Growing up in the ’90s, the internet was that crazy up-and-coming thing. It was exciting and oh boy am I happy having witnessed it firsthand.

At that time, going online meant accessing the internet through a dial-up — which made a sound like “Pshhhkkkkkkrrrrkakingkakingkakingtshchchchchchchchcch*ding*ding*ding*.” On numerous occasions, my trying to sneakily access the internet ended up with my parents shouting, “who is using the internet, get off it, we are expecting a call!”

In the early days, internet companies sprang up like mushrooms everywhere. At that time, Super Mario would have loved to live in the real world instead of inside a video game for sure.

What was the downside of the enormous amount of companies? Many internet companies with little or no revenue were valued at billions of dollars. The result? Bankruptcy was everywhere and the term “dot-com bubble” was born. If you had invested, your money was now a famous South Park scene.

Now, in 2023, it feels a similar scenario might show its ugly head around the corner.

And that brings me to the importance of a little thing called return on investment (ROI). In this article, we will explore what ROI is and how to calculate it, providing examples along the way. Pinky promise, your time spent reading is worth it, giving you a positive ROI.

In the dot-com era, large investments were made in companies, based on the premise that investing was a sure shot and extremely profitable, generating returns of at least 10x the original investment.

This is where ROI comes in. ROI is a measure of the profitability of an investment. It measures the gain or loss of the original investment. It is expressed as a percentage and can be used to compare the profitability of investments in an investment portfolio.

Both companies and individuals benefit from keeping track of ROI.

If you have a portfolio of stocks, you probably track how stocks are performing against their original investment, as well as compared to each other.

Companies look at the total investments made and their contribution to the overall results of the company.

If you are a product manager, you continuously strike the balance between the desirability, viability, and feasibility of a feature. Putting that differently, you ongoingly check if new features bring home the bacon (or bagels to make it vegan-friendly), by checking how many customers are interested, if their interest will boost revenue, and at what cost.

In general, tracking ROI informs decisions about where to invest.

Now, let’s focus on companies and zoom in on product managers.

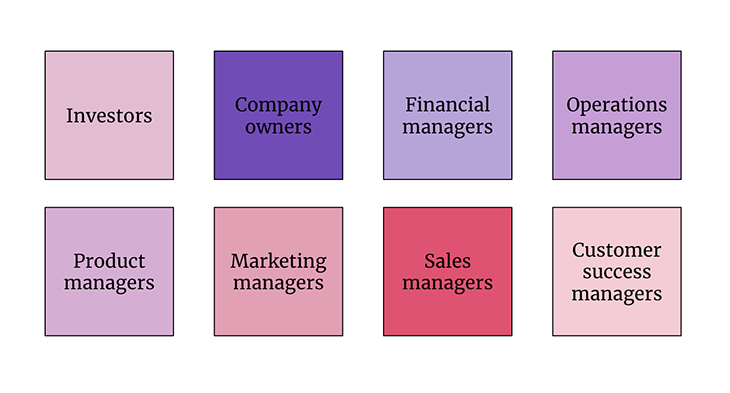

In a company, you’ll find several stakeholders interested in the ROI. Their reason is similar: to evaluate the efficiency and profitability of business operations. Keep in mind that who the stakeholders are might vary based on the industry and company set-up.

So who are these mysterious creatures?

If you are working in a publicly traded company or a start-up, it is the investors. They invest in your company and want to evaluate the overall performance to see if their money is well-spent.

Angel investors might expect to see a 30–40 percent annual return on their investment over three to 10 years. Venture capitalists might settle for 25–35 percent per year over the lifetime of the investment, whereas investors in public trade companies might settle for 10 percent, the historical performance of the S&P500.

They are the ones with final accountability and are keen to see their investments made, pay off, and grow their company. ROI helps them measure performance, identify areas of improvement and make strategic decisions to increase profitability.

Financial managers are accountable for the numbers, heading a team of number-crunchers and figure wizards of the company. They use ROI to evaluate the financial performance of departments, products, or initiatives and make recommendations to top management on the allocation of funding.

They are the ones responsible for smooth operations operating correctly. Their interest in ROI is to evaluate the department’s performance, identify areas of inefficiency, and make decisions to increase productivity and profitability.

Product managers are responsible for the success of the product and making it what the customer needs it to be. They use ROI to identify opportunities, and improvement areas, and evaluate the performance of features.

They mostly use ROI to evaluate the performance of marketing campaigns. For example, how successful was a Facebook ad campaign? Did the time and resources spent generate sufficient new sales?

They use ROI to see how effective their sales team is. Think about the customer lifetime value (CLV) in comparison to the customer acquisition costs (CAC).

They use ROI to see how successful their team is in managing customers. They, for instance, look at the total operational (OPEX) and capital expenses (CAPEX) of their departments in relation to their team’s contribution to upsell and reduce churn.

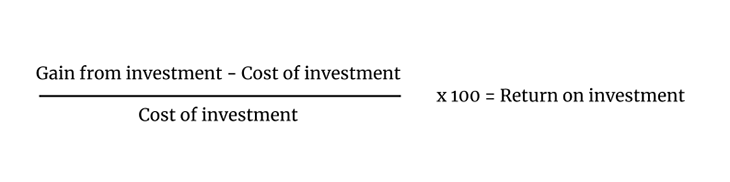

The formula for calculating ROI is luckily more straightforward than Getafix’s formula to create the magic potion that gives Gaulish warriors superhuman strength in Astrix and Obelix.

The formula for calculating ROI is the gain from investment minus the costs of investment, divided by the cost of investment, and multiplied by 100.

To give two examples:

Now you might have picked up that a “good” ROI means something different for each stakeholder and investment area. Even when only looking at ROI for product managers, it is hard to say what a “good” ROI is.

Putting it simply, a higher ROI is better than a lower one. I can imagine that at this moment you’re thinking “Really? What was your first clue?”

The reality is there are tons of factors in play that define a “good” ROI. Rather than looking at “good” and “concerning,” look at outcome-driven metrics.

Product managers are outcome-focused. It’s about the change made in the lives of the target customers, which ultimately speaks to why something is created for the product.

Establish roadmaps, objectives, and key results (OKRs). Measuring outcome-based key performance indicators (KPIs) and metrics provide insights into whether you reached the intended goal. Should you stop working on it, or do you need to shift gears or focus? Measure and evaluate regularly.

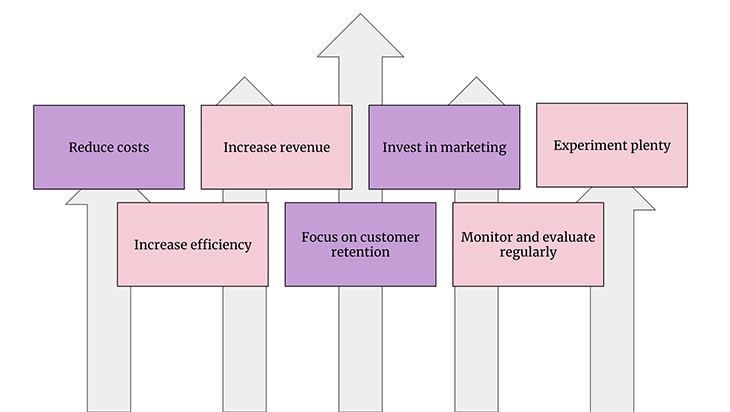

Established the outcome-driven goals and metrics, and when tracking progress towards reaching them you are not happy with the result? No worries, there are several ways to boost your ROI.

Let’s have a look at a few strategies that can help improve ROI.

One effective way to improve ROI is to reduce costs. Think about reducing scope, streamlining development, automating processes, or even outsourcing.

“Now you won’t say” right? Another way to improve ROI is to drumroll increase revenue. This can be achieved by increasing sales or increasing prices.

Out of mind is out of sight. Marketing excels at increasing brand awareness and driving sales through marketing campaigns. Their efforts lead to increased revenue and improved ROI.

Fail quickly, early, and cheaply. Avoid putting all your efforts into one feature. Though you’ll probably make some big bets, validation, and experimentation allow you to benefit from plenty of quick wins that contribute to an improved ROI. This is why building a culture of experimentation is so beneficial.

Improving efficiency can help increase revenue and reduce costs. Identify bottlenecks in your processes and eliminate waste. Invest in new technologies or train employees. When talking about increasing efficiency, you got to love you some Lean Six Sigma practices.

Retaining customers is more cost-effective than acquiring new ones. Successful customer retention reduces the number of spent resources on marketing and customer acquisition.

We already mentioned this in the previous section. Regular monitoring and evaluating performance, and implementing corrective actions accordingly, help optimize ROI over time.

ROI plays a crucial role in product teams’ everyday lives, providing insights into which features and strategies are paying off and which aren’t.

Tracking it supports you in making data-informed decisions about where to allocate effort, and make adjustments as needed to improve profitability.

Here are some tips for how product teams can effectively track ROI:

![]()

I keep hammering on this like Bob the Builder, but clear outcome-driven goals and objectives are the foundation of ROI. If anything, establish clear goals and objectives for your product.

Product managers should track ROI in order to make data-driven decisions about their products and optimize profitability. Think about the customer acquisition costs, customer lifetime value, churn, etc.

Communication and collaboration are essential to delivering amazing features that exceed the set goals and objectives.

Product managers greatly benefit from having excellent communication and relationship-building skills. They allow you to acquire and share the correct data and insights, toward meeting and even exceeding the goals and objectives.

Besides ongoing monitoring and reviewing progress, data visualization is advantageous. A picture is worth a thousand words. Visualizations can be useful to understand the performance, tell a story, and enable you to convince stakeholders and make better decisions.

Product managers have this superpower to make decisions and move forward whilst staying flexible and adapting to change.

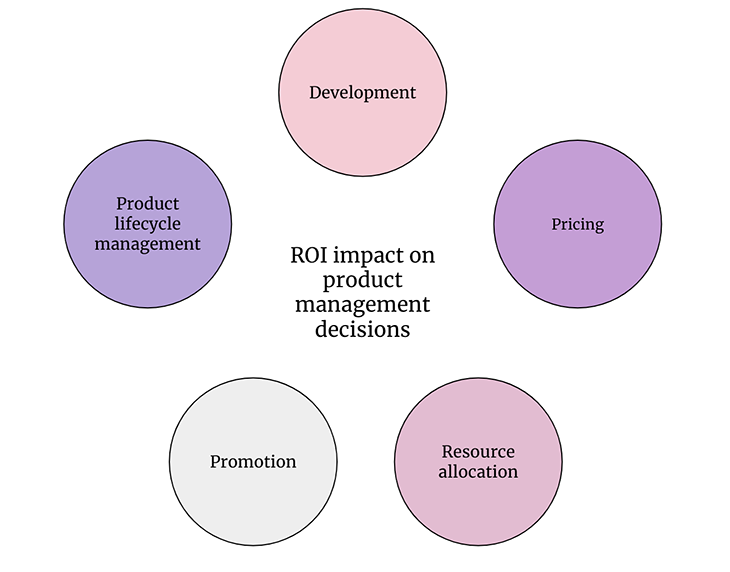

Let’s have a look at how ROI decisions help product managers stay flexible when it comes to making product management decisions:

Product managers use ROI to evaluate the potential profitability of new features before investing time and resources into developing them. ROI helps them decide which ideas to pursue and which to reject.

Another decision product managers need to take is about pricing. ROI is used to determine the optimal price point. By understanding the relationship between price, costs, and revenue, an informed decision can be made on pricing to maximize profitability.

ROI helps you to decide on what to spend resources on and when. For instance, it allows you to make decisions on which features to invest in or put more effort into, and which are ready to sunset.

Without a proper promotion even the best products fail. The Microsoft Zune is one that pops to mind. You don’t know it? I guess I made my point then. ROI helps product managers to decide which marketing strategies to invest resources into, and which ones to avoid or scale back on.

Product lifecycle management (PDLC) keeps the product manager going. ROI is used to evaluate the profitability of a product over its lifecycle. By understanding its decisions can be made when to introduce new functionality, and when to discontinue the product.

In summary, ROI is a critical metric for product managers. What makes a good ROI and what a bad one is pending context and the set goals and objectives.

ROI allows you to evaluate the efficiency and profitability and make data-informed decisions on product development, pricing, resource allocation, promotion, and product life cycle management.

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.

Maryam Ashoori, VP of Product and Engineering at IBM’s Watsonx platform, talks about the messy reality of enterprise AI deployment.

A product manager’s guide to deciding when automation is enough, when AI adds value, and how to make the tradeoffs intentionally.

2 Replies to "What is ROI: Definition, formula, examples, and how to improve it"

((100,000–50,000)/50,000) x 100 = 200% is wrong. 100%is the correct value. Check 2nd example after ROI formula

Thank you for flagging this error! We just made a correction to the article.