Revenue is a crucial aspect of every product development process. A robust revenue trajectory allows you to fund further product development and secure the desired profit for your business.

However, not all revenue is created equal. Distinguishing between different sources of revenue — namely, new and recurring revenue — is vital for deriving essential insights and fine-tuning your projections.

Broadly speaking, there are two types of revenue: new and recurring.

New revenue comes into play when a user transacts with you for the very first time. If your business operates on a subscription model, new revenue refers to a given user’s first subscription purchase. In transactional monetization models, it’s the first transaction made by a particular user.

The exact definition can vary slightly depending on the business model. For instance, if you run a marketplace and a user makes three distinct transactions for the first time on the same day, you might count all of them as new revenue, considering it’s the user’s first day of transacting.

Recurring revenue occurs when a user who has previously transacted with you does so again. This could be through subscription renewal, plan upgrade, or purchasing another product from your e-commerce business.

You might think money is just money, right? Not quite.

Differentiating between new and recurring revenue is critical for several reasons. Among other things, it helps you:

Let’s say you have plenty of new revenue but lack recurring revenue. This indicates that your acquisition and activation channels are performing well — you’ve likely nailed your value communication — yet, you’re falling short in delivering promised value and retaining paying users.

Conversely, if most of your income comes from recurring revenue, your acquisition efforts are lagging behind. This could have severe consequences in the future as users inevitably start churning at some point.

These insights aren’t evident when looking at total revenue alone.

By understanding the state of your revenues, you can tailor your strategies accordingly. Each monetization strategy involves a trade-off between new and recurring revenues.

For instance, annual plans tend to retain better (resulting in more recurring revenue), but convincing users to make such long-term commitments can be challenging (leading to less new revenue).

Adopting a freemium model can boost sales by widening your acquisition funnel (more new income), but the incentive to stay premium may decrease (less recurring income).

By identifying which type of income you’re lacking, you’ll be able to make more informed strategic decisions about how your monetization approach should function.

Knowing where improvements are needed allows for better prioritization of optimizations.

Suppose you have two ideas:

Although standard estimates suggest that creating a new offer page would be more beneficial, if capturing new income is proving difficult, introducing a fresh conversion flow might align better with long-term objectives.

The primary reason why new income is crucial is that it eventually leads to recurring income. The more new income you generate today will translate into more recurring income tomorrow.

This factor is critical since customers don’t stick around forever. They churn over time due to various reasons; consequently, so does your recurring income.

Think of generating new income as adding fuel to keep a fire burning. While, initially, you may be able to enjoy the warmth from the campfire, eventually, it will burn out if you don’t periodically add fuel.

The primary issue with new revenue is that customer acquisition costs tend to increase over time, which in turn raises the cost of generating that revenue.

There are two main reasons for this:

When you’re a newcomer in the market, you primarily attract early adopters who are relatively easy to persuade. However, at some point, this pool of users will diminish.

To continue growing, you’ll need to attract the early and late majority, as well as laggards. This necessitates doubling down on your acquisition efforts (and, therefore, costs) to keep attracting new users.

If your business is fairly successful, it’s reasonable to expect numerous imitators to enter the market. Consequently, acquiring new customers becomes more challenging and expensive.

For instance, advertising on Google is cheaper if you’re the only one bidding for a specific keyword.

Because recurring revenue doesn’t involve new acquisition costs, it’s cheaper and offers higher margins than new revenue.

Enough with the theory. Let’s examine two examples of how analyzing the split between these types of revenues can inform your strategy and aid in making better decisions.

We’ll use a straightforward analysis method — a stacked bar chart — to illustrate the importance of distinguishing between types of revenue.

Let’s say you’re examining your projected revenues (the exact type of product is more or less irrelevant here).

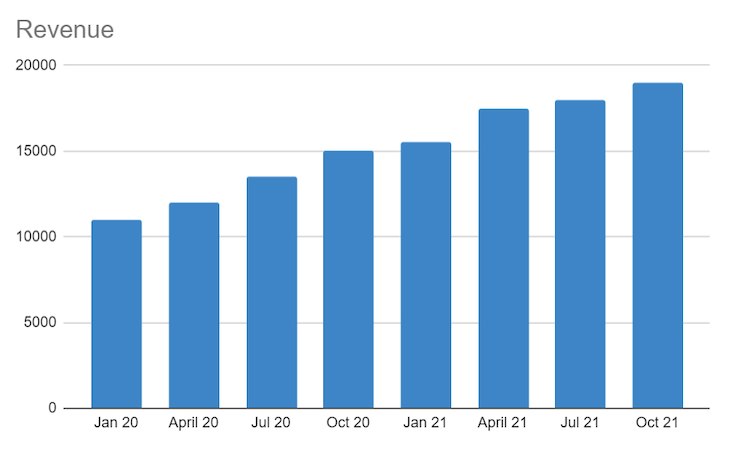

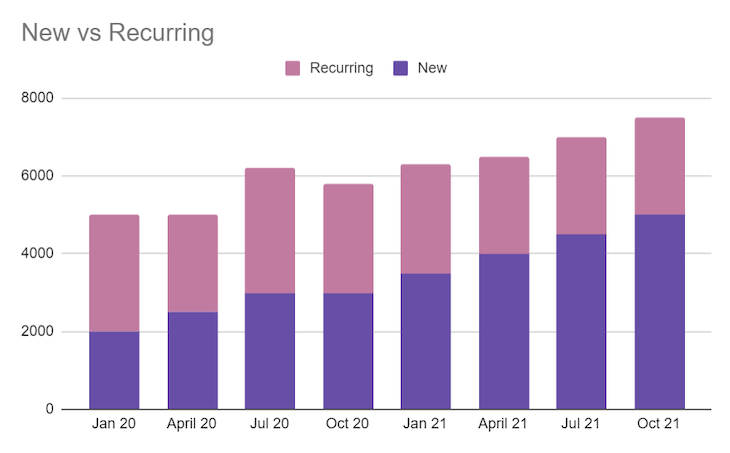

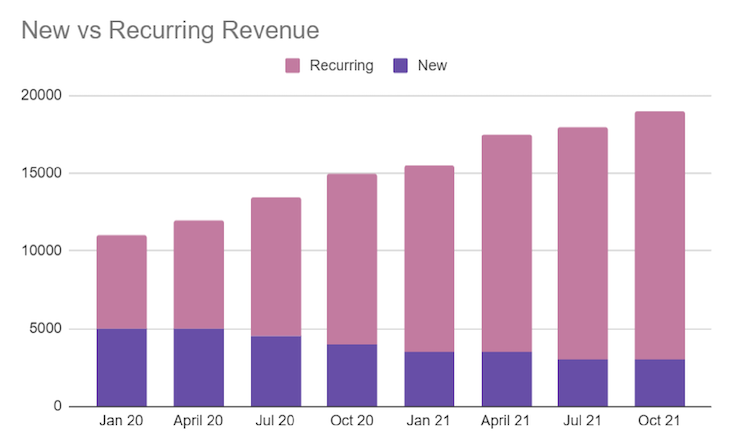

You’ve visualized data from the last eight quarters on a bar chart:

At first glance, things look quite promising. Your revenues are growing by an average of 20 percent quarter over quarter.

However, if you stop here, you might overlook valuable insights. Let’s analyze how much revenue came from brand-new versus recurring users:

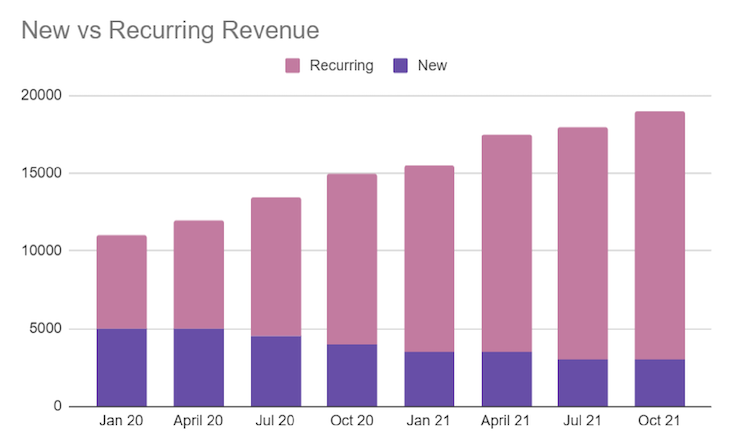

This chart paints an entirely different picture.

Even though your total revenue is growing, most of it comes from recurring sources. These are benefits accrued from past sales.

However, new sales are declining. This is a concerning signal. Even if you’re meeting your current revenue targets, low new sales in 2021 will lead to reduced recurring revenues in 2022 and beyond. In most cases, this trajectory already predicts future declines in revenue.

Gaining this insight early allows you to shift your focus towards new sales before any decrease in revenue becomes apparent.

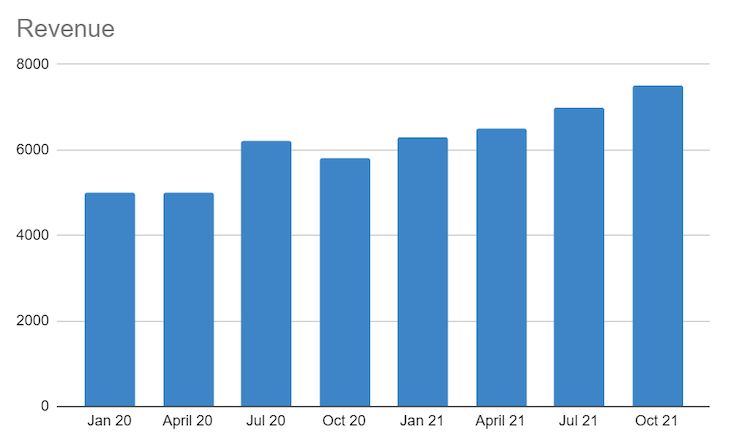

Again, you create a bar chart to analyze your growth trajectory and it looks promising:

But let’s take a closer look at what’s happening beneath the surface:

Here, we’ve identified another valuable insight: most of your growth in revenue comes from new sales. Even though there’s improvement overall, retaining that income over time seems problematic.

As previously mentioned, the cost of acquiring new income will rise over time, thereby reducing your margins. Solely relying on new income is a short-term strategy at best.

It also suggests that there might be an issue with delivering value if users don’t want to transact with you again after their initial purchase. It would be worthwhile investigating what’s going on here further.

Of course, this split also depends on context. Low recurring income is expected behavior if you’re developing a product used sporadically — for example, a website for purchasing apartments. Even so, it would be beneficial to investigate why some users return and see if there are any strategies available to maximize recurring income.

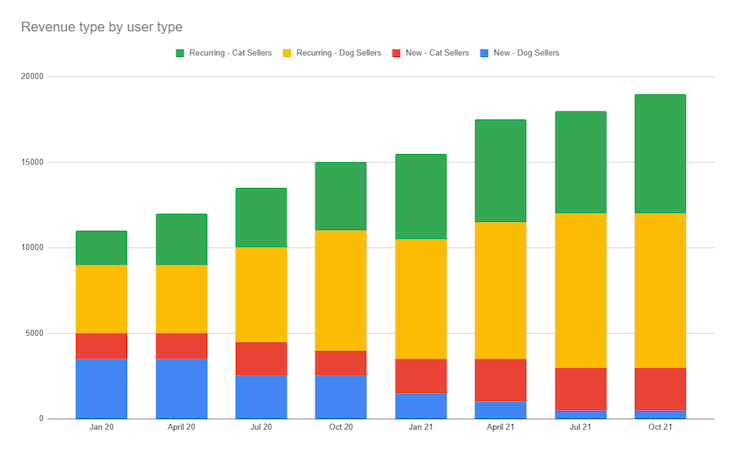

As with any analysis, segmentation is crucial to uncover more valuable insights.

Let’s revisit the first example:

Consider whether there’s a logical way to further segment this chart.

Suppose you run a pet marketplace specializing in selling dogs and cats, and you generate revenue from commissions charged to sellers. In this case, it would make sense to separately analyze revenues from cat and dog sellers:

Now we can clearly see that:

These insights are considerably more actionable than just a high-level split. We can draw various action points based on these findings:

While the chart itself won’t dictate your next steps precisely, it does clarify where you should concentrate your discovery efforts.

As we’ve seen, not all revenue is created equal. New revenue helps boost your long-term income but comes with additional acquisition-related costs.

On the flip side, recurring revenue is cheaper (thus offering higher profitability), but as users churn over time, so does this type of income.

Ideally, you should aim to grow both new and recurring revenues simultaneously to maintain a healthy long-term trajectory.

Use the split between new and recurring revenues in your analysis to gain high-level insights into potential areas of deficiency. Segment it by various use cases to yield more insights that can inform your strategy and roadmap as you optimize your mix of revenues.

Unsegmented, general revenue figures only tell part of the story.

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Maryam Ashoori, VP of Product and Engineering at IBM’s Watsonx platform, talks about the messy reality of enterprise AI deployment.

A product manager’s guide to deciding when automation is enough, when AI adds value, and how to make the tradeoffs intentionally.

How AI reshaped product management in 2025 and what PMs must rethink in 2026 to stay effective in a rapidly changing product landscape.

Deepika Manglani, VP of Product at the LA Times, talks about how she’s bringing the 140-year-old institution into the future.