dates with the goal of underpromising and exceeding expectations. Promise delivery by 5 August and deliver it by 25 July, rather than the other way around.

Incentives are important. Create a rewards program with incentives that are both attainable and desired to drive repeat purchases.

You could also use upsells, the equivalent of asking McDonald’s if you’d like fries with that, to raise the average value of a customer transaction.

Finally, maintain contact. Long-term customers want assurances that you are still thinking of them. Give them a simple way to contact you as well.

Next, let’s go over some tools for keeping track of CLV and improving it over time.

Billsby offers dashboards, tools, and the opportunity to segment data that can rapidly calculate CLV. It also provides CRM and e-commerce platforms that can track all the information multichannel enterprises need to compute CLV and comprehend how it varies over time.

These technologies are all a part of a single platform that provides a single information source for the entire organization without requiring integrations from other parties.

Let Baremetrics track and compute your customer CLV after connecting your payment processor. By monitoring the lifetime value of your customers in real-time, you can make better business decisions.

Integrations with one click! Battle churn MRR, LTV, ARR, and other metrics.

With an app like Smile, you can set up a program that gives your customers access to exclusive perks and discounts, referral and VIP programs, and other fun ways to engage with your brand when they login to your store.

Understanding CLV enables you to make decisions based on how long a typical customer stays with you and how much money they spend during that relationship.

This metric can help you make decisions about how to improve the quality of your goods and services, as well as how to attract and keep customers.

By utilizing CLV to guide your business and product strategy, you’ll eventually create a more lucrative, successful company by concentrating on luring in new customers and keeping long-term customers. Eventually, satisfied long-term customers may serve as both brand ambassadors and repeat customers.

Featured image source: IconScout

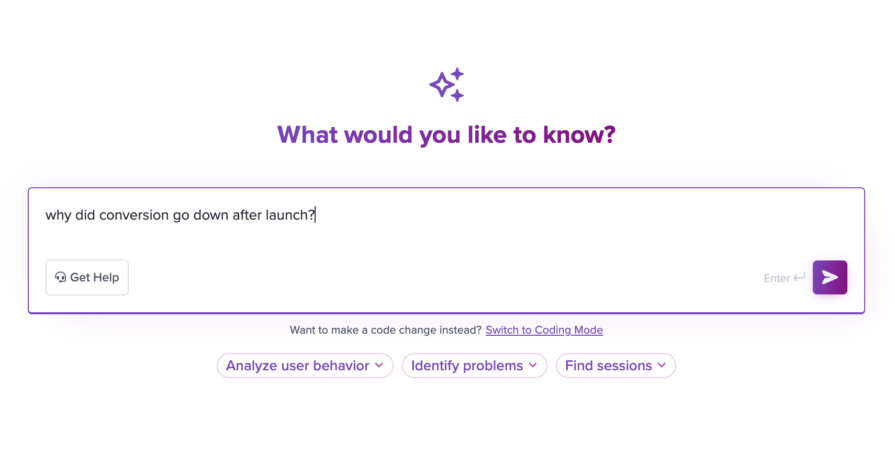

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.