I’m often brought in to fix a leaky user activation funnel. The brief usually goes something like this: “Please help us improve our new user activation rate. Out of all the users who sign up, only 10 percent become active, habitual users of the product.”

You’ve probably dealt with this scenario yourself. And as a well-educated, “data informed” PM, you dig into the data, build detailed onboarding funnels to figure out where users drop off, determine your “aha” and “habit” moments, and build a nice signup → setup → aha → habit funnel.

At this point, you can see exactly how many users are dropping off at each stage and drill down to see who’s dropping off. Then, you go ahead and run some A/B tests.

You modify the setup wizard, you tweak the copy, and maybe strategically place a testimonial, hoping to nudge the activation rate up by a few percentage points. But after a while, you inevitably have to raise your hand and ask the awkward questions: Who is this for? What does value actually mean to them? Why should this product exist at all in a crowded market?

Because if you can’t answer those questions, all the data driven optimization work and A/B testing is just lipstick on a pig.

The reality is that you can’t build an innovative product by relying on quantitative data alone. Successful products merge the quantitative with the qualitative. To help you get started, this article unpacks how you can do just that and covers how things have shifted in the new AI world.

Quantitative data is a microscope. It gives you a precise, almost scientific view of what users are doing inside your product:

But you can’t discover a new galaxy by looking at a petri dish.

Think of qualitative data like a telescope. You can use it to look up and out, towards “the stars:”

All of this lives outside your product, and for innovation, it’s infinitely more interesting than what happens inside. Qualitative data is imprecise, but it lets you see the forest, not just the trees. This is the key to building something that matters.

There used to be a clean-cut distinction in the startup world: pre-product-market fit was about innovation and finding what clicks. Post-PMF was about growth and optimization.

This distinction is hopelessly oversimplified. I’ve always hated it, but today it’s more wrong than ever as AI has changed the rules around PMF.

For anyone who hasn’t read it yet, I highly recommend Brian Balfour’s essay on product market fit collapse. To explain the change more clearly, let’s take a look at the pre-AI era and how things have evolved.

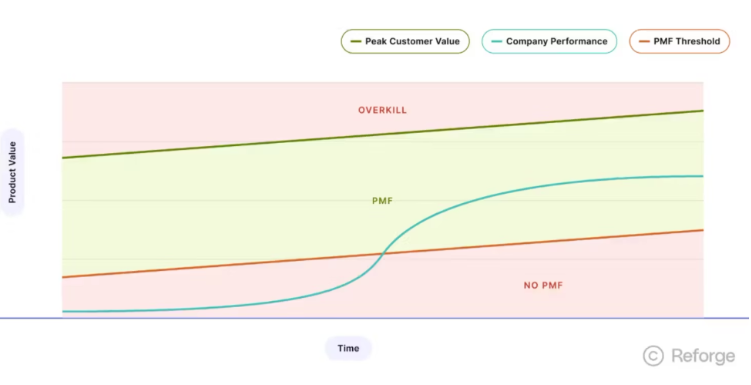

Look at the “PMF threshold” line at the bottom. This line corresponds to user expectations. Before the AI era, this threshold rose in a relatively linear, predictable way. Imagine the blue line (“company performance”) as a startup, struggling to find PMF.

In the middle of the chart the startup meets the expectations of its target audience — something “clicks” — and it achieves PMF. Now it’s comfortably in the green zone, where it can stay as long as it keeps us with those linearly rising user expectations.

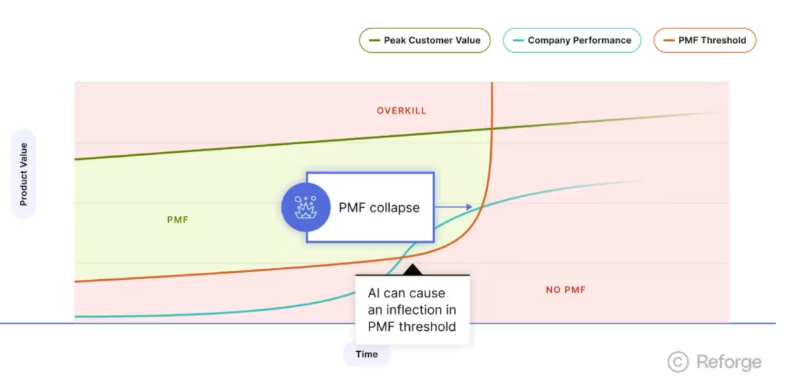

But in the AI era, the PMF threshold no longer rises. It can jump exponentially, almost overnight.

Groundbreaking tools pop up out of nowhere, making the impossible possible. Users adapt instantly, and their expectations skyrocket.

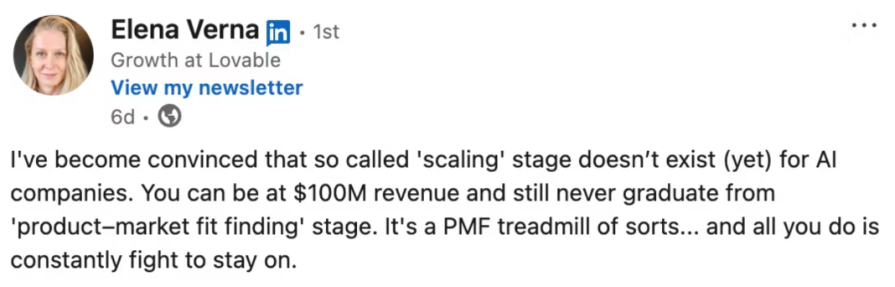

The result is what Balfour calls PMF collapse. Your product might’ve been essential yesterday, but today it’s obsolete because a new AI-native tool just solved your customer’s core problem 10 times better, faster, or cheaper. Take the following LinkedIn post:

Considering the fact that Elena is handling growth for the $100M revenue AI company (Lovable) this means a lot. I would argue that this isn’t just a problem for AI companies. It’s a problem for every company being disrupted by them (we’ve all seen Chegg, Stackoverlow, and even Adobe tumble).

We’re all on a PMF treadmill now. At this point, innovation isn’t optional — it’s a survival mechanism. And the only way to innovate is to use the telescope.

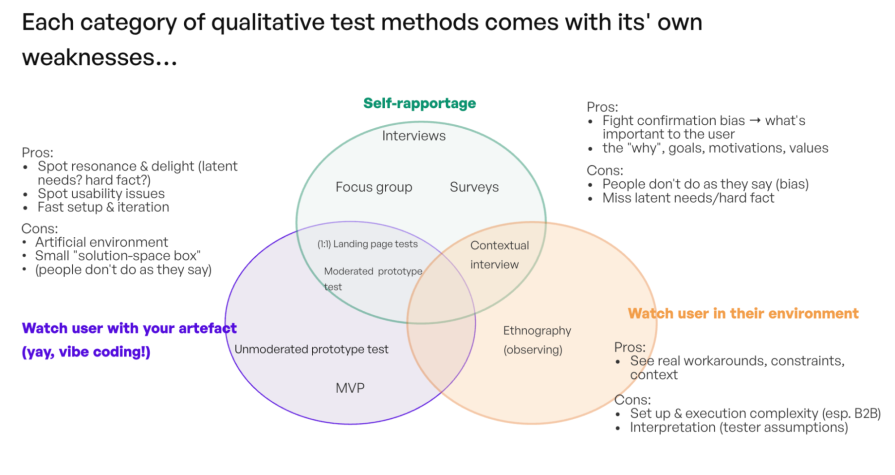

When I say “qualitative data,” most PMs think of customer interviews. But that’s just one tool in a much larger toolkit — and it’s often not the right tool for the riskiest assumption at hand.

You need to wield the full range of qualitative methods, each with its own strengths and weaknesses.

I bucket them into three main categories:

Each category comes with its own strengths and weaknesses:

Mastering the qualitative test toolkit, and knowing which method to use for which question, is more important now than ever.

Unfortunately, many PMs step into this with a hopelessly naive (or arrogant) view of how easy it’ll be to:

The bad news: Qualitative tests are difficult to get right, and very easy to get wrong. If I had a penny for every time a founder/PM stormed off in the exact wrong direction, feeling fully confident because “our users say so”…. I’d be a rich woman.

Remember, modern behavioral science and UX research are almost half a century old. It pays off to invest time and resources to learn from these well-established fields.

Optimization has its place. Using the microscope to fine-tune your onboarding funnel can yield important incremental gains.

But the innovations that’ll keep you on that PMF treadmill won’t be found in your funnel report. They’re out there in the imprecise outside world.

So, grab your telescopes, and figure out how to use them properly.

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

How AI reshaped product management in 2025 and what PMs must rethink in 2026 to stay effective in a rapidly changing product landscape.

Deepika Manglani, VP of Product at the LA Times, talks about how she’s bringing the 140-year-old institution into the future.

Burnout often starts with good intentions. How product managers can stop being the bottleneck and lead with focus.

Should PMs iterate or reinvent? Learn when small updates work, when bold change is needed, and how Slack and Adobe chose the right path.