Imagine you are a product manager for an agile project management software and your revenue model is subscription-based. Let’s say that last month your revenue was $50,000 and this month your revenue is $60,000.

You might think that you had a 10 percent increase in revenue, but if you were asked how much revenue you retained from last month, or your overall net growth, you won’t be able to answer with the same number.

For you to answer this, you have to calculate the net revenue retention (NRR).

In this article, you will learn what NRR is, what the benefits of it are, and how to improve it to optimize the success of your product.

Net revenue retention is a metric that helps to measure cumulative revenue retained from existing customers by examining revenue added due to expansions (upselling and cross selling) and contractions (downgrades and churns) for a given period.

NRR is one of the most important KPIs that companies track and evaluate to know the strength of the product in market, the sustainability of the business, and the net growth of the company.

Net revenue retention measures the ability of a company to retain its existing customers and increase revenue from them over time. It is an important metric that provides insight into the effectiveness of a company’s customer retention and upselling strategies.

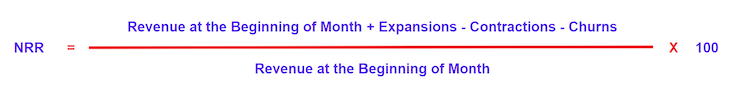

You can calculate NRR by using the following formula:

Net revenue retention is calculated by examining these four factors:

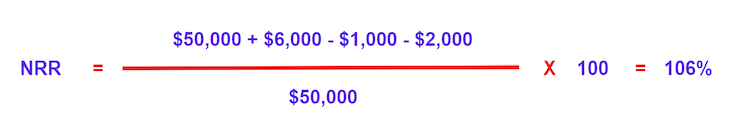

Imagine MRR was $50,000 at the beginning of the month and:

Then we can calculate the net revenue retention as:

This finding means that the company retained 106 percent of its revenue even after certain customer exits and downgrades. Comparing this with the previous month’s retention rate also means that the business is capable of retaining 106 percent of its revenue month-to-month.

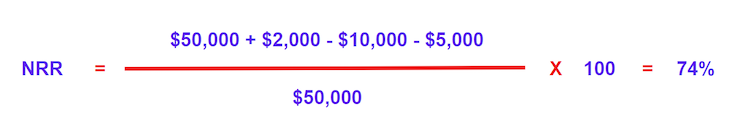

Let’s examine another example where the revenue at the beginning of month was $50,000, but several downgrades happened during the current month, resulting in a loss of $10,000 and a few customers canceled subscriptions resulting in loss of $5,000 more. One customer was cross-sold, adding $2,000 to the current MRR and the sales team couldn’t do any upsells for the current month.

In this case, the NRR would be:

This finds that the business was able to retain only 74 percent of its previous revenue.

A net revenue retention rate of 100 percent means that a company retains all of its existing customers and generates the same amount of revenue from them in each period.

A rate above 100 percent indicates that the company is generating more revenue from its existing customers in the current period than in the previous period, due to upselling or cross-selling.

A rate below 100 percent indicates that the company is losing revenue from existing customers, either due to churn or a decrease in spending.

There are no standards for a good retention rate, although a business whose NRR is above 100 percent is performing as intended. A company that can retain 90 percent and above of its revenue month to month is generally considered stable and growth-driven.

It is easy to think that the more customers we acquire, the more revenue we generate, but businesses have to incur a price called customer acquisition cost on any new customer.

Acquiring a customer is 12 to 15 times costlier than retaining and upselling an existing customer. NRR helps a product manager and sales team focus more on retaining existing revenue and plan strategically on acquiring new revenue.

NRR helps in understanding whether your customers are happy with your product and services. The NRR signifies the strength you have in retaining and engaging customers.

Net revenue retention also helps in knowing whether your pricing strategy is efficient enough for you to generate sales.

NRR can be your key growth driver. Optimizing net revenue retention will help you to decide how much effort you should put into acquiring new customers versus retaining existing ones.

A product manager should track NRR to maintain overall customer success and develop healthy customer relationships to generate recurring revenue.

There are numerous benefits to tracking NRR. Tracking NRR can help you:

Businesses execute several strategies to improve their NRR depending on the products or services they offer or the situation/context the company/business is dealing with. There are few common strategies that companies can take to improve NRR as a whole:

The most important factor in retaining customers is ensuring that they are satisfied with your product or service. Providing exceptional customer experience can improve customer satisfaction and loyalty.

This can be achieved through personalized communication, timely response to customer inquiries, and consistent delivery of high-quality products and services. Companies can use customer feedback and surveys to identify areas for improvement and implement changes to enhance customer experience.

Upselling and cross-selling can generate additional revenue from existing customers. Companies can identify upsell and cross-sell opportunities by analyzing customer data and behavior, understanding customer needs, and tailoring product or service offerings to meet those needs.

One of the most effective ways to increase revenue from existing customers is to offer them additional products or services that complement their existing purchases.

Loyalty programs can incentivize customers to stay with a company and make additional purchases. Companies can offer rewards, discounts, or exclusive access to products or services to customers who have been with the company for a certain period of time or have made a certain number of purchases.

Companies that prioritize customer retention are more likely to achieve a high net revenue retention rate. This can involve investing in customer service, marketing, and other strategies that help to keep customers engaged and satisfied over time. Churn can be reduced by addressing the reasons why customers leave.

Companies can analyze customer data to identify patterns and reasons for churn and implement strategies to address these issues. This can include improving product or service quality, providing better customer support, offering incentives for long-term contracts, and adjusting pricing strategies.

Providing excellent customer support can help retain customers and prevent churn. Companies can offer multiple channels for customer support, such as phone, email, and chat, and ensure that support is timely, knowledgeable, and helpful. Companies can also provide self-help resources, such as FAQs and tutorials, to help customers find solutions on their own.

Several companies have demonstrated success in achieving high net revenue retention (NRR) or improving their NRR. Here are some examples of companies and how they achieved high NRR:

In 2021, Salesforce reported an NRR of over 120 percent, indicating that its existing customers spent 24 percent more on its products than they did the previous year.

Salesforce achieved this high NRR by investing in customer success programs, providing excellent customer support, and regularly releasing new features and functionality to meet evolving customer needs.

HubSpot adapted its corporate strategy and reported an NRR of 107 percent in 2020. This indicated that its existing customers spent 7 percent more on its products than they did the previous year. Its NRR continued to improve as its 2021 Q2 earnings report showed NRR over 110 percent.

The company achieved this high NRR by focusing on customer success, providing extensive educational resources, and offering a flexible pricing model that allows customers to scale its usage as needed.

Zoom worked to improve its NRR by focusing on customer satisfaction and retention. As a result, it reported an NRR of 130 percent, showing that existing customers spent 30 percent more on its products than they did the previous year.

Zoom improved its performance by providing an easy-to-use platform, offering excellent customer support, and regularly releasing new features and enhancements to meet changing customer needs.

Netflix had a huge year in 2020. The company reported an NRR of 139 percent.

Netflix saw its NRR increase by providing personalized recommendations, regularly releasing new content, and offering a flexible pricing model that allows customers to choose from different subscription tiers.

To improve its NRR, Shopify focused on customer success and providing value-added services.

According to Shopify’s Q2 2021 earnings report, its NRR was over 120 percent. Shopify achieved this by providing a user-friendly and reliable e-commerce platform, offering a range of value-added services, such as payment processing and shipping, and providing excellent customer support.

Slack reached a high NRR through a combination of customer-focused features and exceptional customer support.

The company can credit its recent success to its integration with other software, custom notifications, and collaboration tools that make it easy for teams to communicate and work together. Slack also keeps customers satisfied and loyal through its 24/7 customer support, including live chat and email.

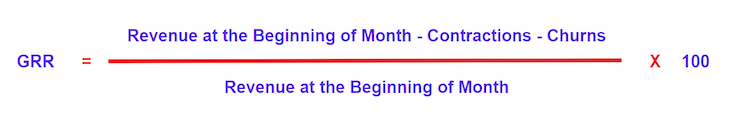

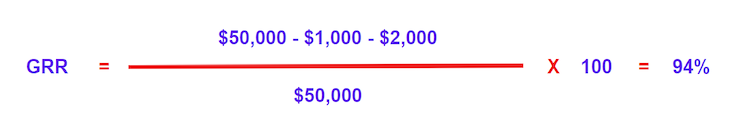

To understand the difference between NRR and gross revenue retention (GRR), let’s look at how to calculate GRR:

As you can see above, NRR and GRR are both metrics used to measure customer retention and revenue growth, but they differ in how they calculate revenue and account for customer churn and expansion revenue.

GRR measures the total revenue generated from existing customers for a given period considering contractions (downgrades and churns), but without considering the expansions (upsells and cross sells). NRR, on the other hand, considers both revenue lost due to customer churn and revenue generated from existing customers through expansion opportunities.

Let’s calculate GRR for example above assuming MRR at the beginning of the month as $50,000 and:

Our NRR for the above example was 106 percent and GRR is 94 percent. As GRR never considers upsells and cross sells, the GRR is always below 100 percent. Usually the closer the GRR is to 100 percent, the more likely a company is stable.

The key difference between NRR and GRR is that NRR accounts for both customer churn and expansion revenue, while GRR does not. This makes NRR a more accurate measure of customer retention and revenue growth, as it provides a more complete picture of how a company is performing and growing over time.

GRR can be a useful metric to track in conjunction with NRR, but it should not be relied on as the sole measure of customer retention and revenue growth.

NRR is a potential indicator of business strength, however, there are few misconceptions PMs should avoid when using NRR to drive product success.

Net revenue retention (NRR) is a critical metric for measuring the effectiveness of a company’s customer retention and upselling strategies. Companies that prioritize customer satisfaction and invest in customer retention are more likely to achieve a high net revenue retention rate, which can be a key driver of growth and profitability over time.

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Christina Valls shares how her teams have transformed digital experiences at Cedars-Sinai, including building a digital scheduling platform.

Red-teaming reveals how AI fails at scale. Learn to embed adversarial testing into your sprints before your product becomes a headline.

Cory Bishop talks about the role of human-centered design and empathy in Bubble’s no-code AI development product.

Learn how to reduce mobile friction, boost UX, and drive engagement with practical, data-driven strategies for product managers.