In this comprehensive guide, we’ll define what a competitive analysis is, describe the benefits product teams stand to gain from conducting one, and walk through the steps of how to do a competitive analysis.

Through the tutorial, we’ll refer to examples to demonstrate how each step of a competitive analysis works in practice. We’ll also provide a list of customizable, free competitive analysis templates for you to use when completing these steps on your own.

Picture this: you just came up with the next disruptive, game changing, AI-powered e-commerce marketplace. The objective is to connect buyers with sellers to fulfill their tailored and customized product needs.

You’re confident your product will take on Etsy and other big players in the market. You did some market and user research and have a good idea of your ideal customer and their (underserved) needs. Based on this data, you believe your marketplace can reach product-market fit quickly.

It’s now time for you to dust off your copy of Sun Tzu’s The Art of War. Why is that, you ask?

The Art of War is an ancient Chinese military textbook that, although dated somewhere between ~500–400 B.C., is one of the most influential management books out there to this day. It provides great strategic and tactical advice. Moreover, it provides guidance to help you assess yourself and your competition to gain an advantage.

Maintaining a competitive advantage is the goal. Even if you have the best product in the world and you know there is a market for it, if you don’t understand your competition, you‘re bound to fail. That’s why you need to perform a competitive analysis.

As the band Rage Against the Machine would say, know your enemy.

Competitive analysis (sometimes called a competitor analysis or competition analysis) is exactly what it sounds like: a structured approach to identifying and analyzing your competitors. More concretely, it’s an assessment of your competition’s offerings, strategy, strengths, and weaknesses.

A competitive analysis helps you answer questions such as:

When conducted thoroughly and regularly, a competitive analysis provides you with tons of information that can be used to improve and optimize your product. The end result is a holistic overview of your competitor landscape.

Competitive analysis is a fundamental product management instrument. It helps PMs learn what works and what doesn’t when trying to acquire market share, identify market trends, and locate gaps in their product offering.

Competitive analysis exists to help you avoid making mistakes and empower you to beat competitors to the punch in the pursuit of product growth and success.

Knowing your competition will bring you great rewards. Conducting a competitive analysis will help you more effectively:

Typically, the first time you create a competitor analysis is when doing your market research. This helps you get an idea of the product-market fit, which will evolve along your journey.

As a product manager, your role is not to analyze how well your competitors are able to showcase themselves. It is your job to make the product what the customer needs it to be. Understanding your competitor’s capabilities, pricing, and product positioning helps you in this.

Keep in mind that your competitors will likely showcase themselves to appear better than they probably are. You’ll be able to acquire tons of information about them, but you should take that information with a pinch of salt.

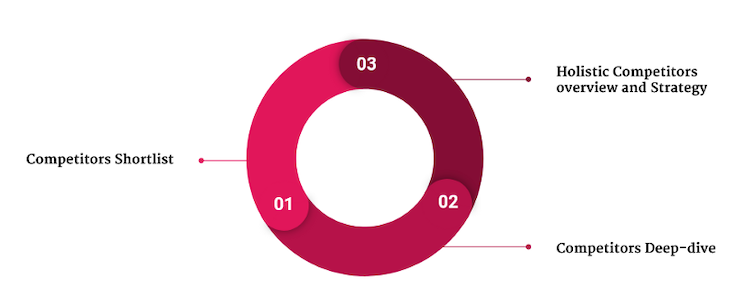

There is no a single way to do a competitive analysis. In general, a competitive analysis is made up of three fundamental components:

To demonstrate how to do a competitor analysis, we’ll refer back to the example outlined in the introduction.

Remember, in our example, we’re looking to disrupt the market with an AI-powered e-commerce marketplace app that helps buyers and sellers connect to fulfill highly customized orders. Let’s call our innovative new product AGORA.

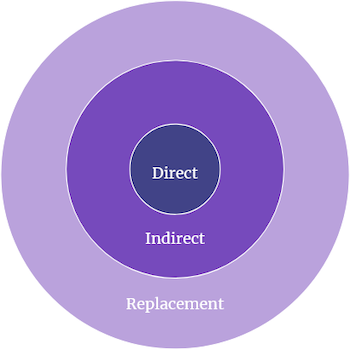

There are three types of competitors:

For a competitive analysis, you need to identify at least your direct and indirect competitors. So how do you do that? By looking inward and researching obsessively.

To figure out who your direct and indirect competitors are, you need to look inward first to understand your product positioning: who are you servicing and what is the offering you are providing?

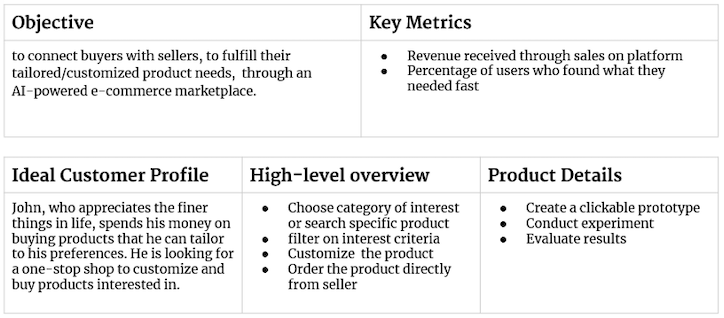

You can answer these questions by doing a self-assessment using the product canvas. Originally introduced by Roman Pichler, the product canvas has since tbeen tweaked and refined.

In its core, the product canvas covers:

For our example product, the competitive analysis might look something like this:

A simple Google search using keywords from your self-assessment can get you pretty far.

Other resources that can help you identify your competitors include tools such as Crunchbase, Similarweb, Statista, etc.

As the old saying goes, the customer knows best. If you don’t have many customers yet, review sites such G2, Capterra, Trustpilot, and Google Reviews can help you.

If you do have customers, go ask them. Most customers try and evaluate several products before deciding on the right product to buy. Nothing is stopping you from asking them which other brands they considered and why they ultimately chose yours.

Once you have established who your competitors are, you might find yourself in a market with many direct and indirect competitors. If that is the case, select about seven of the most relevant competitors to include in your competitor deep dive.

From your a shortlist of competitors, choose about seven of your most important and dig up all the relevant information on each one.

The research conducted during the previous step will help you capture the most relevant information about your competitors for the following categories:

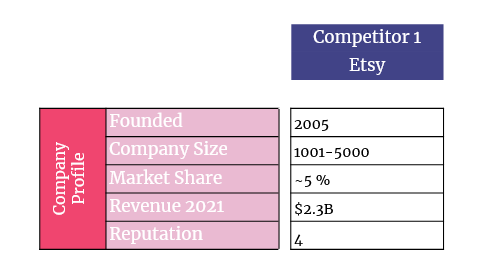

Start by creating a company profile for each of your competitors to gain a better understanding of who they are. Include the following information:

Let’s apply this framework to our AGORA competitive analysis example:

It’s important to understand who your competitors are serving and who is buying the product. This not only to reconfirm that the competitor is indeed a direct (or indirect) competitor, but also to understand what customers like and dislike about the competitor’s product.

The information you’re looking for includes:

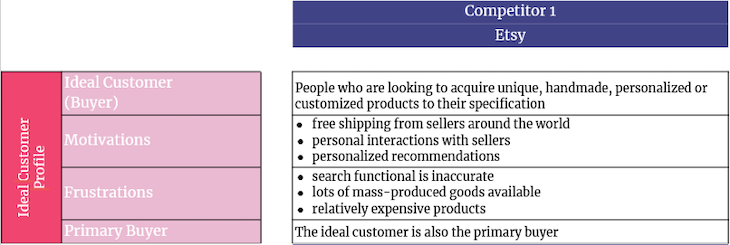

Let’s see what this would look like following our AGORA example. Below is an example ideal customer profile for Etsy. First, for the buyer:

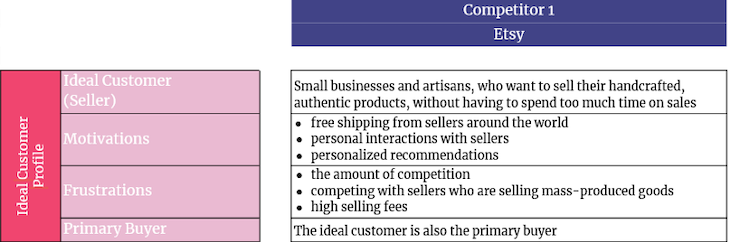

And the ideal customer profile for Etsy sellers:

Not to be captain obvious, but you want to capture more details about the product your competitor is offering and its positioning.

The information we’re looking for at this step includes:

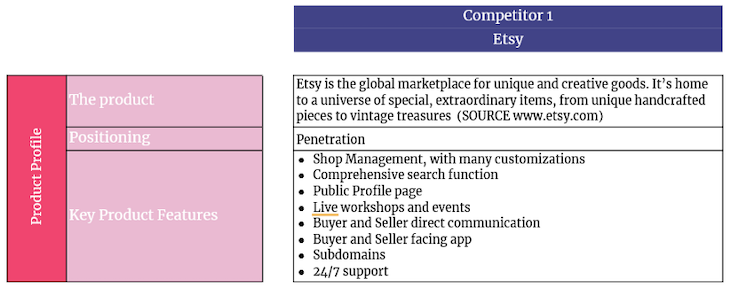

Referring to our example AGORA app, the product information associated with Etsy on a competitor analysis might look as follows:

Next, seek to understand how your competitors are bringing the product to market.

List the following information:

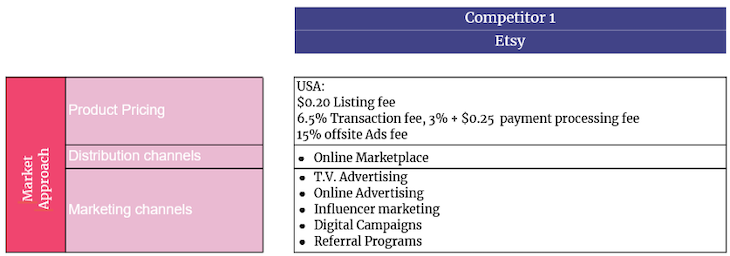

In our AGORA competitor analysis example, this section would look something like:

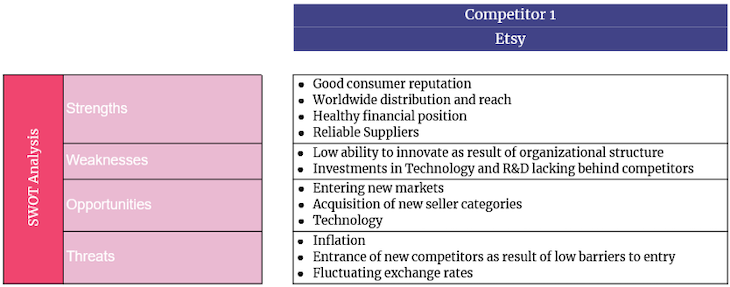

With all the information you’ve collected, you’ll find yourself in a good place to do a SWOT analysis. This is one of the most common and popular competitive analysis frameworks.

SWOT stands for strengths, weaknesses, opportunities, and threats:

For AGORA, our example competitive analysis might include a SWOT analysis that looks like this:

Now that you have a better view of your competitors, it’s time to determine how you want to approach them in the market: do you want to avoid your competitors or attack them?

Two extremely useful tools that can help you make this assessment are the competitive matrix and battle cards.

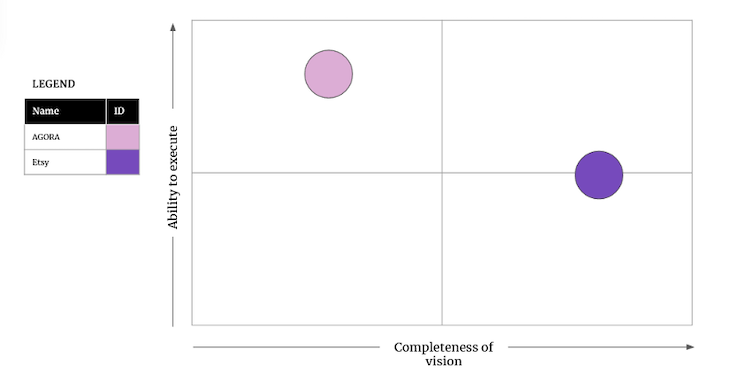

One way to operationalize the data you gathered during your competitive analysis is to plot out a four-quadrant competitive matrix.

Define key factors for the and x and y axes and plot yourself and your competition accordingly to see how you stack up. This approach is also known as perceptual mapping.

A competitive matrix for our example would look like this:

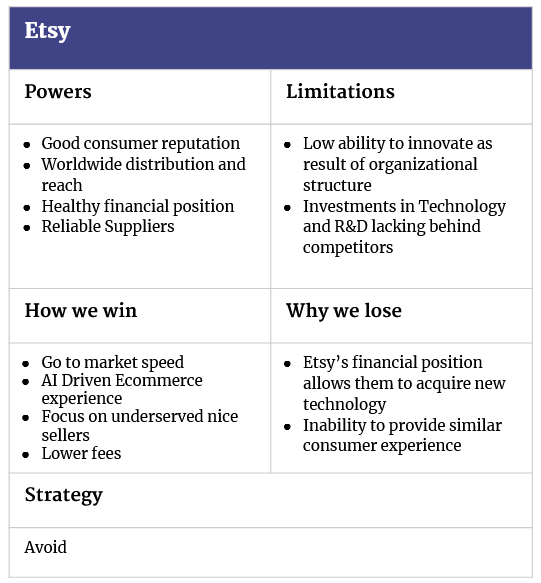

You can use the four-quadrant competitive matrix and competitor insights to create battle cards for each of your competitors.

Battle cards are a visual aid that help you compare your product against those of your competitors at a glance. It’s a quick and easy way to see how you stack up in key areas of performance and value. It’s also a neat way to help sales in their conversations with customers.

Here’s what you should include on each battle card:

A battle card for our example competitive analysis might look as follows:

If you‘ve followed the framework described above, you should have solid insight into your competitors, your product opportunities, and the best strategy to attack or avoid your competitors in the market.

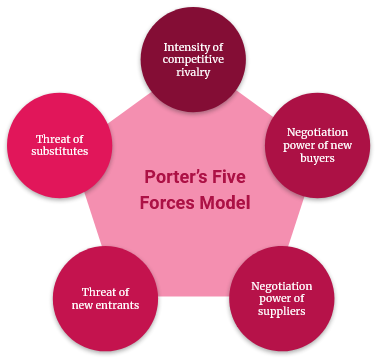

If you want to dig deeper, you can follow up your competitive analysis by producing a Five Forces analysis and/or customer journey map.

You still might want to consider gaining more insights into the competitive structure of the market you are in — in other words, gain a better understanding of how easy it is to either enter or be replaced by a competitor in the market.

A great framework to use for this type of competitor analysis is the Five Forces model , originally conceived by Michael Porter.

According to the Five Forces model, you can assess the market you are in by looking at:

Instead of zooming out, you can also zoom in on the journey ideal customers make when interacting with the product itself, the distribution, or marketing channels.

On a journey map, your touchpoints are the customer, the activity performed, how the customer experiences the activities, and their expectations.

A competitive analysis is a continuously updated document packed with information about your most important competitors to help you determine how to approach them in your target market.

The competitive analysis model described in this article consists of three steps that are designed to produce the insights you need to rule the market once and for all.

Below are free, customizable competitive analysis templates for each step of the process described in this article:

NOTE: To use and customize the competitive analysis templates above, after opening, select File > Make a copy from the main menu.

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Maryam Ashoori, VP of Product and Engineering at IBM’s Watsonx platform, talks about the messy reality of enterprise AI deployment.

A product manager’s guide to deciding when automation is enough, when AI adds value, and how to make the tradeoffs intentionally.

How AI reshaped product management in 2025 and what PMs must rethink in 2026 to stay effective in a rapidly changing product landscape.

Deepika Manglani, VP of Product at the LA Times, talks about how she’s bringing the 140-year-old institution into the future.