“Wow! I could really use a new car.

Sure, mine runs okay, but it’s getting older. It sometimes makes that weird ticking noise so I’ll start looking around. But shopping for a car takes time… I need to brush up on my knowledge of the market, think about what features I need, and decide what car payment I can afford.

And then when I pick a new car, I have to think about what to do with my old car. Do I try to sell it? Do I keep it or give it to a friend or charity?

There is so much that goes into this!”

Have you ever been in a situation like this? Sure you have! Most consumers have.

Maybe it’s not a car specifically, but something else that you need to replace. In your head that feels simple enough, but when you start to break it down it can become overwhelming with all the steps it would take to switch items.

This is the switching cost.

Switching costs are the costs that happen when you switch products, brands, or vendors.

Switching costs can be broken down into three areas: financial costs, process costs, and relationship costs.

When consumers are evaluating moving to a new product, or you as a business are trying to get their attention to explore your product over the one they currently use, typically the first question is, “How much does it cost?”

Consumers will stop shopping immediately if the cost of the new product feels too high. It needs to be apparent to the consumer that the cost delivers value.

As a business, financial costs can be the first hurdle to overcome. Consumers want to understand the value they’re going to receive from a product in relation to the cost. This happens even for first-time purchases but is even more important when switching from one to another.

Customers know what they’re getting for the price they’re actively paying. And if they are looking for other options, there’s obviously something missing from their current experience. The question then becomes, “What is the cost of that missing feature?”

Consumers are going to compare what they have today for X price to what the other option is for Y price and explore the difference.

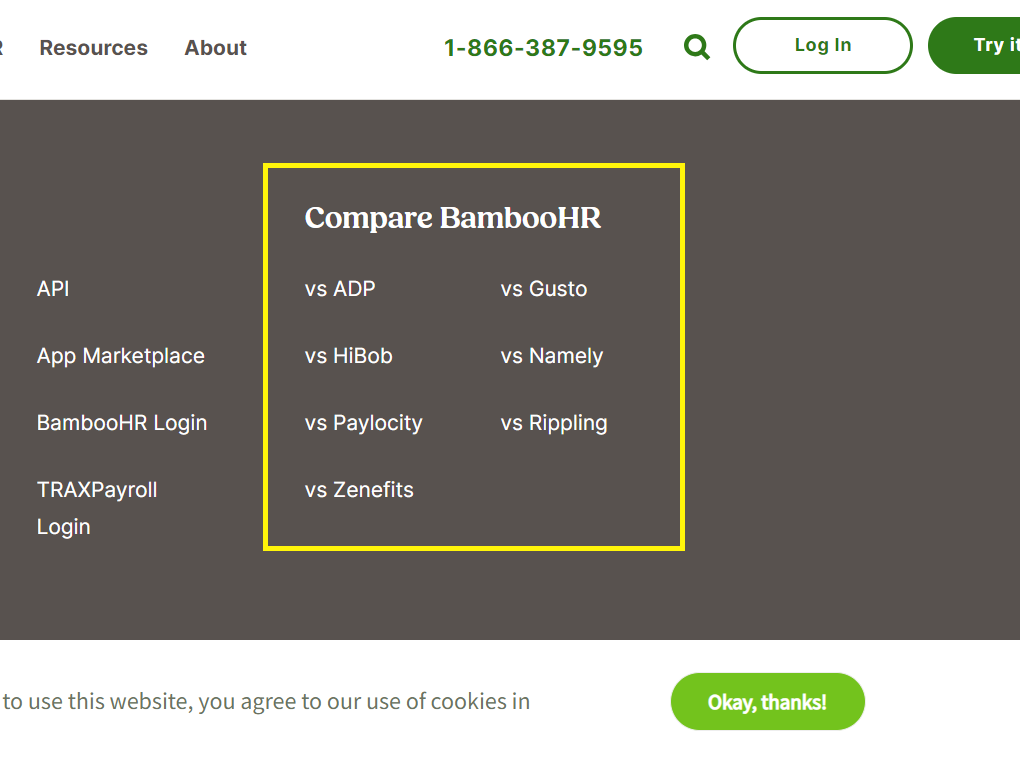

For heavily saturated markets, you may see this often. Many companies try to make this easy for customers to evaluate by having marketing dedicated to a side-by-side comparison of common competitors:

This helps customers see exactly what value they (or other consumers who have already switched) have received by moving to a new product, vendor or platform.

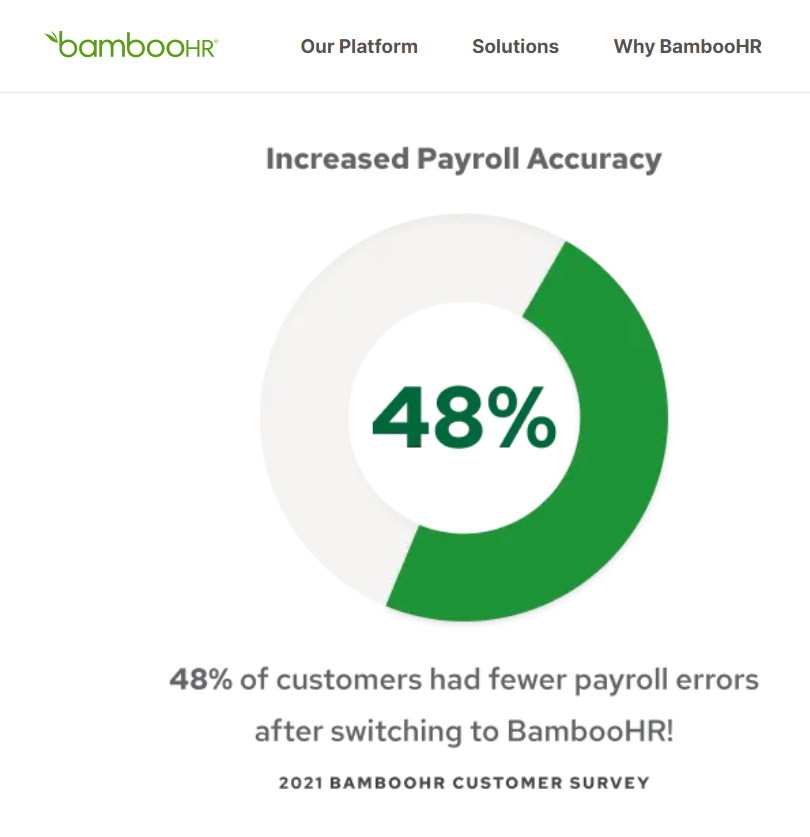

Presenting customers with a comparison or testimonials from others who have switched can help offset the financial switching cost hurdle but focusing on the value the product will deliver:

Another type of switching cost is relationship cost.

Having a successful company requires you to build strong relationships along the way. Think of a delivery company who offered a deep discount when it was first starting up, or the printer who responded to a last-minute request and had to bring its staff in extra early to hit a deadline.

Those relationships are meaningful and appreciated. So if a company is starting to look at new vendors due to rising costs or decreased satisfaction, there is a relationship cost to be evaluated too.

Is it worth saving the company $5,000 a year switching to a new printer even though Bernie and his team have helped us for the last 4 years?

I have Ernesto’s number in my phone to call anytime. I can’t do that with a big company.

It’s helpful here to stick to the facts about what can be offered when switching. Specifically, support services and longevity can help someone overcome these relationship costs.

Does your company offer 24-hour support or advanced support packages so a business can have a direct number in their phone still?

Is there a loyalty discount you can offer if they sign up for a multi-year plan so they know your company can support them for the next 4 plus years?

Make sure you understand the relationship cost a customer may be struggling with and position available alternatives your company provides clearly.

It’s important to recognize that this can be the hardest switching costs for businesses, regardless of the features a new product can offer as there is emotion tied to these costs that are difficult to measure.

Last but not least is the process cost.

Imagine you’re the manager of a restaurant and you notice the cost of produce has gone up with your current supplier. You want to keep your restaurant prices low so you start to explore other options.

You find a vendor who can match your current price, however they can only deliver at 11:00 AM when you usually get your deliveries at 6:00 AM.

This would be a process cost because by switching suppliers, you’ll most likely need to change your restaurant’s prep process, make time during the day (lunch rush) to intake the produce, and risk not having the supplies you need prior to the restaurant opening in the morning.

Process changes may not seem like a huge change, but it can help downstream impacts to the company such as scheduling and production which hinders a company from switching.

You’d need to decide if the trade-off of time is worth keeping your costs down.

When it comes to switching costs, there are two main areas for you to consider: market competition and customer loyalty.

Switching costs help drive competition. Many companies compete for the same market share across consumers and pitch directly against one another.

Highlighting the pros and cons across similar products and vendors helps customers decide what works best for their budget and preferences.

In a market that’s highly saturated, it’s important to find your competitive advantage and highlight that to consumers. It can be difficult to compete on costs when there are plenty of other vendors to compare, but finding something unique that places your business above the rest can help customers make the switch.

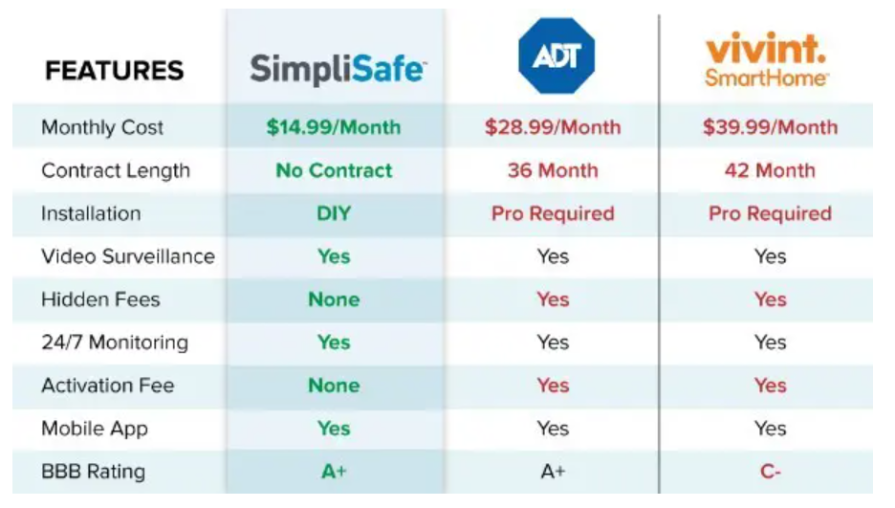

For instance, this illustration shows a comparison between three popular home security vendors and how each differs on the basis of cost and obligations:

When it comes to customer loyalty, many customers feel most comfortable by staying consistent with a brand they know and love. Whether or not the brand is the cheapest or has the best options, a customer who has bought from this company is likely to stay there due to familiarity and the cost of switching feeling too cumbersome.

Many companies rely on this loyalty to keep their customer churn low by using tactics like loyalty programs or points to reward customers for staying with their brand.

You can leverage switching costs to hold onto your market share in two ways: positive and negative switching friction.

Examples of negative switching friction include fees for canceling contracts before they’re up for renewal, or requiring additional funds for extracting data or information consumers would need to move to a competitor.

These are negative because it would put the consumer in a less than desirable position when switching products or vendors due to having to pay the fee or cost to switch.

Many software products also have an intricate implementation period where customers get to customize their experience which sounds lovely when you’re setting up the product and personalizing it to your business. However, when you look at rebuilding that experience with a new vendor, it may cost more money as those options may not be available or would require a custom build. This can be an upfront cost for the company but would deter your customers from leaving for a competitor later down the road.

Companies also use positive switching friction with things like loyalty programs and rewards. This aids in a consumer’s brand loyalty as they are earning points or rewards the more they stay with a specific brand for their purchases. Customers are less likely to switch because they don’t want to risk losing the points or rewards they have accrued with the brand.

Popular examples of company loyalty programs include hotel rewards, like Marriott Bonvoy and Hilton Honors. These programs frequently reward hotel visitors with free rooms or special upgrades after hitting certain milestones.

Another example is airline frequent flier miles. Airlines compete daily for consumers to pick their flight over another that is going to the exact same destination, but customers who use a particular airline can get points based on the number of miles they fly. Customers can achieve certain loyalty program statuses to get free flights or upgrades after they have completed certain mile thresholds.

If you are the competing company, it’s best to be transparent with known switching costs. Help new customers weigh the pros and cons and get them a true estimated cost to switch so when they do, they’re confident they’re making the right choice and getting more value.

When evaluating a new product or trying to get consumers to evaluate yours, focus on the value your product drives.

If you’re in a competitive market, it can be helpful to call out known switching costs whether financial, relationship, or process to better help your customers know what they’re getting into as they are shopping.

You can leverage switching costs to your advantage to hold onto customers and make them less likely to want to switch. That said, if any of the strategies require additional customer costs, make sure you are transparent with terms or fees upfront.

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Great product managers spot change early. Discover how to pivot your product strategy before it’s too late.

Thach Nguyen, Senior Director of Product Management — STEPS at Stewart Title, emphasizes candid moments and human error in the age of AI.

Guard your focus, not just your time. Learn tactics to protect attention, cut noise, and do deep work that actually moves the roadmap.

Rumana Hafesjee talks about the evolving role of the product executive in today’s “great hesitation,” explores reinventing yourself as a leader, the benefits of fractional leadership, and more.