Product management is full of processes and frameworks, and product managers must think through them before deciding to invest in or build significant new products or services. As part of that process, one of the very first steps is market research and market analysis.

Well-executed market analysis will give you a clear indication of how successful the right product can be when introduced to the right target market for the right price. In this article, we’ll talk about market analysis and how to do it effectively, as well as walk through examples and a free template.

Simply put, market analysis is all the market research and competitive analysis done to determine a product-market fit. Sounds easy right? Well, there is a bit more that goes into conducting market analysis for your product than may meet the eye. But when done thoroughly, market analysis can lead to a very successful launch and future for your product.

Typically, market analysis is done before your product strategy is created. You need to know the details uncovered in this research to build out an effective, informed product strategy and vision.

To develop a strong product strategy, you’ll need to have a deep understanding of your target customers, the market, and where or how your product will fit in.

Here’s a basic but great example — let’s say you want to open a donut shop. Would you just jump right in with the first open space you see, fill your store with donuts, open the doors, and expect the masses to come? How do you know people even want donuts in that area? Are there other donut shops nearby? What price do you sell your donuts for and to whom?

Not conducting this type of detailed research upfront can lead to failed launches, lost money, and lost time. It would be much better if you planned ahead and did the research to determine that there is, indeed, a need for donuts in the area. The competition is slim and your customers are kids with no more than allowance money to spend on donuts too! I bet if you knew those details upfront, you would make vastly different decisions about your launch.

This is where conducting market analysis comes into play. It’s understanding that landscape ahead of time to eliminate risk and ensure from both a qualitative and quantitative perspective there is indeed a need for your product (or service).

There are six main buckets to dive into to create your market analysis. A complete analysis will be a combination of the qualitative and quantitative info below. Once you have these pieces identified, you will easily be able to craft your strategy and have a solid foundation to pitch from when discussing your product with stakeholders.

For the purpose of breaking these down let’s use the following example objective:

“You currently have a social platform that is used daily by 1.2 million users for free and want to introduce a premium version.”

This may seem like a given, but as part of your analysis, you will want to make sure you have a firm understanding of your industry and any current trends. Be able to answer what is going on in your industry, any big changes that may have recently occurred, as well as where the industry is headed.

Use this section to pitch your product or service and what value you think it can provide to the market. This section could also include a brief summary of who you think this product or service is for and anything high-level about the opportunity that you want stakeholders to know upfront.

Your product is likely not relevant for everyone and that is OK! What is important in this step is to first identify the market you want to bring your product or service into and then identify what personas could benefit from it. Alternatively, it’s good to figure out who would not be your ideal customer too. Get as specific as you can here.

Questions to answer in this section include:

Using our example above, we will want to understand from our existing user base what types of users would benefit most from this premium service. So let’s say we identified that our target premium users would be 13–35 years old.

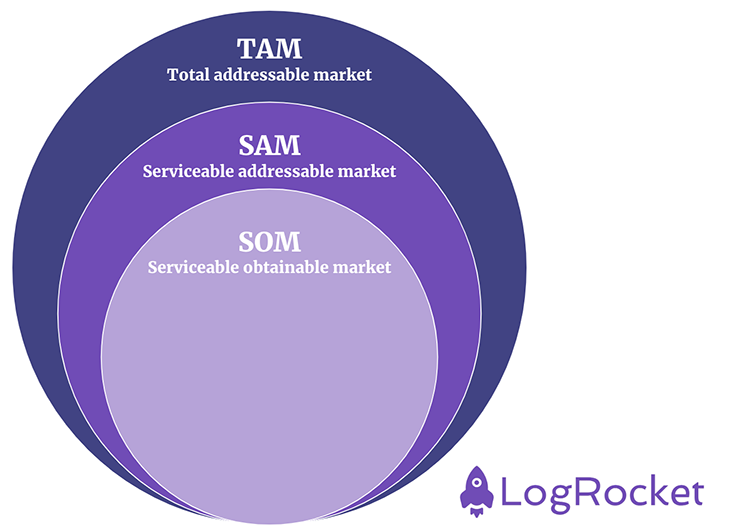

Now that you have identified who your target customers are and aren’t, the next step is to understand how big the market is for that persona. This is where you’ll want to provide specific data on the demographic you are trying to reach crossed with the total market in that area. This can be done by calculating the TAM, SAM, and SOM.

Let’s take these terms combined with our example from above and break it down a bit more:

| Total addressable market (TAM) |

|

| Serviceable available market (SAM) |

|

| Serviceable obtainable market (SOM) |

|

This article on the TAM, SAM, and SOM can walk you through calculating these numbers. Having this prepared aids product teams (as well as finance teams) in understanding the revenue opportunity with your product before it even gets built. It is the backbone of creating a compelling market analysis for stakeholders as well.

Once you have these numbers, you can then enter them into a diagram to represent the bigger picture. You may recall seeing these values often represented in an onion-shaped char that looks something like this:

Next, identify any major barriers to entry into the market with this product or service offering. Outline any steps you think you need to take to remove those barriers if known.

The last but most important step is to take all the information above and plug it in side-by-side with the competition in that market to see how your offering would stack up. By mapping out what your competition has versus your offering, you will be visually able to see any opportunities or areas to look further into.

For example, if you find within your market there is a lot of competition with similar offerings, this may lead you to evaluate whether this is the right market to jump into or if you should explore elsewhere. Or perhaps you discover that no one is offering this product or service in your market. In this case, you have an opportunity to get ahead with a new offering or do deeper research into why no one has introduced something similar yet.

Take time to compare your offering to several competitors in the market (I recommend between three and five). You’ll want to dig deep to understand anything you can about their offering including who they offer it to, how long they have been providing that option, pricing, and more.

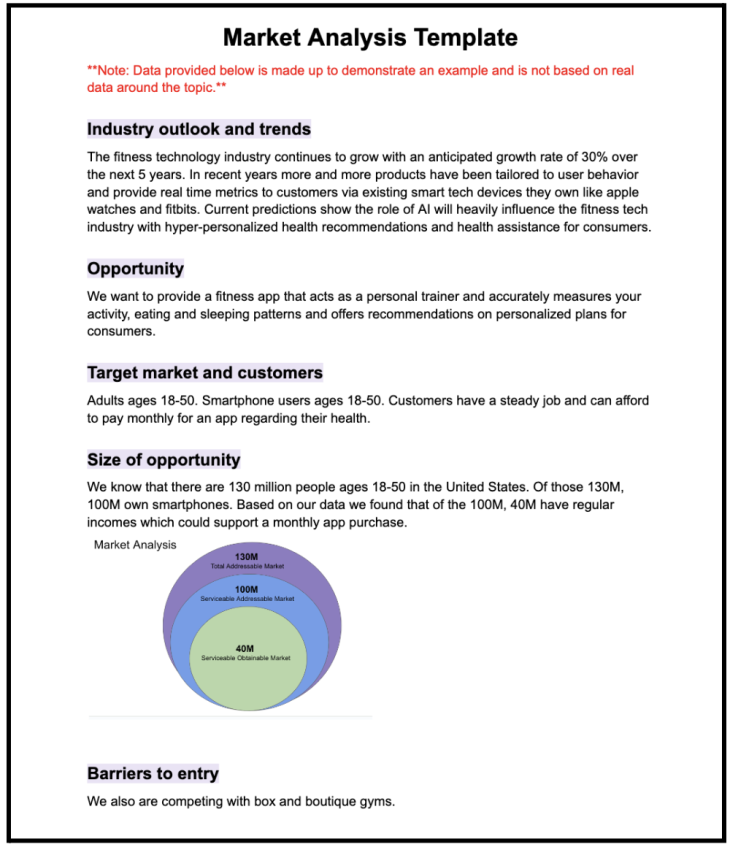

Now that you know what a market analysis is and its components, here is a free template that you can use to craft your own market analysis. Please click File > Make a copy to download it to your own Google account and customize it as needed.

Here’s what the template above would look like when populated for our fitness app example:

When you have a new idea for a product or service, take time to thoroughly research the market and competition before diving headfirst. This will help you make informed product decisions that won’t turn out to be expensive mistakes.

Hopefully, this article took away some of the mystery behind market analysis in product management!

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Rahul Chaudhari covers Amazon’s “customer backwards” approach and how he used it to unlock $500M of value via a homepage redesign.

A practical guide for PMs on using session replay safely. Learn what data to capture, how to mask PII, and balance UX insight with trust.

Maryam Ashoori, VP of Product and Engineering at IBM’s Watsonx platform, talks about the messy reality of enterprise AI deployment.

A product manager’s guide to deciding when automation is enough, when AI adds value, and how to make the tradeoffs intentionally.