Sanjay Modi is most recently former Managing Director, Product Management at Charles Schwab. He is an “engineer by training, passionate product person, and entrepreneur at heart,” and has worked in various industries, including cyber security, B2C and B2B digital platforms, and fintech. Before joining Charles Schwab, Sanjay worked in product and technical roles at DigiCert, Symantec, TechAspect Solutions, Centric Software, and Intergraph.

In our conversation, Sanjay discusses his role in leading a website security product portfolio through drastically changing customer needs, particularly during the rise of website encryption and security. He talks about the process of combining multiple layers of customer touchpoints into one unified customer relationship. Sanjay also shares the importance of making sure your customers come first during a merger and acquisition, and how their business cannot be disrupted because you’re going through organizational changes.

At Symantec, I led the Complete Website Security product portfolio for enterprise customers. Approximately 80 percent of the Fortune 500 companies were our company’s customers at the time. Our product enabled encryption on internet traffic, which was and still is a key requirement for exchanging any sensitive information over the network. It operates at a scale of billions of transactions per day. The product evolved from when there were few encryption-related needs, and that’s how our customer engagement started — they would come and get the products they needed and then move on and come back to us when they needed more. It was a transactional relationship.

Our product also had a considerable lifecycle. So you’d need to purchase it, configure it, and install it, and then there was a renewal aspect of it because these were digitally perishable products. There was a lot of friction here, and to know what they needed now and what they would need in the future, customers needed to do a lot of planning. When we looked at the overall customer journey, we saw there were many pain points. We figured out that we could simplify it with go-to-market, and the rest of it we could simplify with actual product changes.

In go-to-market, we freed up customers from thinking about and planning what they would need in the future. We offered them a subscription based on their current footprint, needs, and projected growth, but didn’t hold them to that number. They could come and get as many products as they need throughout the year without really going through another budget cycle, and then next year, the subscription tier will reset for what they have. We gave them a simple, self-serve subscription with an annual touchpoint with us from a purchasing point of view.

It always starts with customers and how they actually interact with you, how their needs evolve, and where they will go. When that product started, the needs of customers were limited. They were happy coming those few times a year and they were done with those transactions. But suddenly, internet growth skyrocketed. Even a normal company has hundreds of servers internally, and if you were selling your product and services on the internet, you would literally have hundreds of thousands of servers. We saw this big shift in customer needs.

We looked at these evolving needs and what we were doing to solve them. With our then-current model, we were holding back their deployments. There was a delay in rolling out their product, so we were kind of a bottleneck for them. We thought that this would be one thing that we can simplify. It’s all about the customer journey and identifying where they are now, where they may go, and trying to reshape your own business processes accordingly.

I think one thing was the growth that we were seeing and our ability to keep up with it. The second thing was our increasing customer touch points, which started telling us that things were changing in a way that we couldn’t support with the current model. We were seeing our product issuance and customer touchpoints increasing rapidly. They didn’t need to be, because we were not troubleshooting anything — we were just trying to provide them with the products that they needed. That’s what started indicating to us that there is an opportunity to solve.

Customers were coming to us for various security needs, not just for their internal and external websites, but for their applications — their server-to-server communication, email, digital signature, etc. And we started seeing that same account coming to us through different channels, interacting with different sales and customer success people to get different products. That was an opportunity for us to combine that interaction in one unified customer relationship.

Also, they were buying many products from us in different categories that there was no easy inventory tracking and visibility on their side. That was also an opportunity for us to provide them with a single pane of glass — they can see all the products they have from us, no matter which department they were purchased for. That’s where we started thinking about how we can wrap this into one single product and customer relationship. That’s where the idea of Complete Website Security and Application Security was born, and we rolled it out.

Internally, we had to work with a cross-functional team, starting from sales, marketing, and my product team, and customer success and support. We worked internally with all the teams for sales, educating them that they’re not selling a single solution, but a security portfolio with the benefit of having everything in one place. Marketing had to reposition the products because, again, they’re not selling 10 different products, but offering the security needed for an organization through one place. There were product-related changes because we had to bring these products together in a unified view, and once the product was sold to a customer, customer success came in to help them configure, deploy, and make it usable for them. Every department had a touch point here, and we were literally reinventing our whole business.

This was not a flip of a switch change. It took a couple of years to get this out. There could be a lot of points of opinions and desires to go one way or the other. We always looked at it from what is best for customers, and that’s because they’re the ones who are paying the bills. And if any suggestion would result in a better thing for the customer, then we would pull it into our product. If we chose not to, we’d transparently explain why we were not doing it. Sometimes, if you don’t provide enough details, the friction becomes unmanageable. We rolled this out over 2–3 years and then moved customers into this new model segment by segment.

Two key stakeholders are impacted by any business merger: the customer and the employees. You have to make sure that whatever the business or economic driver is behind the merger or acquisition, your customers come first. Their business cannot be disrupted because you’re trying to change your own business. We had to keep that in mind — our customers still trust us, and we hold them close in terms of the overall change process.

The second key stakeholder is employees. This is a big transition for them. Either they become part of the newly formed company or, unfortunately, sometimes part ways with the company that they were working for. Keeping your team engaged is very important, and we believed in having transparent, timely communication. That means telling the team that this is the best we can do for our customers at this time, and we need to really be doing that.

The last thing that comes to mind about that process is product rationalization, which is about keeping your product portfolio current and slowly end-of-life-ing products that you don’t want to continue. Of course, there’s a reason why the merger or acquisition is happening. And in product rationalization, both stakeholders are impacted. You have to discontinue some products and move customers to new products. Pride of ownership can come out in your teams, like, “Hey, I built this product. This is the best one.” But you need to think about what’s best for your customer, not your opinion about your product.

We had a multi-prong approach for that because each customer segment was different. We had Fortune 500, 100, and 50 customers all the way down to retail customers. We needed different communication channels: mass communication, tailored communication, and 1:1 communication.

When we started the operations of the merger, I got on a call with every one of our big customers and explained to them what was happening. I let them know that nothing is changing as far as their business needs are concerned, and we are there to support that. For the rest of our customers that we couldn’t reach out to directly or we couldn’t scale, we had email communication, website communication, and in-product communication to tell them what’s going on, the changes that are happening, how it benefits them, and steps they may have to take.

These days, nearly every company is digital. Most of your customer base is acquiring your product through digital channels, and you are serving them digitally through those channels. I was brought into Schwab to provide consistent online security across the platforms that their clients were using. Security is key and is the number one contributor to customer trust.

Having a consistent experience in security is paramount, because no matter which channel you’re interacting with in that company, if you as a customer have confidence that on the other side it’s the same trusted entity, that goes a long way. You cannot have a different experience every time. That was key for me to bring in. There were so many platforms and experiences that we needed to bring together to make it all consistent. That way, no matter where the customer comes in, their first impression in terms of authentication and going through the application journey is exactly the same no matter where they start.

I’m fortunate to have all these different experiences spanning different industries and roles. Particularly in cybersecurity, even if you’re a product person, you’re playing a key role as a trusted advisor for your customers because security is an area where not everybody’s an expert. More than a product, they’re buying your advice. You need to tell them what is and isn’t working and be very transparent with them.

In B2B and B2C products, your interaction with customers is slightly different. In B2B, you get specific 1:1 feedback, and you have to aggregate it to develop your product. Otherwise, your product will go in 10 different directions. In B2C, you get aggregate feedback from your large customer base, and then you have to figure out a specific point where you can make the change to solve that.

In fintech, it’s a different world. Apart from your customers and your team members, there are a couple of other key stakeholders: regulators and the other fintechs in that ecosystem. Because today, people just don’t go to one place with their money management. They go to PayPal, Venmo, Mint, TurboTax, etc. If you are part of that ecosystem, you need to make sure that you are really interoperating well with those.

I am an entrepreneur at heart. This is my third startup, and if I count my business ventures when I was still at school, this would be my fourth or fifth. So if I get a chance, I’ll come back to doing something of my own again. My startup name is Saralam, a Sanskrit word for simple. The mission is to simplify digital interaction for enterprises and consumers using generative AI. Last year, we saw a big change in how AI is accessible to everybody and what it can do. We are taking that further and simplifying many complex digital tasks that you and I as individuals, as well as enterprises, have. We are using AI to execute complex digital workflows.

We have built software over the last 60 or so years, and it was built thinking that primarily humans would use it. Now, we have another tool to help us out. So how can we simplify that? We are starting with using AI to build better-quality software. Today, software test development and testing happen manually through engineers or QA testers. We are using Saralam’s custom trained AI models and a vast catalog of test cases to develop test cases for software, run those test cases, and maintain those as the software application evolves. This approach provides speed, better test coverage, and cost efficiency compared to today’s processes being used for software testing.

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Learn how to spot PMF erosion early, diagnose the cause, and help your product recover before decline turns into panic.

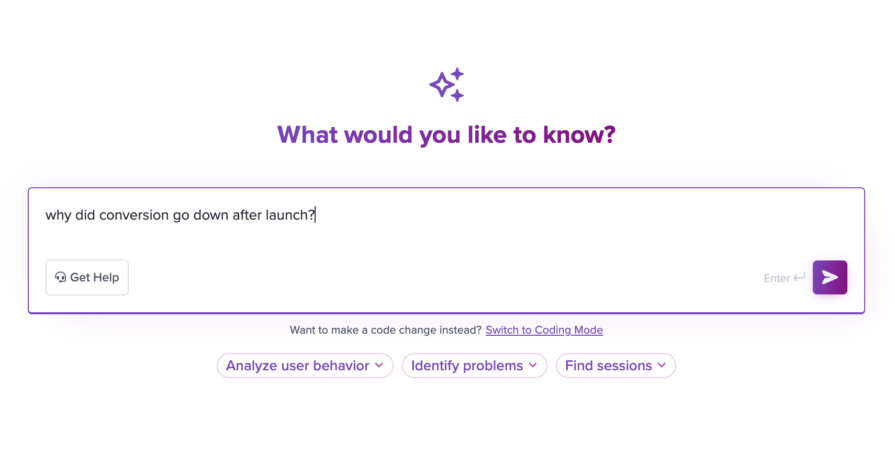

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

One Reply to "Leader Spotlight: Staying ahead of changing customer needs, with Sanjay Modi"

hello