Donna Foti is Director, Consumer Insights & Analytics at KIND Snacks, a snack food company based in New York City. She began her career as a strategic planner in advertising, and progressed to consumer insights roles at top CPG companies including Pfizer, Unilever, Pinnacle Foods, Heineken, and Diageo. Donna also started and ran her own consumer insights consulting business, with clients such as Zoetis, Citibank, and KIND Snacks, before joining KIND Snacks to head up its consumer insights department.

In our conversation, Donna talks about her best practices for communicating data, including using the “granny test” and a storytelling narrative, as well as leveraging designs and visual assets. She discusses the qualitative and quantitative methods her team finds most helpful, including ethnographic research like shop-alongs. Donna also shares how she uses marketing mix modeling to surface critical insights.

I believe that there are four elements of any good data-driven story:

Yes. It’s kind of like in the movie The Wizard of Oz where the wizard is just a person behind the curtain. Behind our version of the curtain, my team and I are analyzing extensive amounts of data — sometimes up to 50 pages — to identify the pieces relevant to the story. When I talk about that granny test, that’s the snippet that usually acts as the headlines of the charts or visuals.

Yes. Sometimes, when we’ve discussed plans for innovation research, renovation research, and market research with internal teams, it’s difficult for them to grasp the plans and processes. However, when we presented them with more visuals in one-page executive summary formats, they were able to understand these points better, especially from a holistic point of view.

The average attention span today is only eight seconds, which is less than that of a goldfish. I’ve found that presenting data visually is very helpful because people absorb and process visuals much more quickly than they absorb words.

A consumer is a consumer — it doesn’t matter if they’re in food, retail, banking, or some other industry. In any case, you need to understand the triggers, barriers, and unmet needs of consumers. Once you understand those, you can figure out how to target your brand or product to those consumers. The real challenge is figuring out how your brand can gain an advantage over its competitors on an emotional level, a rational level, or both.

Yes. Industry regulations have an impact on the type of research that you’re allowed to do and how you’re allowed to do it, especially if the industry is something akin to banking or alcoholic beverages. But, it’s not really an issue for gaining a basic understanding of consumer needs. For example, it doesn’t impact the way that we do focus groups or quantitative research in a major way.

Yes. I’m a big believer in ethnographic research, whether that takes place in consumers’ homes, shopping along with them in a store, or even when they’re making a drink selection at a bar. By actually seeing how the consumer lives and shops, as well as understanding their life context beyond the brand and industry, you can get priceless insights that surveys can’t provide.

When it comes to early-stage strategy in particular, I always start with some type of qualitative research to get those deep, rich insights before moving on to more quantitative research methods, such as segmentation.

With that said, segmentation research is invaluable. It works best when it’s done from both a consumer targeting perspective and a need-states perspective. You can marry the two to find demand spaces, which are important for innovation, messaging, brand strategy, and portfolio strategy. For example, if you have two products in your portfolio with the same target audience, you can ensure that they’re not competing with each other by targeting different need states.

Depending on the objective, we will often use statistical techniques like MaxDiff or conjoint analysis to help identify patterns in the data. We’ve also had success leveraging consumer communities as an effective and efficient way to conduct both qualitative and quantitative research.

Additionally, some of our surveys are done via text message, which is much more nimble and consumer-friendly. Instead of a traditional word-heavy, five-point scale questionnaire, many of these surveys use emojis. For example, if we ask, “How do you feel about this product?” respondents can answer with a smiley face, serious face, or sad face.

It depends on the brand strategy and the objective of the study, but there are three KPIs overall that are really important to measure and that are highly correlated with purchase intent:

Marketing mix modeling is a bit of a beast — there’s so much data that needs to be collected and so much historical data needed for the model to be accurate. It’s well worth the effort, though, and I’ve seen marketing mix modeling used in several ways.

The most obvious way that we’ve used it is to help us understand which channels are driving the most volume and which channels we’re getting the greatest return on. We use that data to prioritize or reprioritize our spending and identify opportunities to improve efficiency, whether that’s in creative optimization or media plan adjustments.

One of the more interesting and unique ways that we’ve used marketing mix modeling effectively is when I worked for a food company. We identified that a packaging change had driven a 20 percent sales decline — a problem that we solved by updating the packaging. It was actually the one variable that wasn’t captured by anything in the model, and it coincided exactly with the packaging change. This goes to show that sometimes, you identify something that you weren’t even expecting out of the modeling.

As a best practice, I always look for a strong model fit for the accuracy of the data and credibility with the team. This example in particular was a unique scenario where the one thing that didn’t fit had to be an attribute outside of the model, and it turned out it was the packaging. We know that to be true because when the packaging was addressed, the brand returned.

Three factors are pertinent to having good insight: consumer wants, consumer needs, and consumer beliefs. These can be translated into statements like “I want X,” “I need X,” and, “I believe X” from a consumer language point of view.

It’s also important to understand those three statements on three different levels: in life, in the category, and for the brand. Once we understand the statements on those different levels, we can translate the insights into implication-oriented strategies for the brand. From there, we can identify the jobs to be done, unmet needs, and growth opportunities, which ultimately influence the brand strategy.

It depends, but it’s usually always by target. There’s a holistic view that goes into the brand planning, but then when you drill down into the specific initiatives, it comes down to whatever the target is for that particular initiative.

Consumers have been bombarded with events over the past several years that have impacted their mind state — even above and beyond the COVID pandemic. Depression and anxiety are at an all-time high. They’re more stressed and stretched than ever before, and are generally very worried about the economy.

As a result, their mental, physical, and financial wellness has become a top priority for them. Products that can help them to address any of those, either by making them feel more in control, more empowered, or experience more enjoyment will prosper in the long run.

From a more technological perspective, I think AI is going to have a big impact on how we do research and target consumers. It’s going to make consumer data more comprehensive and more readily available, as well as make data synthesis and output quicker and easier. Finally, it is going to enable us to create more personalized marketing to consumers.

Photo credit: Jill Lotenberg

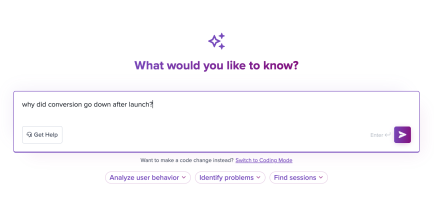

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Melissa Douros talks about how finserv companies can design for the “Cortisol UI“ by building experiences that reduce anxiety and build trust.

Introducing Ask Galileo: AI that answers any question about your users’ experience in seconds by unifying session replays, support tickets, and product data.

The rise of the product builder. Learn why modern PMs must prototype, test ideas, and ship faster using AI tools.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.