Luc Lam is VP of Innovation and Consumer Insights at Behr Paint Company. He began his career in industrial design and worked at Fiskars and Beyond Design before joining the market research and innovation team at LG Electronics. From there, Luc founded two companies — Design Ocean, a product development agency, and Good Yei, a virtual reality marketing and user research startup. Before his current role at Behr, he served in various innovation, UX research, product management, and leadership roles at BSH Home Appliances Corporation – North America.

In our conversation, Luc talks about what innovation looks like in words versus in execution within teams, as well as how to manage stakeholder expectations for each one. He discusses his team’s emphasis on inclusivity in research practices, and talks about the importance of having everyone participate in field research.

I joined Fiskars fresh out of college, and that was my first time encountering consumer research. I was able to see the impact of understanding not just the type of solution we want to shape, but whether we’re solving for the right problem. That’s the heart of innovation itself — the ability to influence a larger audience by having more insights into the consumer’s real needs.

When starting out in any innovation-related area, we all aspire to be a great inventor. For example, we see the amazing talent that helped build companies like Apple. The reality is that we’re not being paid to invent something, we’re being paid for a deliverable. This could be something like a CAD file, for example, and by the time the designer touches the project, it’s often too late to convince leadership to commit to a significant change from what was originally envisioned.

We have to consider what flight level we’re tackling. With any project or scope, are we looking at it from a strategic, operational, or tactical standpoint? Or are we hands-on? The best frameworks all revolve around the idea of some kind of business canvas.

All business canvases, no matter who’s creating them, typically cover a golden trinity of desirability, viability, and feasibility. It’s important to ask questions like: are we creating value for the end user? Are we satisfying a practical business need? And will this thing actually sell? The feasibility aspect comes in to evaluate whether this thing can actually be made. Can it be done so efficiently? And can it be made reliably within the cost parameters of the project?

My feeling is that innovation as a term has become a bit trendy. This is partly due to the influence of UX, but for the past few years, theories have been driving the ship for people’s expectations around innovation.

The core of keeping any theoretical approach in check always ties back to empathy. As we deal with people from different disciplines and with varying levels of responsibility, we have to be able to wear their hats and communicate in a language that’s familiar to them. Once we have that, we can start to empathize — identifying root problems and looking at things from their point of view around what’s important to them in the project.

At the same time, it’s important to acknowledge when something feels a little bit too theoretical. Acknowledge the differences between “bread and butter” projects that we’ll still need to maintain, especially in a mature market, compared to those that are more greenfield. The reality is that we’ll always need a mixed portfolio. Not all innovations can be big breakthroughs, nor should they be. Each project needs to be tackled in its own way while also addressing the needs and experiences that different team members and stakeholders each bring to the equation.

Often, there are multiple journeys to consider. When we think about the entire value chain, there are merchants and other customers in the equation as well. These are practical realities that, unfortunately, often act as barriers to end users reaping the solution we’re trying to pitch to them.

In terms of leveraging insights from the UX team, the consumer value proposition is one of the most important pieces of the business model canvas. A good practice is to map that out and, practicing transparency, make stakeholders aware that there are other important considerations. Then, as we communicate the other project goals, we have some objective criteria to share as well. That’s the power of being able to bring consumer research, as well as research and validation models, to the project.

Anything around innovation involves ambiguity and complexity against an established mental model. People have good reasons for thinking in specific ways. And at Behr, we cultivate a very strong culture of transparency. That’s been key to our success.

We also promote two specific tenets — the first is inclusivity in our research practices. Our goal is to literally bring people along on the journey. This means that they’re not just receiving an end report sometime down the line — they can be there on the spot, see the information that comes in, and, most importantly, have the subject matter expert or advocate interpret this information for them.

For example, someone might say, “The consumer said X.” Then, somebody with a research background could advocate for the consumer and say, “Well, you heard them say X, but in reality, it’s not exactly what they mean. They’re saying X because it’s obvious in this context, but it doesn’t mean that that’s the real problem.”

The second tenet is acknowledging any problems in our projects. Transparency should be complemented with the fail-fast model. The goal is to celebrate when something doesn’t work well — when there’s a high risk we should be able to pivot quickly from our original goals.

Yes. I have an example from the kitchen appliance industry — a vertical where products have different affordances. There’s a lot of passion that comes with cooking and, as a result, some people have a lot of passion for high-quality applications. That’s been very clear.

But, this doesn’t apply to all types of appliances. For instance, refrigerators are generally a passive product. We’d be comparing apples to oranges if we used one paradigm to compare every type of kitchen appliance. We had some research where the consumer kept showing us the importance of refrigerators being easy to clean. One of the stakeholders said, “So, based on this feedback, we should focus on making our refrigerators easy to clean.”

I challenged that person and said, “Well, the reason they’re talking about cleaning is because you asked them to perform a cleaning-related task. They’re in front of the refrigerator trying to clean it, so of course they’re going to mention the ease of that task as being important to them at this moment, but that’s not the reason they would buy it.”

Cleaning is a very experience-specific problem for that type of product. In reality, the design and feeling of capacity of the fridge is what matters most to consumers. But, these considerations are much more intrinsic, meaning consumers can’t express them as easily. We have to deduce it based on the way that they communicate and the way that we see them interact with the product in the context of their lifestyle.

One of the ways that I tackle this is to ensure that we have a process for asking the right questions at the right time. We should never work so theoretically that a project fails to address two key questions: “Would the consumer really buy this?” and “What’s the deal killer for the proposed solution?” When I say deal killer, I’m referring to a specific thing that acts as a barrier to purchase. Oftentimes this barrier is related to trust.

In a theoretical world, a consumer might accept a solution because it solves their problem, but there’s a trust factor to it. Is the product something that they would directly expect to solve their problem, or are they asking for something else? Lots of products and projects try to act like a Swiss Army knife — solving all problems for all people. In reality, this approach doesn’t meet consumer expectations most of the time.

We conduct various forms of consumer and market research to get feedback on things like the colors we offer. Color is big in our world. We have a broad team that works to understand the intricacies of trends — both where consumers are going and where the industry is headed. Our goal is always to marry those two things.

The consumer is moving through time. As they move, they are affected by what we call PEST (political, economic, social, and technology) trends. One of the easiest ways to conceptualize this internally is to take those trends and draw analogies. I can give you an example from my startup days — we were looking at the VR industry. The key problem wasn’t whether the VR experience was amazing or not, it was whether the average person understood that it is incredibly different from just experiencing something in 3D.

We ended up drawing an analogy to the greeting card industry so that consumers could understand us better. Greeting cards are inviting, have broad appeal, and their messages are easy to absorb. To leverage this analogy, I made an industry-first, single-step pop-up card. It was a virtual reality viewer that people could use to get a bite-sized, contextual view of virtual reality.

There are two aspects to this: the project and the company. In terms of the project, just like in the software industry, we have to acknowledge the difference between our MVP and our scaler. We need clear, tangible goals, while also beating the point of validation to death. When we iterate from X to Y, the goals are always going to change. Though, through this iteration, we can’t lose sight of the core things we’re trying to accomplish.

I recommend using something like a charter so everyone understands the project goals and can consistently reflect on them while moving through sprints. Then, if the goals change, have good transparency about that, and don’t be afraid to pivot.

This is partly tied to consumer insights and validation. At its core, the MVP solves the prioritization of needs that we originally set up. We have to make sure that it’s not solving a problem that often creeps up but that the consumer doesn’t care about. By understanding our consumers well enough to establish that prioritization, we know that whatever we do from a solution standpoint is going to be honest to the consumer’s needs.

Around that is the practicality side. To what degree can we solve the consumer’s problem, knowing that if we set this line in the sand for the MVP, anything above that point is like a cherry on top?

For me, it’s the frontier spirit. In an innovation space, we’re always dealing with ambiguity and contradiction. This is vastly different from traditional product development. For example, in a case where we have structured data, we fully know what our inputs are. This is something that a market research survey can solve — the consumer can literally tell us because they have familiarity with it.

In the case of innovation, when we’re working on the frontier, we’re creating value that didn’t exist before. We can create something truly new to the world. Anyone can do this, even if they’re at the beginning of their career or toward the end. I find that amazing.

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

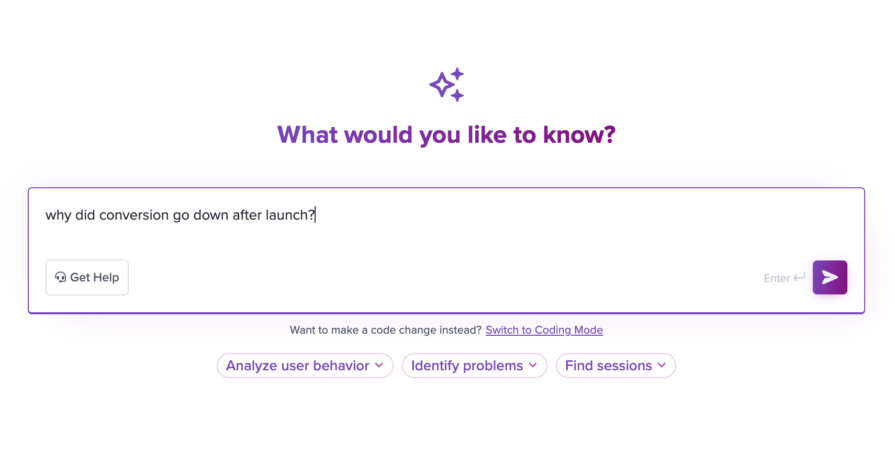

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.