In this guide, we’ll define what a customer satisfaction survey is, break down the information product teams should aim to discover, and outline steps and best practices to write and distribute customer satisfaction surveys that generate actionable insights.

Picture this: your company sells a product that enhances singers’ vocals. It’s a real game-changer for pros and karaoke warriors alike.

You already have a decent customer base, but you don’t know anything about their usage or overall experience. Naturally, you want to expand your base, so you reach out to influencers to promote the product.

After weeks of radio silence, you see a message in your inbox from some guy named Michael Jagger. He apologizes for his delayed reply — he just got back from what could be his band’s farewell tour.

He attached a short video clip, but the content is not what you had hoped for. He sings:

This product is a real irritation,

How is it supposed to fire my imagination

I can’t get no, oh, no, no, no, hey, hey, hey

That’s what I say

I can’t get no satisfaction

I can’t get no satisfaction

’Cause I try, and I try, and I try, and I try

I can’t get no, I can’t get no

Clearly, Michael is not eager to promote your product.

His feedback and the general lack of customer feedback make you realize you need more insights into what your users think about your product — and how satisfied they are when using it to live out their rock star dreams.

In today’s customer-centric and data-driven product world, hearing and capturing the voice of the customer is crucial. A customer satisfaction survey helps you understand what your customers think and how they feel about your product and its adjacent services.

The customer satisfaction survey consists of a list of questions about the product experience.

Besides the tons of insights you gather from the customer satisfaction survey, an extra advantage is that it will make customers feel they have a say in your product and that their feedback matters.

Not convinced yet? Let me summarize the additional rewards you can reap. Conducting customer satisfaction surveys enables you to:

There are four types of customer satisfaction surveys:

Let’s explore each customer satisfaction survey type further. We’ll outline some questions you should ask and provide a template for each.

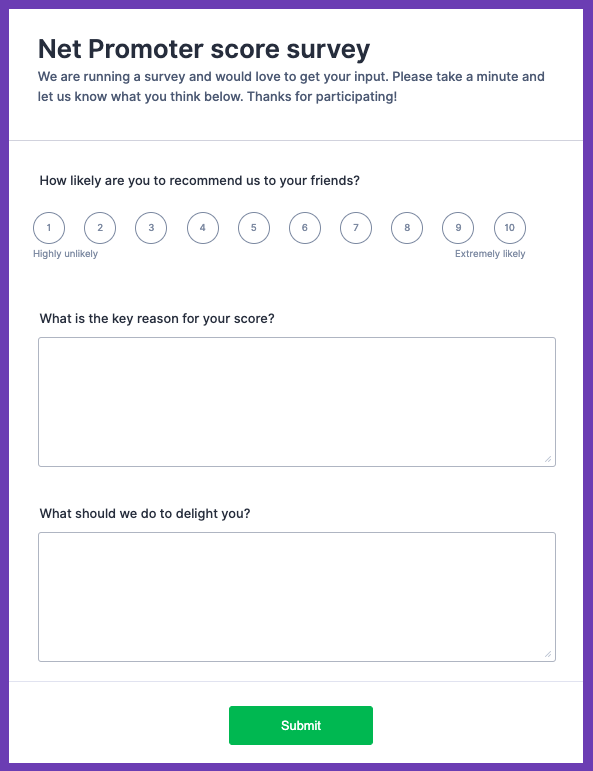

The Net Promoter Score (NPS), along with the Customer Satisfaction Score (CSAT), is among the most heavily benchmarked customer satisfaction metrics.

NPS is a proven metric that measures customer experience and forecasts business growth.

The formula to calculate NPS is:

NPS = % of promoters – % of detractors

Promoters are customers who are active, recurrent users and advocates of your product. Detractors are those who are not happy with your product and could potentially damage your product and brand through negative word of mouth.

According to Bain & Company, which created the NPS score, a good NPS score ranges from 0–19, a favorable score is between 20–49, an excellent score falls between 50–79. If you achieve an NPS above 80, you’re word-class.

Keep in mind that what constitutes a good NPS score varies depending on the industry and market.

Access this NPS survey template from Jotform:

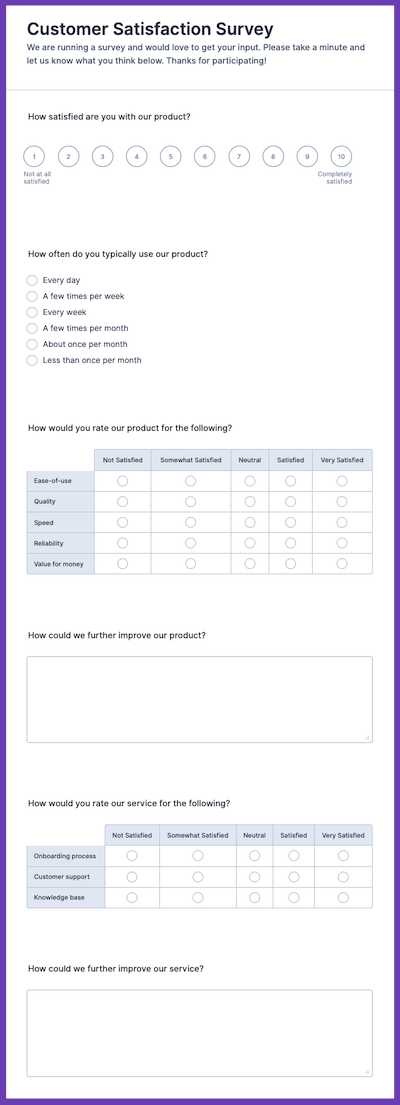

The Customer Satisfaction Score (CSAT) provides insight into how happy and satisfied customers are while using your product. This is both quantitative through the CSAT score and qualitative through feedback that explains the number.

CSAT is calculated by dividing the number of satisfied customers by the total number of respondents. The formula is as follows:

CSAT score = # of satisfied customers / Total # of respondents

What is a good CSAT score? As with the NPS, it varies per industry and market, though a CSAT score of >75 percent is generally considered “good.”

Click here to access the CSAT survey form template displayed on the right.

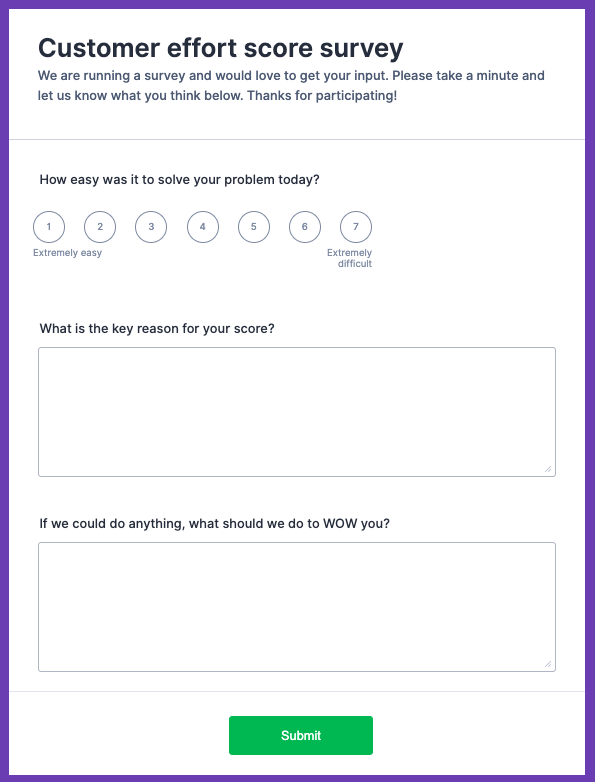

The customer effort score measures the ease of use experienced by a customer during a specific interaction.

CES data is collected in real time after the interaction has taken place and is calculated by dividing the total number of survey respondents by the total sum of responses.

With some companies using a 1–5 scale and others using a 1–7 scale, for the responses, there is no universal benchmark for what constitutes a good CES. In general, though, you could say that a score around the center of the scale is a positive one.

Click here for a Customer Effort Score (CES) survey template:

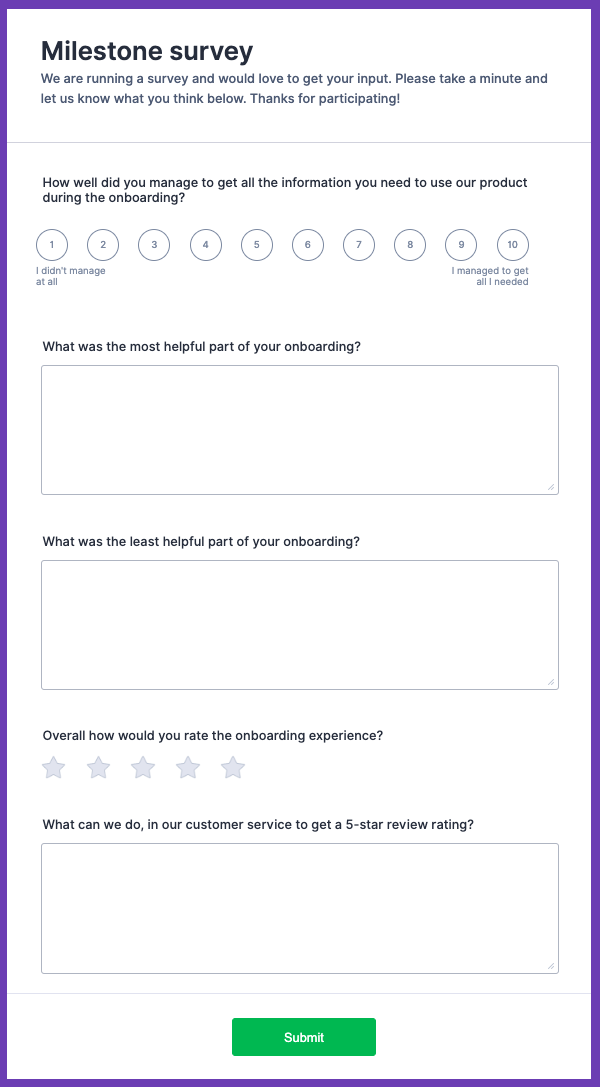

Compared to the NPS, CSAT, and CES surveys, a milestone survey does not revolve around a single metric. It’s a more comprehensive survey that aims to collect information about a specific topic — for example, the onboarding experience, product development ideas, or the usability of a feature.

The distribution of a milestone survey is either time-based or experience-based.

A milestone survey template is available here:

The most important questions in a customer satisfaction survey revolve around the following three categories:

Customer demographic questions cover the primary factors to establish who the customer is. The insights gathered from these questions enable you to understand, validate, and evolve your customer personas.

Product use questions are questions about the product itself. They can be about the process leading up to the actual purchase as well as the actual usage of the product, features, services, or support provided.

The information gleaned from product use questions provides insight into the customer journey, the feature set, and what customers are looking for.

Customer satisfaction questions aim to provide insight into the product experience. The questions revolve more around the psychology of the customer when using the product.

Typically, customer satisfaction questions aim to determine how your product makes users feel. Why do they feel that way while using your product? What could change that feeling?

These insights give you a good understanding of the perception of your customer base.

Now that you know the types of customer satisfaction surveys and the topic categories of questions to ask, let’s have a look at the two main types of questions commonly found in customer satisfaction surveys:

Open-ended questions aim to find out what the customer is thinking and to understand the context behind actions taken. This type of question allows the customer to provide a longer, more comprehensive answer.

An open-ended question typically begins with:

Open-ended questions are best to use when you want to get a better picture of how to achieve customer satisfaction by truly understanding customers’ feelings and attitudes about a topic.

Closed-ended questions can only be answered by choosing pre-populated answers. They are incredibly useful when you either need quantitative data, need to categorize respondents and responses, or your audience is not really interested in the topic.

Closed-ended questions can either be static or dynamic — dynamic means that an answer to a closed question has an impact on what question is presented next.

Closed-ended questions come in four generic forms:

Nominal questions are used to measure categories consisting of mutually exclusive attributes — for example, industry types (agriculture, education, financial services, etc.).

Ordinal questions are used to rank order, meaning the next value is bigger than the previous one. What matters is the order; the difference between the values is irrelevant.

A semantic differential question is an example of an ordinal question. The answer to a semantic differential question sits on a multiple-point rating scale between two opposite traits, such as love and hate.

Another example is the Likert scale question, though it is sometimes treated as an interval question.

A Likert scale question might look similar to the semantic differential question, the difference being the purpose it serves. Where a semantic differential question talks about a trait, the Likert scale question aims to understand the level of agreement or disagreement with the statement.

Interval questions are presented on a multiple-point scale, asking respondents to pinpoint where they fall on it. As such, ordinal and interval questions might look similar, but there is a difference. Whereas ordinal questions do not present an equal split or difference between two consecutive steps, in interval questions, the equal split or difference is obvious.

Ratio questions are the next level. Whereas nominal questions can be categorized, ordinal questions can be ranked, and interval questions on top have an equal interval, ratio questions have a true zero.

Closed-ended questions can be presented in the form of checkboxes, multiple choice, drop-down, or rating scales.

Creating a survey that customers are willing to fill out and submit is an art. To position yourself to get a good response rate, follow these best practices:

Start the survey creation process by defining the objective of the survey. What do you want to get out of the survey?

Having a clear understanding of the objective will help determine the flow of the survey and identify the questions to include.

You are asking your customers to spend some of their valuable time providing information. Spend time identifying what you are actually asking your customers.

What is the objective of the survey, and what questions would generate the most useful, actionable, and measurable information?

You know what they say about assumptions, and influenced insights are useless. When you believe a feature of your product is the greatest thing since sliced bread, it’s hard to ask objective, non-leading questions about it.

Take a step back, formulate objective questions, and avoid including superlatives.

Questions that cover more than one topic are confusing and skew data. When questions are unclear, it’s hard to tell what the customer is actually answering.

Keep in mind that you are asking customers to help you out, and you want them to complete the survey. If they give up along the way, you will never know what they wanted to say.

Limit the number of questions and challenge yourself to ask only questions that truly matter.

The biggest challenge to collecting customer satisfaction insights is to actually get your customers to participate. This risk can be partially mitigated by reaching as many customers as possible.

To further mitigate the risk, it is worth spending some time thinking about the sample size and means of distribution to get the highest response rate.

There are many options for how to distribute the survey, such as via blog post, phone, SMS, or a prompt in the app itself.

In the digital age, there are three common methods for distributing customer satisfaction surveys:

A QR code is a graphic visualization of a link that can be read with a QR reader.

The beauty of using QR codes is that you can easily use them online on websites or on paper, stickers, and other printed objects. The key benefit of this is that there are no additional costs to distribute, and it is easy to reach a large audience.

Whether it is through pop-ups, callouts, or using plain old text or surveys supported by images or video, websites are a proven way to gather customer satisfaction feedback.

The benefit of posting customer survey questions on your website is that the survey can be shown when customers have already confirmed their interest. This makes the survey less intrusive and increases the chance of completion.

What used to be done by post is now done by email. This method is probably still one of the most popular ones.

The benefit of distributing customer satisfaction surveys via email is that it is easy to set up, personalize, and automate and costs very little.

In product management, we are in it to win it. You can only win when you receive feedback from your customers and understand how satisfied they are with your product.

Customer satisfaction surveys such as NPS, CSAT, CES, and milestone surveys are a great tool to acquire the insights you need to succeed. These four types cover customer demographic, product usage, and satisfaction questions. The questions are either closed, open, or a mix of closed and open questions.

Featured image source: IconScout

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals.

With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done.

Get your teams on the same page — try LogRocket today.

Christina Valls shares how her teams have transformed digital experiences at Cedars-Sinai, including building a digital scheduling platform.

Red-teaming reveals how AI fails at scale. Learn to embed adversarial testing into your sprints before your product becomes a headline.

Cory Bishop talks about the role of human-centered design and empathy in Bubble’s no-code AI development product.

Learn how to reduce mobile friction, boost UX, and drive engagement with practical, data-driven strategies for product managers.

2 Replies to "Customer satisfaction survey templates, examples, and questions"

Hey there logrocket peeps, you have a small typing mistake, here:

Example CES survey questions

How easy is it to easy our product?

Great catch! Thanks for pointing out that typo. Fixed now.