Editor’s note: This blog was updated on 7 April 2023 to add a section on how to develop a go-to-market strategy and specify more examples of go-to-market strategy tactics and programs.

Go-to-market (GTM) strategy is key to any product’s success. Without one, you’re essentially driving blind — trying to introduce a product to an audience that, chances are, doesn’t know anything about it. The word “strategy” in “go-to-market strategy” emphasizes this well, you can’t just throw a last-minute plan together and hope it’ll work.

Thought and intentionality are the drivers behind go-to-market strategy. You have to really understand your target audience, its needs, and the context around you.

In this article, we’ll talk about what go-to-market strategy means, how to develop a GTM strategy, the various factors and considerations to account for, and demonstrate some examples of GTM strategy along the way. Let’s get started.

So what does go-to-market strategy mean, exactly? The name is pretty telling; go-to-market strategy is a thorough, comprehensive plan outlining how a company is going to bring a new product into the market it’s hoping to serve. The plan truly goes from A–Z and includes all aspects of the product, starting from research at the very beginning and to post-launch promotional activities and advertising (and beyond) at the end.

The objective of a go-to-market (GTM) strategy is simple: drive awareness, accessibility, and retention of a product from initial validation to scaling it for a much larger market population. As you might imagine, the strategies adopted will transform over time based on market confirmation.

The general notion is that go-to-market strategies are transactional, so companies often wait to execute until the product is ready to deploy.

However, a good product manager initiates the GTM strategy when conceptualizing a product idea. The strategy should capture new realities around business models, market maturity, brand positioning, competitive forces, and growth strategy.

Software-defined solutions and as-a-service business models necessitate a transformational approach to GTM strategy. Products do not reach end-of-life anymore; they evolve and drive continuous innovation.

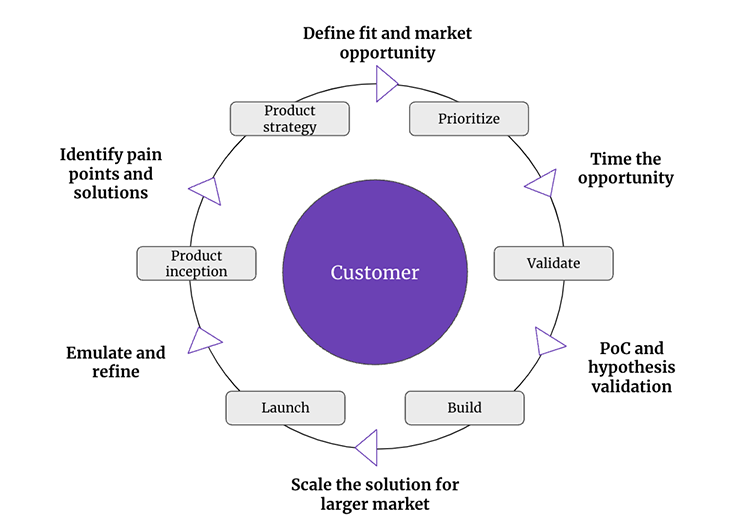

The lifecycle below represents how organizations now think about products and solutions. Every lifecycle step requires a conscious approach to a market strategy, not just the launch phase.

The product inception phase captures a pain point and creative solutions. Product strategy, however, needs to consider the product’s market entry, differentiation, viability, and feasibility. Each phase validates the hypothesis and refines the GTM strategy as we move through the cycle.

Products are rarely fire-and-forget nowadays. The deliberation on building stickiness, increasing switching costs, and creating long-term value for the customer is crucial.

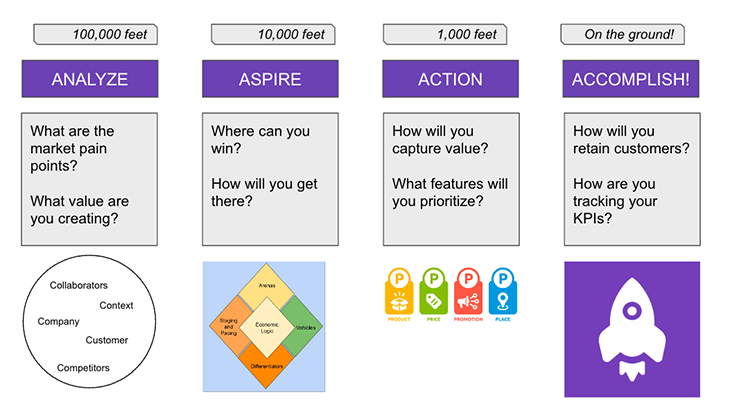

When introducing a new product in a new or an existing market, I often use the Analyze, Aspire, Action, Accomplish model to build a proper idea of what we’re working towards. It applies various frameworks at distinct stages of the product lifecycle. These help set us up for success as we build a GTM strategy:

The intent is not to explain the tools captured within the framework but to present the key outcomes from each phase:

The analysis phase requires a solid understanding of customer pain points (said and unsaid), market dynamics (what is available, why it is insufficient), and potential solutions to minimize or eradicate the gap.

At this stage, the GTM aspects are usually not critical. However, solving a problem with no avenue to reach the customer is also futile.

The aspirational step is where I believe the hypothesis for a GTM strategy is crucial. In product parlance, segmenting, targeting, and positioning (STP) is an essential activity.

The key questions here are:

This step should also inform you of critical competitors and the differentiators you need to win in the market. It should define your ideal customer profile, and, more crucially, identify beachhead customers.

The action stage should help determine a product-market fit, messaging (writing a press release, the FAQs, credentials that you expect to have, etc.), and the different personas you must target.

Once the product is launched to the market, the accomplish stage should help with data-driven product refinement.

When pursuing my MBA, my group worked (unofficially) with Marriott on a concept idea to offer an experience-first product. While considering Marriott’s breadth of brands, we selected JW Marriott and Sheraton to provide an experience beyond just room and food to the middle-aged and Millennials, respectively.

The package considered everything from travel, activities, pricing, and even specific pilot locations where the offer would be live first. The concept also identified messaging for the personas and essential ecosystem strategies, including travel and experience partners.

Now, let’s go over how to develop a GTM strategy. The Analyze, Aspire, Action, Accomplish model I shared earlier is kind of like a mini version of what I’m about to break down.

You can use the following steps — or categories of steps, rather — for holistic GTM strategy.

It’s vital to understand the context of the world around you before you try to bring a new product into the mix (or bring an existing product to new markets). Just like the “analyze” component, this step builds the foundation you need for a GTM strategy.

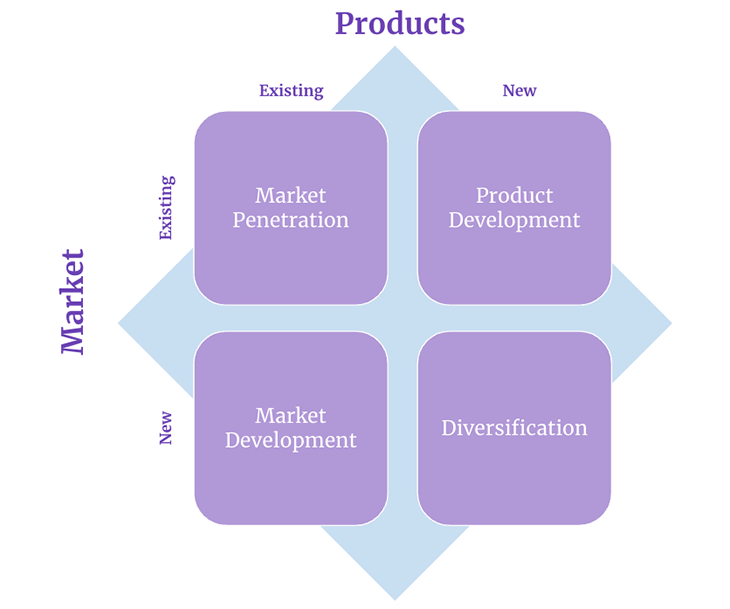

The first thing to consider is how mature the market is. The best GTM strategies to adopt often depend on the market’s maturity, which you can evaluate using the Ansoff matrix:

Consider an electric vehicle, for example. It is a new product in an existing market. The adoption threshold is dependent on solving the range anxiety.

As Tesla demonstrated, building a supercharger network was equally important as making the car itself.

I would argue that autonomous cars will be a new product in a new market. It’s easy to imagine this as an existing market, but an autonomous car has the potential to completely redefine how people think about car ownership.

Further, societal context is important. In 2013, Google launched Google Glass. Though Google thought it was super cool and innovative to bring a wearable, information-displaying headset in public, they failed to recognize the privacy concerns that came along with that.

The general public immediately saw through to the privacy concerns, and Google Glass didn’t last very long as a result. If they’d considered the context and implications around their new product sooner, they hopefully wouldn’t have poured as much time and resources into it.

It should be no surprise that product-market fit holds a big piece of the GTM strategy pie.

Product-market fit refers to the product’s ability to fulfill the unmet needs of your target market. Driving your value proposition here is extremely important, as you want people to clearly see how you meet their needs in ways competitors can’t.

The general idea is to find the sweet spot where you’re offering just enough value that your customers find the product usable and your business sees it as feasible and viable. There are lots of ways to capture this data across both qualitative and quantitative methods. Things like customer interviews, surveys, and focus groups can be a great way to capture this information. You can also do observation studies to see if your product is being used by target customers in the way that you think and hope they are.

And, if you have a product that already exists in the market but isn’t being adopted as highly as you hoped (or is slowly being overtaken by competitors), it may be time for a rebrand.

In 2018, we researched cars, their perceived branding, and their attempt to rebrand themselves. It was interesting that vehicles such as Buick and Cadillac had transformed themselves to be more amenable to upper-middle-class people in their early 40s (BMW and Lexus had held this market), whereas Lincoln failed.

Such repositioning requires a considerable thought process from a GTM perspective, especially regarding social messaging, following, advertisements, product considerations — the whole nine yards.

What are your competitors doing? What are they not doing? How do customers perceive your competition’s products?

These are all great questions that can help you build a successful GTM strategy. You don’t need to namedrop your competitors to convince people that your product has an edge over theirs, but you can emphasize how your product differentiates itself from others on the market. If it’s obvious, customers will notice all on their own.

Though there are many tried and true methods for competitive analysis, here a few steps to follow to kick it off:

By fleshing out these ideas, you can get a better view of who you’re directly competing with. Though you’re in the same market, you may not be direct competitors, and looking at these three steps can help you draw those conclusions.

Take Microsoft Surface and Apple iPads for example. Yes, they’re both tablets and would be considered competitors for that reason, but their features and target audiences don’t really make them competitors after all.

Further, when evaluating the competition, think creatively. Brita, for example, opted not to compete with other kitchen appliances. Instead, it was sold in the water aisle, which positioned it to compete with bottled water.

Such decisions are not determined at the launch stage but during inception. Cialis beat Viagra by redefining the customer purchase criteria where Levitra wasn’t. Without going into too much detail, let’s just say that product differentiation was crucial in this endeavor.

Goal setting and tracking are going to help you figure out where you’re placing in your GTM race and keep you on track. Without clear goals that everyone buys into, there will be no real direction that your team is working towards, and you’ll find yourself in disarray.

I know everyone talks about SMART goals, it’s basically drilled into our heads. SMART goals, to everyone’s disdain, really do make all the difference. Setting goals that are smart, measurable, attainable, etc. makes it easier to see where and how you’re falling flat.

On the flip side, milestones will help hold you accountable to the pace you’re at — are you behind schedule, ahead, or right on the money? They provide an opportunity to evaluate your tactics, identify bottlenecks, and pivot when needed. By regularly reviewing your progress against milestones, you can make data-driven decisions to optimize your GTM strategy, improving your chances of success in the market.

For example, say the goal is to increase the number of new customers by 18 percent within the first six months after launching the product. You have a specific number to reach within a certain time frame, and in the case of our example, we’ll say it’s not an overly egregious goal. Your milestone can be to acquire 10 percent of these new customers by the end of the eighth week. The track is set, and you can adjust methods depending on how far behind or ahead you are of that finish line.

Everything is in place — it’s time to launch! Boots are on the ground. This is the most nerve-wracking and critical stage of the journey. You’re going to need to align a number of things here.

First and foremost, ensure communication is clear and specific across all functions. Sales and marketing need to know what’s going on, as do executive teams and adjacent product functions. Collaborate effectively and ensure you’re informing the right stakeholders throughout the launch process.

Similarly to how goals and milestones are crucial, you’ll also need to put some KPIs in place to monitor how your GTM plan is performing. Check them regularly to see how you’re doing and adjust accordingly. There’s no shame in admitting that something needs to change — after all, all products didn’t come out perfectly from the get-go. Be ready to make changes and adjust your plan as needed to respond to changes in the market, feedback from customers, or any unexpected challenges.

As part of our capstone project, thanks to a fantastic initiative from the NIU College of Business, we worked on a real-life GTM, from cradle to grave.

The solution was a way to minimize readmissions. Preventable readmissions (readmission is when a patient returns to the hospital within 21 days after discharge for any reason) cost over $25 billion, and Medicare incurs more than 60 percent of that cost.

Medicare instituted a penalty for hospitals where readmissions are too high. A database of all hospitals and their readmission rate (and propensity for pen) was available.

Based on the information, we devised a method to segment the ideal market, their demographics, and five states that maximized the sales motion. Note that the “ideal customer profile” is not genuinely perfect — it was a “what’s possible” with the resources available on-hand.

In addition, we identified a set of hospitals that would be the best candidates for a pilot. An extensive amount of math went into parsing through the spreadsheets — my group was willing to recommend me for a Ph.D. just for that work — but we distilled it down to a single roadmap of client profiles (pilot, short-term, long-term).

While the GTM strategy was to work with the hospitals, the eventual goal was to work directly with Medicare to save them at least 30 percent of the $17 billion spent on unnecessary expenses.

You’re also going to have to choose if you want to pursue a product-led or sales-led growth approach, as they represent fundamentally different methods of acquiring and retaining customers. Most articles about product-led vs. sales-led growth strategies push one versus the other. The truth is, you have to pick what’s best for your situation. You should also know where the inflection point is to switch from one to the other (or use them in tandem).

Before I go further, let me explain as I best understand it — because my approach often is not to choose between the two consciously.

A product-led approach often depends on organic growth, backed by an exploratory model (freemium, trial to buy), self-serve capabilities, and a seamless user experience when it comes to setting up and using the product.

Companies spend considerable finance on marketing rather than on the sales motion. The product-led strategy enables a broader net and a lower acquisition cost (CAC).

A prominent example of a B2C product that took a product-led approach is Spotify.

Unbelievably, AWS started as a product-led offering, with self-service capabilities and utilities that enabled faster time-to-market and monitoring usage, free trial, and cost transparency. It held the No. 1 position in cloud hosting and attracted small businesses, especially startups.

However, Azure, being late to the party, took a sales-led approach. It built strong channel and solution partners, offered end-to-end advisory and execution, and quickly catapulted to no. 1, led heavily by large contracts with the top companies in Fortune 500.

AWS has since transitioned to a hybrid model and built a substantial presence in the large-cap market by offering both a sales-led approach and a marketplace, which are add-ons once they acquire a client.

The most significant driver for a hybrid approach is the transformation to as-a-service models. Many organizations consider customer success management as a sales function. While partially true, CSMs are not purely commission-driven and are usually not in the loop during the initial stages of a sale.

The expectation of driving adoption, cross-selling, upselling, and renewals to minimize CAC implies that they provide the convergence between product and sales-led approaches. I reach out to CSMs for product feedback because it tends to be rooted in data

Side note: If you can’t monitor KPIs and back your CSMs, you shouldn’t be in the SaaS business!

A sales-led approach to growth, on the other hand, depends heavily on your sales team or channel partners. Depending on your product (transformational versus incremental) and who you are (Amazon versus startup), your sales team will connect with clients, build relationships, explain product benefits, and take it through the contractual process.

As you might imagine, the success of your product also depends on the sales organization’s willingness to sell. If you’re considering shifting from a perpetual to a recurring model and do not regard the sales angle, you’re sure to have a paperweight on your hands!

B2B products that require long contract cycles and considerable time to deploy and onboard often require a sales-led approach. However, this doesn’t imply that sales will influence the product features or roadmap.

Creating a go-to-market strategy is more art than science. However, it is crucial to start with a hypothesis, do it early, and make it fluid enough to pivot based on data.

Consider the type of product you are building, the markets you are targeting to define the brand, the competition, the pilot customers, and the growth strategy you must adopt. While no crystal ball guarantees success, a conscious approach will amplify the probability.

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Great product managers spot change early. Discover how to pivot your product strategy before it’s too late.

Thach Nguyen, Senior Director of Product Management — STEPS at Stewart Title, emphasizes candid moments and human error in the age of AI.

Guard your focus, not just your time. Learn tactics to protect attention, cut noise, and do deep work that actually moves the roadmap.

Rumana Hafesjee talks about the evolving role of the product executive in today’s “great hesitation,” explores reinventing yourself as a leader, the benefits of fractional leadership, and more.